For weeks now, Democrats have been demanding that Republicans negotiate an extension of expiring COVID-19-era premium health care tax credits in exchange for their votes to reopen the federal government.

But most Republicans, many of whom would like to see further reforms to Obamacare, do not appear keen on extending the COVID-19-era policy.

Prominent Senate Democrats have presented the extension of the health care cost assistance as an urgent matter, as insurance companies—which have received billions from the enhanced tax credits—are announcing potential premium increases if they expire. The expanded subsidies are set to expire at the end of the year, at which they would return to pre-COVID-19 levels.

“Even a majority of Trump supporters by nearly 60% support an extension,” Senate Minority Leader Chuck Schumer, D-N.Y., said last Friday. “People are learning about this issue, and they’re aghast that their premiums could go up so much.”

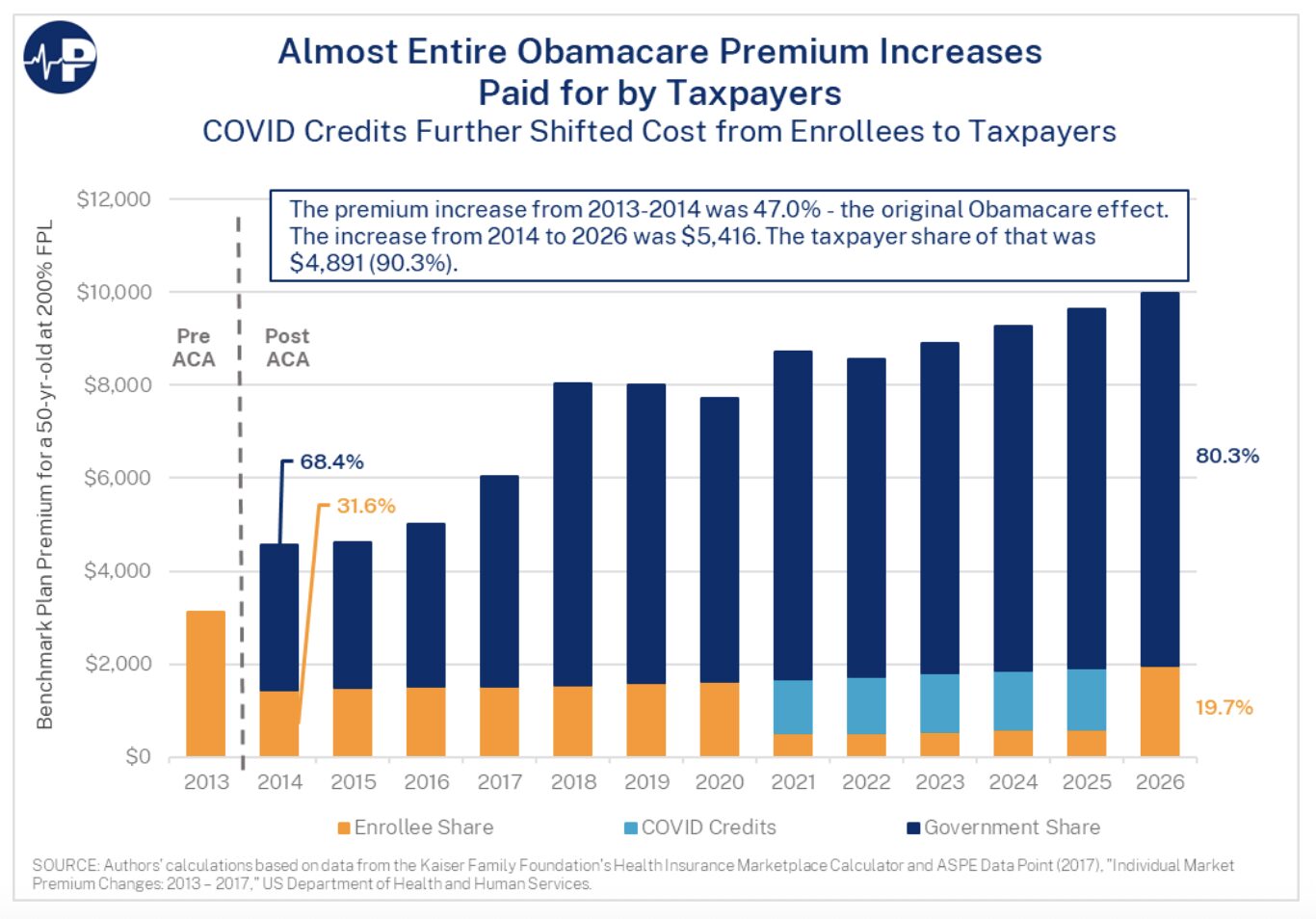

But Republicans and conservatives in Washington tend not to speak of the tax break so glowingly, pointing to the fact that the credits often function as direct payments to insurance companies.

