British epidemiologist Peter Daszak, EcoHealth Alliance, is testifying today in front of Congress, where Congressional investigators will try and get to the bottom of multiple inconsistent statements he's made about gain-of-function research which took place at the Wuhan Institute of Virology.

Watch live here (due to start at 1000ET):

Hours before Daszak's testimony, the House Select Subcommittee on the Coronavirus Pandemic released a staff-level report recommending that Daszak be formally disbarred and criminally investigated as a result of his actions prior to and during the COVID-19 pandemic. Key findings include:

EcoHealth used U.S. taxpayer dollars to facilitate gain-of-function research on coronaviruses at the Wuhan Institute of Virology in China.

EcoHealth violated the terms and conditions of its NIH grant by failing to report a potentially dangerous gain-of-function experiment conducted at the WIV.

EcoHealth also violated NIH grant requirements when it failed to submit a required research update report until nearly TWO YEARS after the NIH deadline.

The Trump Administration identified serious concerns with EcoHealth Alliance’s funding of the WIV and instructed NIH to fix the problem. Then, NIH terminated EcoHealth’s grant.

NIH is currently violating the terms of the WIV’s formal debarment by funding EcoHealth’s research.

Meanwhile on Monday, journalist Paul Thacker revealed a new set of documents which raise further questions into the work done by Daszak, as well as statements made by the National Institutes of Health regarding papers showing they funded risky virus research at the Wuhan Institute of Virology to create dangerous chimeric viruses.

As Thacker writes at The Disinformation Chronicle (which you should really subscribe to if you haven't already), and reprinted with permission (emphasis ours),

* * *

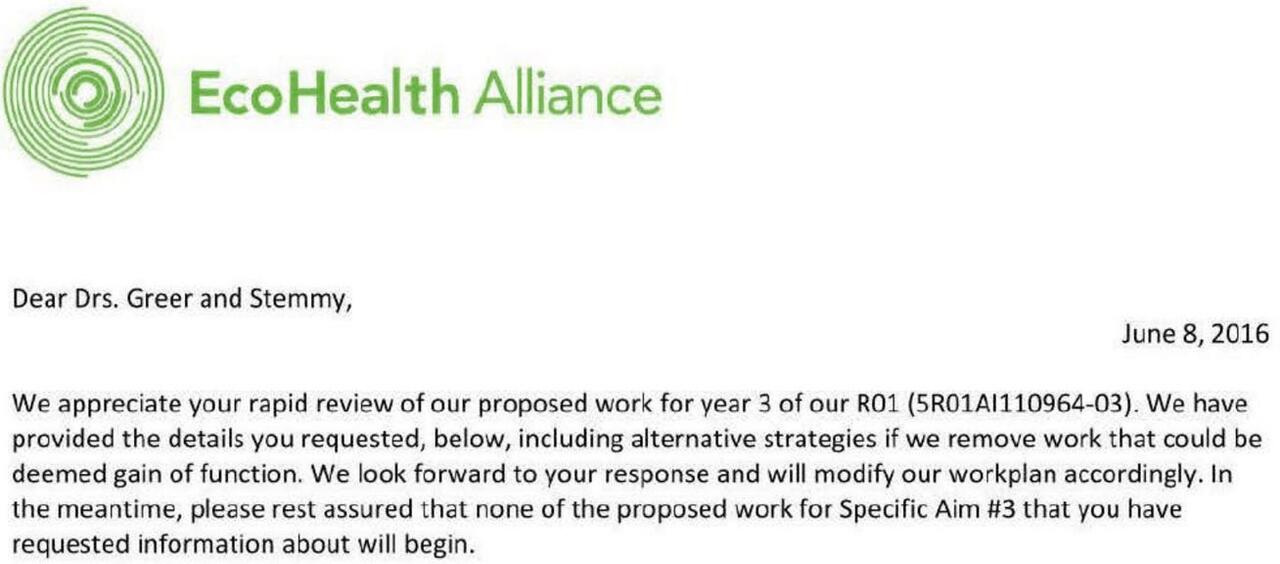

EcoHealth Alliance president Peter Daszak notified NIH funders that EcoHealth Alliance planned to conduct risky virus research at the Wuhan Institute of Virology (WIV), in a June 2016 letter, many months before a pause on such research was lifted in 2017. When the NIH released some of this information in 2021, they assured Congress and the public that these chimeric virus studies could not have led to the COVID virus, but they did so in a public statement that cited research the NIH itself had funded at the WIV.

The documents also show that, after once making a pretense of overseeing EcoHealth Alliance’s grants, the NIH is now happy to coordinate messaging with Peter Daszak’s nonprofit.

