Search This Blog

Monday, June 30, 2025

FDA Eliminates Risk Evaluation, Mitigation Strategies for Autologous CAR T cell Immunotherapies

Agency determines the safety and effectiveness of these immunotherapies can be assured without a REMS

June 27, 2025

The U.S. Food and Drug Administration announced today that it has eliminated the Risk Evaluation and Mitigation Strategies (REMS) for currently approved BCMA- and CD19-directed autologous chimeric antigen receptor CAR T cell immunotherapies.

These products are gene therapies that are currently approved to treat blood cancers, such as multiple myeloma and certain types of leukemia and lymphoma.

“The FDA has taken the bold step to remove the Risk Evaluation and Mitigation Strategy requirement from giving CAR T therapies. REMS is a useful safety system, but reevaluation over time helps inform whether a REMS is still needed to ensure that the benefits of a product outweigh its risks,” said FDA Vinay Prasad, M.D., M.P.H., Chief Medical and Scientific Officer and Director, Center for Biologics Evaluation and Research. “Eliminating the REMS that is no longer needed also expedites the delivery of potentially curative treatments to patients and reduces burden on providers.”

A REMS is a safety program that the FDA can require for certain medications with serious safety concerns to help ensure the benefits of the medication outweigh its risks.

The FDA determined that the approved REMS for the following products should be eliminated because a REMS is no longer necessary to ensure that the benefits of the autologous CAR T cell immunotherapies outweigh their risks. Abecma (idecabtagene vicleucel)

Breyanzi (lisocabtagene maraleucel)

Carvykti (ciltacabtagene autoleucel)

Kymriah (tisagenlecleucel)

Tecartus (brexucabtagene autoleucel)

Yescarta (axicabtagene ciloleucel)

The elimination of REMS for the above products removes the requirements that hospitals and their associated clinics that dispense products must be specially certified and have on-site, immediate access to tocilizumab. The information regarding the risks for these CAR T cell immunotherapies can be conveyed adequately via the current product labeling, which includes a boxed warning for the risks of cytokine release syndrome and neurological toxicities, and medication guides.

“Physicians and institutions now have greater experience identifying and managing toxicities with the currently approved CAR T products,” said Richard Pazdur, M.D., FDA Oncology Center of Excellence Director. “This approach will potentially facilitate patient access to these treatments while continuing to prioritize safety.”

Continuous monitoring and assessment of the safety of all biological products, including the CAR T cell immunotherapies, is an FDA priority and we remain committed to informing the public when we learn new information about these products.

These products will continue to be subject to safety monitoring, through adverse event reporting requirements in accordance with regulations (21 CFR 600.80). The elimination of the REMS for these products does not change FDA requirements for manufacturers to conduct post marketing observational safety studies to assess the risk of secondary malignancies and long-term safety with follow up of patients for 15 years after product administration.

Related Information

FDA Safety Communication

"Frozen At The Wheel": Bessent Slams Fed For Delay On Rate Decisions

US Treasury Secretary Scott Bessent on Monday criticized Federal Reserve policymakers for what he described as their hesitant posture on interest rates, while signaling that the U.S. Treasury is unlikely to alter its current strategy on debt issuance by increasing long-term bond sales.

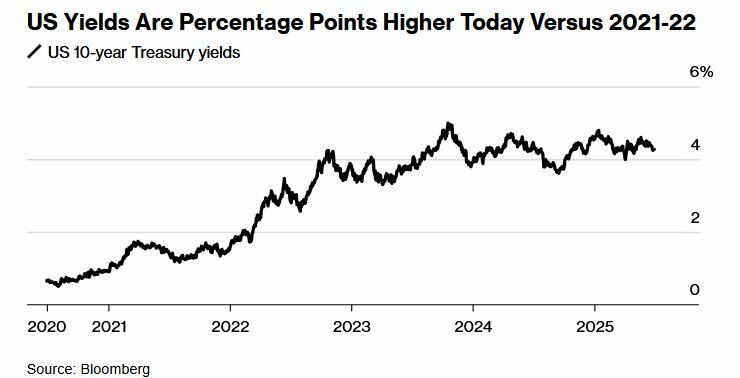

In a wide-ranging interview, Bessent said that recent yields on long-duration Treasurys make it a poor time to lengthen the government's debt profile. “Why would we do that?” Bessent said on Bloomberg Television. “The time to have done that would have been in 2021, 2022.”

