With less than two weeks to go until President Trump takes over The White House - and 24 hours after he unveiled a new $20 billion major investment from Emirati billionaire Hussain Sajwani to build new data centers across the US - the Biden administration plans one additional round of restrictions on the export of AI chips from the likes of Nvidia in a final push in his effort to keep advanced technologies out of the hands of China and Russia.

Bloomberg reports, citing people familiar with the matter, that Biden wants to curb the sale of AI chips used in data centers on both a country and company basis, with the goal of concentrating AI development in friendly nations and getting businesses around the world to align with American standards

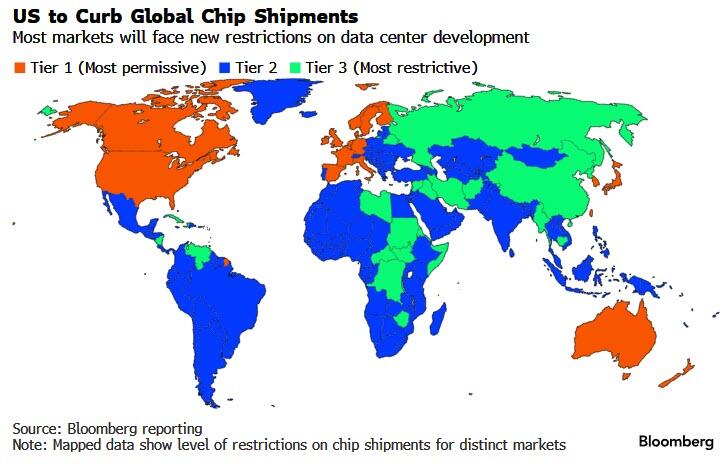

The regulations, which could be issued as soon as Friday, would create three tiers of chip trade restrictions, said the people, who asked not to be identified because the discussions are private.

At the top level, a small number of US allies would maintain essentially unmitigated access to American chips.

A group of adversaries, meanwhile, would be effectively blocked from importing the semiconductors.

And the vast majority of the world would face limits on the total computing power that can go to one country.

Countries in the last group would be able to bypass their national limits - and get their own, significantly higher caps - by agreeing to a set of US government security requirements and human rights standards, one of the people said.

That type of designation - called a validated end user, or VEU - aims to create a set of trusted entities that develop and deploy AI in secure environments around the world.

Nvidia explained its dissatisfaction at Biden's decision in the most diplomatic manner:

“A last-minute rule restricting exports to most of the world would be a major shift in policy that would not reduce the risk of misuse but would threaten economic growth and US leadership,” Nvidia said.

Every data center and business is already incorporating AI through what the company calls accelerating computing, Nvidia said.

“The worldwide interest in accelerated computing for everyday applications is a tremendous opportunity for the US to cultivate, promoting the economy and adding US jobs,” the chipmaker said.

NVDA shares are down just over 1% in the after-market...

...which pushes the giant tech company into 'correction' - down over 10% from its $3 trillion-plus peak market cap.