“Please pass this information on to the people at NIAID who need to coordinate communications,” Daszak wrote to NIH official Erik Stemmy, attaching a draft of a May 2023 press release. “And I'm available this evening, all day Friday and any time over the weekend to discuss.”

The 611 pages of new documents were provided to The DisInformation Chronicle by the whistleblower nonprofit Empower Oversight, which has sued the NIH to gain access to public records. Neither NIH spokeswoman Renate Myles nor EcoHealth Alliance’s Peter Daszak returned numerous requests for comment.

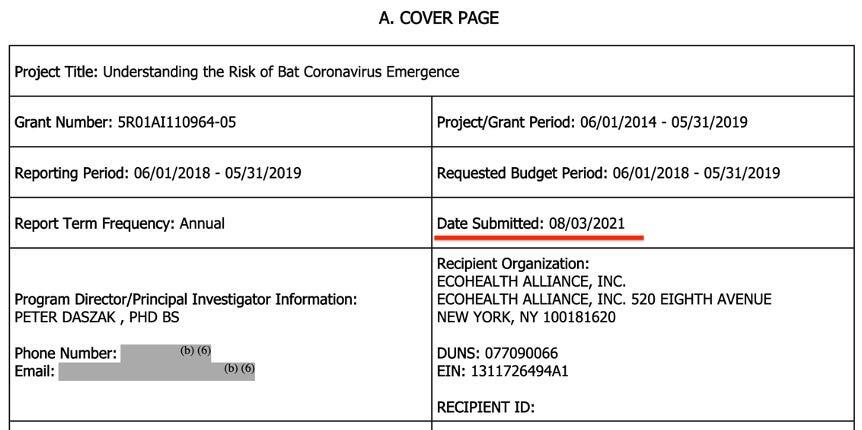

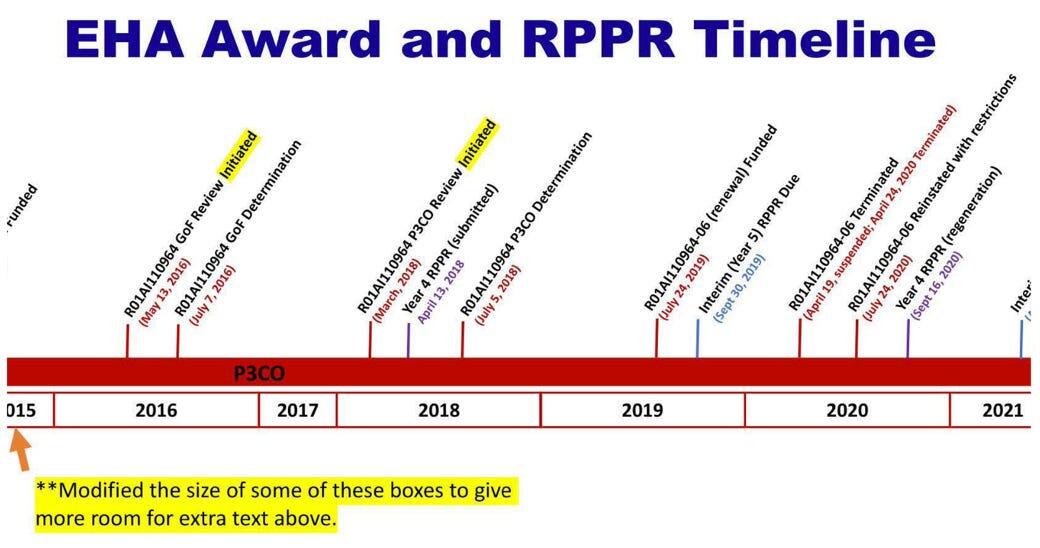

Controversy over EcoHealth Alliance’s risky research on MERS and SARS viruses first erupted in an October 2021 investigation by The Intercept, which reported that the WIV conducted dangerous virus experiments that the NIH was not fully aware of. The Intercept discovered these experiments in a missing 2019 report for an EcoHealth Alliance grant titled, “Understanding the Risk of Bat Coronavirus Emergence.”

The NIH first withheld the 2019 report from The Intercept, only to later provide it after they were sued. The Intercept also discovered that the 2019 report was inexplicably dated August 2021.

That summary of the group’s work includes a description of an experiment the EcoHealth Alliance conducted involving infectious clones of MERS-CoV, the virus that caused a deadly outbreak of Middle East respiratory syndrome in 2012. MERS has a case-fatality rate as high as 35 percent, much higher than Covid-19’s. The scientists swapped out the virus’s receptor-binding domain, or RBD, a part of the spike protein that enables it to enter a host’s cells, according to the report. “We constructed the full-length infectious clone of MERS-CoV, and replaced the RBD of MERS-CoV with the RBDs of various strains of HKU4-related coronaviruses previously identified in bats from different provinces in southern China,” the scientists wrote.