Ten-year Treasury yields currently stand at about 4.26%, well above the levels of shorter-term instruments such as the two-year note (3.73%) and 12-month bills (3.81%). Bessent suggested issuing more long-term bonds at these rates would be counterproductive, especially given his expectation that inflation will continue to moderate and pull interest rates lower across the maturity spectrum.

“As we see inflation come down, I think the whole curve in parallel can shift down,” he said, referencing the Treasury yield curve, a key barometer for economic sentiment.

Bessent, who succeeded Janet Yellen as Treasury chief, has retained much of his predecessor’s issuance strategy, despite having previously criticized her for over-reliance on short-term borrowing. At the time, he argued the policy was politically motivated to suppress long-term borrowing costs ahead of the 2024 election.

But Bessent emphasized that now is not the moment to pivot. “Why would we do it at these rates, if we are more than one standard deviation above the long-term rate?” he asked rhetorically.

Fed 'Frozen at the Wheel'

While expressing confidence in the direction of fiscal policy and trade strategy, Bessent leveled pointed criticism at the Federal Reserve’s rate-setting stance. They "seem a little frozen at the wheel,” he said of Fed officials. “My worry here is that, having fallen down on the American people in 2022, the Fed’s now looking at their feet," rather than looking ahead.

The Treasury Secretary cited the Fed’s delayed response to rising prices in 2022 as a pivotal misstep and warned that similar inertia could hinder the central bank’s ability to respond to changing economic conditions. “The Fed made a gigantic mistake in 2022,” he added.

Bessent also pushed back against the idea that recent tariffs have stoked inflation. “We have seen no inflation from tariffs,” he said, calling such effects “transitory” and suggesting they result in only a one-time price adjustment. He hinted at more trade activity on the horizon, saying he expects a “flurry of trade deals” in the days leading up to the July 9 negotiating deadline. The U.S. has already reached agreements with the United Kingdom and China, with ongoing talks still underway.

Meanwhile, as speculation mounts over who might succeed Fed Chair Jerome Powell when his term ends in May 2026, Bessent acknowledged that discussions are already underway. “Obviously there are people who are currently at the Fed who are under consideration,” he said, adding that the administration is eyeing the January 2026 seat opening as a potential stepping stone for the next chair.

Observers have noted Governor Christopher Waller - a Trump-era appointee who has recently called for possible rate cut - as a likely contender. Bessent also mentioned that current Governor Adriana Kugler’s term concludes in January, providing another possible opening for strategic appointments.

He downplayed speculation about his own interest in the job. “I’ll do whatever the president wants,” he said, but added that he already has the "best job in DC”

Looking forward, Bessent expressed optimism about the direction of U.S. fiscal strategy. He voiced support for the Republican budget bill currently advancing in Congress, describing it as a “start” in the effort to bring U.S. debt under control while promoting economic growth.

Bessent also suggested that we could see a lowering of rates, as inflation is "very tame," adding that he is confident the fiscal policy bill will progress in the coming hours.

High Turnover in Small Pool of Bond Traders Hits Canadian Banks

Banks are luring former bond traders out of retirement in Canada, as a high level of staff turnover shakes up the government finance sector at a busy time in the market.

Brad Pederson joined Royal Bank of Canada last month as a senior government bond trader, a spokesperson said. Pederson had retired after bowing out from running Canadian rates trading and government finance at Toronto-Dominion Bank.

At TD, Steve Fraser returned from a hiatus in April to become director of government spread product trading, a spokesperson said. Jamie Williams, who previously led Canadian government trading at HSBC and Canadian Imperial Bank of Commerce, joined ATB Capital Markets earlier this year, according to people familiar with the matter.