“These are expanded Obamacare tax credits. And frankly, they’re not tax credits, really, at all. For the most part, they’re direct subsidies to insurance companies,” Senate Majority Leader John Thune, R-S.D., told reporters shortly after Democrats first voted against stopgap funding of the government. “So it needs to be reformed.”

Recipients of the premium tax credit can elect to have the credit advanced before filing their taxes, a process in which the subsidy actually flows directly to the insurance provider on behalf of the recipient.

Even if Republican leadership in both chambers decided to throw Democrats a bone in the matter, many conservatives in the House are altogether opposed to extending what is an expansion of Obamacare—a law they abhor to begin with. Passing a clean extension of the tax credits would be difficult, giving the House’s large conservative Republican faction.

“Look, they want to continue a COVID-era insurance company giveaway scheme,” House Freedom Caucus Chairman Andy Harris, R-Md., told The Daily Signal a day before Democrats voted against funding the government. “There’s no reason to [extend] it. COVID is over. The insurance companies have made billions of dollars off the enhanced tax credits. It’s about time to return to the pre-COVID level of tax credits with the original [Affordable Care Act] tax credits.”

Within the conservative orbit, the expanded credits—which were passed in a 2021 Democrat budget bill that received zero Republican votes—have never been popular.

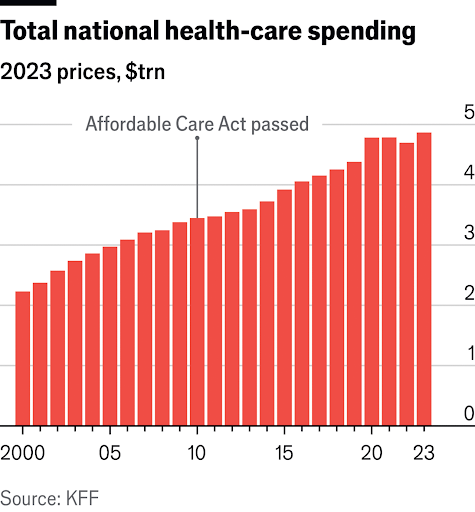

The Heritage Foundation has argued that the Obamacare tax credits have increased federal spending by making it go up with increasing premiums. “As premiums rise, so do the subsidies,” reads a 2023 report urging a repeal of the tax subsidies.

To be sure, it is entirely possible that Republicans could yet extend the tax credits, although it remains unclear what sort of reforms might be put in place, or how long an extension could be.

A bipartisan group in the House of Representatives has proposed a clean, one-year extension of the subsidies to punt on the matter. Additionally, Sen. Josh Hawley, R-Mo., has said he’s “willing to talk about” extending the tax credit, and is open to suggestions on how long the extension could be and whether or not to place an income cap on them.

Speaker of the House Mike Johnson, R-La., who has not ruled out a reformed extension of the credits, has said there are “535 members in the entire House and Senate, and there’s probably 400 different ideas on how to fix” the issue, so “vigorous, deliberate debates” are needed.

But in general, Republicans appear to be seeking to restructure Obamacare, rather than double down on it.

Sen. Cynthia Lummis, R-Wyo., argues that to extend the subsidies would be to put more resources into a program that has not yielded results for Americans.

“COVID is over, so it’s time to resume lower levels of spending,” she told reporters last week. “We probably should be looking at Obamacare on a more holistic basis, because it’s not a success, and it’s going to have to require expensive Band-Aids to hold it together. So, it’s probably time to take a more serious look at it.”

That’s a major reason why Republicans say they do not want to negotiate the subsidies in the midst of a shutdown—because, in their view, Obamacare is a fundamentally flawed piece of legislation. As such, they see little reason to rush into pumping more money into it as part of a deal to temporarily reopen the government.

“The president says that he wants to make it better,” Sen. Markwayne Mullin, R-Okla., an ally of Senate leadership, recently told reporters.

He added that President Donald Trump “wants to make health care affordable for everybody. Right now, we know Obamacare isn’t working. I mean, it’s skyrocketing prescription drugs, skyrocketing premiums. They have to have a premium tax to offset the cost of it. So, what the president is wanting to do is, ‘Let’s talk.‘ Let’s work it out. Let’s figure out how to get the free market going again and get it where it actually works for the American people.”

Democrats and Republicans are on very different pages on the health care issue.

While Democrats have presented an alternative funding bill that would repeal every cost-saving health care provision in the July budget reconciliation bill, top Republicans say they’re just getting started on their work on health care.

“We have more reforms coming to try to fix Obamacare, which is not working for the people,” Johnson said last week.

https://www.dailysignal.com/2025/10/08/most-republicans-arent-keen-extend-obamacare-subsidies/