After reviewing the documents for The Intercept, Jack Nunberg, a virologist and director of the Montana Biotechnology Center at the University of Montana, told reporters, “Changing the receptor binding site on MERS is sort of crazy.” Nunberg added, “Although these new chimeric viruses may retain properties of the MERS-CoV genetic backbone, engineering of a known human pathogen raises new and unpredictable risks beyond those posed by their previously reported studies using a non-pathogenic bat virus backbone.”

However, new documents show that EcoHealth Alliance proposed these experiments to the NIH’s Erik Stemmy in a June 2016 letter—three years before Chinese researchers at the WIV purportedly conducted them in 2019. This is also five years before EcoHealth Alliance submitted their report of these experiments to the NIH, which is dated August of 2021.

The date when these chimeric virus experiments were conducted is crucial, as the White House allegedly stopped funding these type of studies in 2014. MERS is known to infect and spread in humans, and was specifically designated under the NIH’s pause on funding gain-of-function research of concern.

“Public involvement in this deliberative process is key, and the process is thus designed to be transparent, accessible, and open to input from all sources,” reads the governments statement on the funding pause, which ended sometime in 2017.

However, in a June 2016 letter, almost a year before the pause was lifted, Daszak described these same risky experiments with MERS and SARS viruses that the White House alleged were no longer being funded. “We have provided the details you requested, below, including alternative strategies if we remove work that could be deemed gain of function,” Daszak wrote to the NIH’s Erik Stemmy.

While The Intercept reported that the WIV allegedly conducted the risky research in year five of the grant, Daszak told the NIH in the 2016 letter that the virus research was proposed for year 3 of the grant. This date should have placed the experiments within the timeframe when the White House had ceased funding such research—a pause which was lifted in 2017.

When The Intercept reported in 2021 on these virus experiments—alleged to have taken place in 2019—the NIH sent Congress a letter to explain reported discrepancies in risky research that EcoHealth Alliance conducted at the WIV.

“NIH says ‘no NIAID funding was approved for Gain of Function research at the WIV.’” Republicans on the House Oversight Committee tweeted, attaching a copy of the NIH’s letter. “Obviously, they were lied to. NIH confirmed today EcoHealth and the WIV conducted GOF research on bat coronaviruses.”

The NIH also posted a statement at that time claiming the WIV research they had funded could not have created the SARS virus that caused the pandemic.

The chimeric viruses that were studied (i.e., the WIV-1 virus with the various spike proteins obtained from bat viruses found in nature) were so far distant from an evolutionary standpoint from SARS-CoV-2 (Figure 1) that they could not have possibly been the source of SARS-CoV-2 or the COVID-19 pandemic.

The NIH’s statement cited three peer reviewed studies as evidence that chimeric viruses created by EcoHealth Alliance at the WIV could not have led to the COVID-19 virus. Two of these studies were funded by the NIH and were published by EcoHealth Alliance’s Peter Daszak and Chinese researchers at the WIV. A third study the NIH cited was funded by the Chinese government and was published by Chinese researchers at the WIV.

The new documents also show that Congress and the media forced NIH officials to carefully script their responses about EcoHealth Alliance’s grants and research. The day before The Intercept’s story broke, NIH officials passed around flip cards for Anthony Fauci with a timeline of EcoHealth Alliance grants. NIH also included talking points Fauci could use regarding essays that had appeared in the Wall Street Journal and the Los Angeles Times.