Banks are also poaching from one another. TD hired Dan Wilson away from RBC after it lost Sameer Rehman and David Gourlay to rival firms earlier this year. The chain reaction of replacement hires rippled through the sector.

“There are elevated levels of movement on the street across Canadian fixed income,” said Dan Ram, RBC’s global head of rates and foreign-exchange forwards.

The churn on trading desks is happening at a time when Canada’s public-sector debt market is adapting to higher volumes of new bonds, as economic uncertainty and the trade war do damage to government finances.

Canadian provinces are just beginning to face the repercussions of slowing demand and new US tariffs, Laura Gu, senior economist with Desjardins Group, wrote in a June 3 report. Provincial governments are increasing capital spending to boost growth: combined provincial budget deficits are expected to widen to C$45 billion (RM138.98 billion) in the current fiscal year from around C$20.1 billion, Gu wrote at the time.

Federally, Prime Minister Mark Carney has yet to release a budget, but his plans to shore up the Canadian economy and military suggest higher deficits to come.

All of that points to more public-sector bonds to underwrite and trade for Canadian banks.

“Heightened volatility and robust public-sector issuance will continue,” RBC’s Ram said. “We’re preparing for this environment by investing in talent and experience.”

The bank created a leadership position — head of Canadian bond trading — for Gourlay. Pederson, fresh out of retirement, will also train juniors on the team in addition to trading, Ram said.

The recruitment pool is limited for government finance positions in banking because the roles require specialised expertise and deep relationships built over decades, said Bill Vlaad, who runs Toronto-based recruitment firm Vlaad & Co. People in these jobs tend to stay at the same banks, he added, and the high turnover probably won’t continue.

US Supreme Court to Decide on Controlling-Investor Challenges

The US Supreme Court will consider whether activist investors can use an 85-year-old law to challenge corporate moves bolstering controlling shareholders, in a case being closely watched by some of Wall Street’s biggest investment funds.

In a setback to hedge fund manager Boaz Weinstein, the court agreed to review a decision allowing a lawsuit against closed-end fund provider FS Credit Opportunities Corp. and others, including BlackRock Inc., the world’s largest asset manager.

Klotho Neurosciences Moves Forward with Manufacturing Gene Therapy for the Treatment of ALS

Klotho Neurosciences (NASDAQ: KLTO) announced advancement in manufacturing and process development for KLTO-202, its investigational gene therapy treatment for amyotrophic lateral sclerosis (ALS). The company has licensed a unique RNA splice variant of the human alpha-Klotho gene from the Autonomous University of Barcelona for developing advanced gene therapies.

The company's research has demonstrated that overexpression of secreted alpha-Klotho (s-KL) using gene therapy has shown positive therapeutic outcomes in multiple animal studies, including mouse and non-human primate models. The timeline for development indicates approximately 8 months for manufacturing and 4-6 months for regulatory processes, with Phase I/II clinical trials expected to begin by Q3 2026.

KLTO plans to collaborate with contract research organizations (CROs) to manage manufacturing and clinical trials, maintaining operational efficiency without significant staff expansion. The company aims to use an AAV vector to deliver the s-KL gene directly to motor neurons affected by ALS, a disease that typically leads to paralysis and death within 2-3 years of diagnosis.

Unicycive Gets CRL in Chronic Kidney Disease Trial

Unicycive Therapeutics (Nasdaq: UNCY) announced receiving a Complete Response Letter (CRL) from the FDA regarding its New Drug Application (NDA) for Oxylanthanum Carbonate (OLC), intended to treat hyperphosphatemia in chronic kidney disease patients on dialysis.

The CRL cited deficiencies at a third-party manufacturing vendor unrelated to OLC itself. The FDA did not raise concerns about pre-clinical, clinical, or safety data. The company has identified a second manufacturing vendor that has already produced OLC drug product and could help resolve the Clinical Manufacturing and Controls (CMC) issues.

Unicycive plans to request a Type A meeting with the FDA to discuss next steps. The company reports an unaudited cash balance of approximately $20.7 million, with runway expected into the second half of 2026.