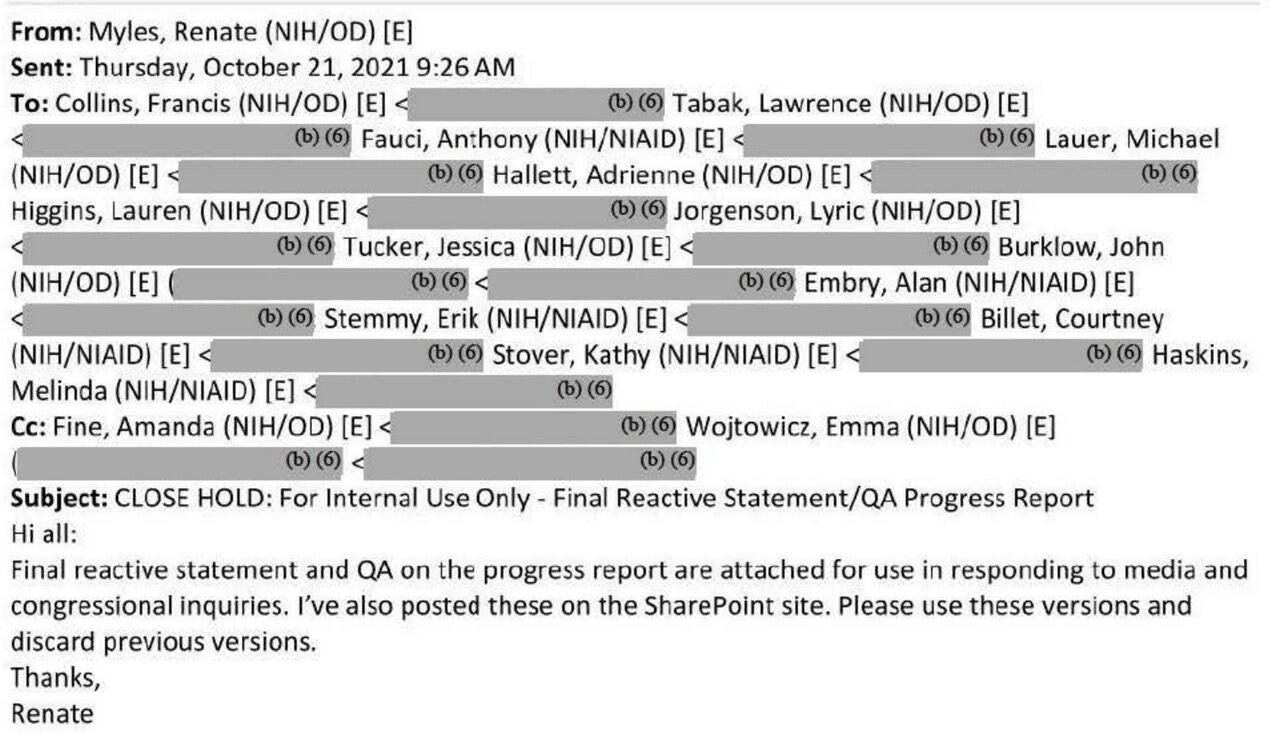

The following day, The Intercept published their investigation, and the NIH’s Renate Myles passed around a reactive statement for the media and Congress as well as possible questions the NIH might receive along with approved answers.

“CLOSE HOLD: For Internal Use Only,” reads the October 21, 2021, NIH email subject line. “Final reactive statement and QA on the progress report are attached for use in responding to media and congressional inquiries,” Myles emailed.

An official in the NIH Director’s office emailed around news clippings the following day to keep everyone on message. “We anticipate more articles later today, and will update these clips with those articles once they pop. Let us know if you have questions.”

Emails show that The Intercept investigation also spurred multiple Hill briefings. “Last week NIH Deputy Director Larry Tabak briefed multiple Congressional committees on the Year 5 Progress Reports from the NIAID grant to EcoHealth Alliance,” reads a November email. “We received multiple follow-up questions (attached) that we would appreciate you taking a first pass at drafting responses.”

As has become NIH policy, much of the discussion in these emails is highly redacted, with entire pages sometimes blacked out.

To respond to an Inspector General audit of EcoHealth Alliance’s grants, NIH pulled in officials from all across the agency, including legislative affairs, the communications office, Anthony Fauci’s office, and the office of then-Director Francis Collins.

“Tracked changes show NIH OD edits to NIAID's most recent input as well as OCGR-Leg's recommended counter edits,” reads a November 2021 email.

By April of 2023, the NIH began coordinating directly with EcoHealth Alliance to prepare for renewal of the controversial grant that caused so many headaches. In an email to Peter Daszak, NIH’s Erik Stemmy advised him to update the grant’s language as reported in the NIH’s grants database to “reflect the revised work for that award.”

“No problem at all Erik,” Daszak responded. “Very happy to see that things will be moving forwards. We have a lot of work to do on the grants management extra oversight, but all that is fixable.”

Before submitting changes to the NIH database, Daszak ran the language past NIH’s Erik Stemmy on May 3. “Could you quickly read through and check - we can make further edits if you think there is anything here that could be worded better for the public understanding of our work, given that there will likely be interest in it.”

“Thanks for sharing the draft update, will get back to you ASAP!” Stemmy replied, later emailing Daszak, “Looks like it accurately reflects the renegotiation so please go ahead with the update.”

On May 4, 2023, Daszak forwarded Stemmy the draft of EcoHealth Alliance’s press statement announcing the grant renewal. “As per our Notice of Award requirements, and to make sure we can coordinate public discussion about the grant, I'm emailing to notify NIAID in advance that we're aiming to make a public statement.”

When EcoHealth Alliance published their announcement on May 8, 2023, the statement noted that they would not be conducting any gain-of-function virus experiments, the very research they had denied conducting in the past.

“It clarifies that the work does not involve recombinant virus technology, dual use research of concern, nor experiments intended to enhance the virulence or transmissibility of human pathogens (so-called ‘gain of function’ research).”

TIMELINE

JUNE 2016: Peter Daszak of EcoHealth Alliance notifies NIH that they plan to make chimeric MERS and SARS viruses in year 3 of a bat coronavirus grant.

2017: NIH lifts pause on research involving chimeric MERS and SARS viruses.

SEPTEMBER 2021: EcoHealth Alliance emails The Intercept that EcoHealth Alliance had not conducted MERS research. “The MERS work proposed in the grant is suggested as an alternative and was not undertaken.”

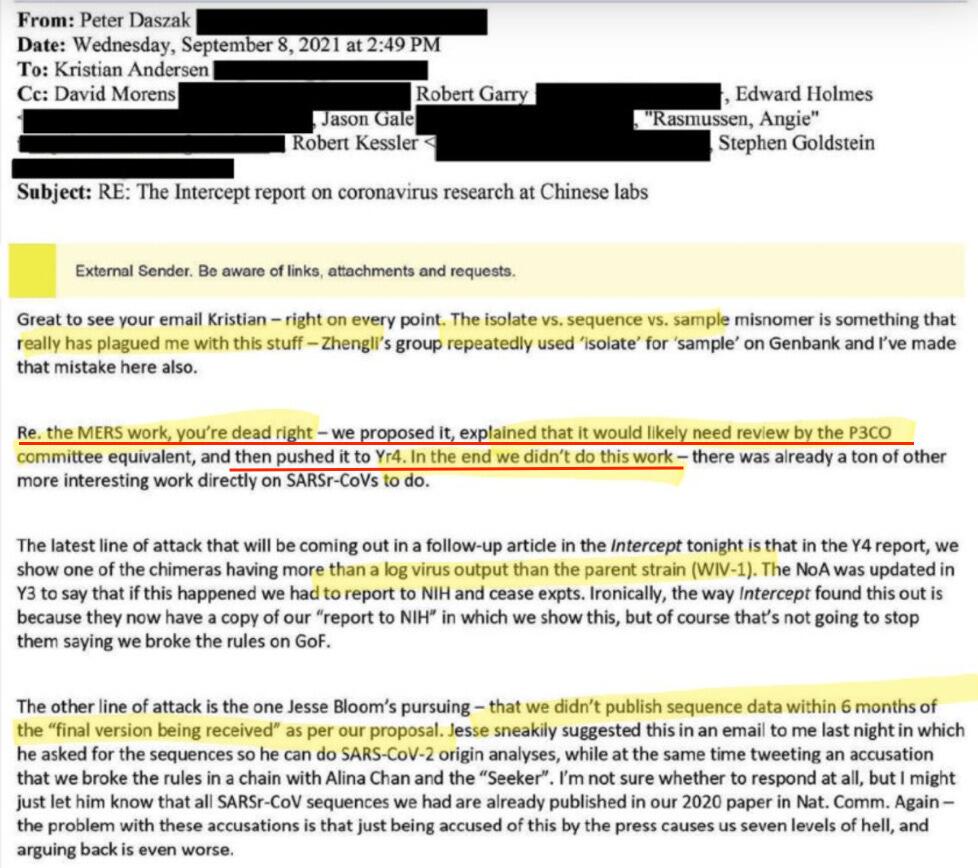

That same month, Peter Daszak emails several researchers and NIH officials that EcoHealth Alliance proposed the MERS research “and then pushed it to [year] 4. In the end we didn’t do this work.”

OCTOBER 20, 2021: To get out ahead of a coming investigation by The Intercept, NIH notifies Congress that EcoHealth Alliance performed risky research on chimeric MERS and SARS viruses “during the 2018-2019 grant period.”

OCTOBER 21, 2021: The Intercept reports that EcoHealth Alliance performed risky MERS studies in China, according to a year 5 grant report by EcoHealth Alliance.

That same day, the NIH alleges EcoHealth Alliance research conducted at the WIV could not have led to the pandemic, citing three peer reviewed studies the NIH and Chinese government had funded at the WIV.

MAY 2023: EcoHealth Alliance coordinates on public statements with NIH officials to announce the agency has renewed their grant, but the research will not involve risky research to make chimeric MERS and SARS viruses.

* * *