President Joe Biden on Thursday said Brian Deese, who heads the White House's National Economic Council, is departing. Biden said in a statement that he's grateful to Deese's family "for letting us borrow Brian" and he knows "they're excited to welcome him home." Lael Brainard, the vice chair of the Federal Reserve, has emerged as a contender to take Deese's job, though others are also under consideration.

Search This Blog

Thursday, February 2, 2023

Most Shorted Companies All Exploding Higher

We may not (yet) be at Jan 2021, when an army of Reddit apes sniffed out some of the most shorted names in the market (such as GME, AMC) and with the financial benefit of trillions in freshly printed stimmies, sparked unprecedented short squeeze havoc in capital markets, including the obliteration of one of the marquee hedge funds du jour: that of Steve Cohen protege Gabe Plotkin's Melvin Capital, who was aggressively (with leverage) short most of these companies... but we are not that far off, either.

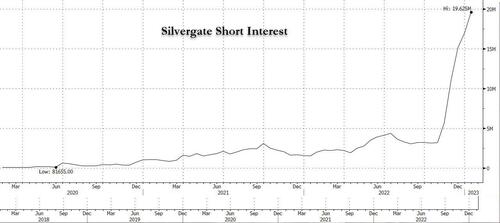

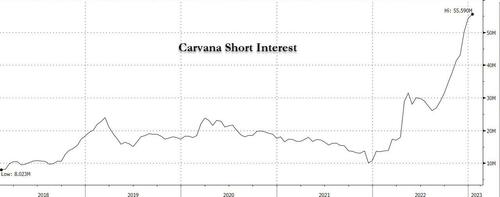

After some of the highest beta names suffered a historic obliteration in 2022 courtesy of the Fed's fastest tightening campaign since Volcker, yesterday's unexpectedly dovish presentation by Jerome Powell has sparked a historic meltup, one that is straight out of the Jan 2021 playbook, and the result has been that the most heavily shorted names such as Silvergate...

... and Carvana...

... are soaring the most on record.

Of course, none of this should be a surprise to regular readers in a market where technicals, positioning and liquidity are all that matter - as we won't tire of repeating again and again. In fact, it was the technicals and positioning that led us to correctly predict that "We Are Setting Up For A Tech-led Squeeze Higher As Shorting Gets Extreme" one month ago, even as everyone on Wall Street - including such "reputable" banks as JPM, GS, MS and so on - were urging clients to sell and go short, while those who listened to us are up 33% in 3 weeks!

And while there may not be fiscal stimmies this time, the monetary spigots are starting to turn. Consider the following:

- Powell says "disinflation" 13 times

- BOC pausing

- BOE pausing

- ECB one more and done, turns to "climate QE"

Furthermore, since there will not be a fiscal boost this time (thank you divided Congress) it means the Fed will have to work overtime to offset the slowdown.

Yet what is strange is how stubborn the bears have become in light of clearly shifting monetary sands, instead focusing entirely on the shitty fundamentals, as if those have ever matters. Consider what Goldman's John Flood said last night: while hedge funds are starting to turn bullish, vanilla "Long Onlies" still refuse to chase:

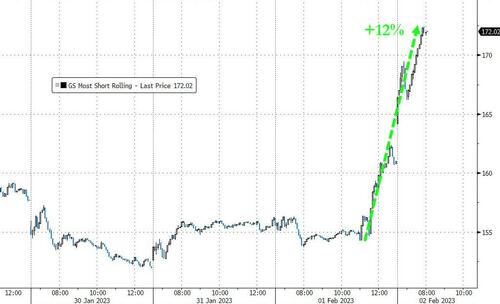

Slight uptick in HF buy skew post fed with HF 430bps to buy - clear pain trade to the upside here with signs of covering and HFs buying Supercap tech to get on some exposure. Our most short basket squeezed another +305bps...

[ZH: Most Shorted basket is now up 12% from the start of the Powell press conference]

...

We have seen large buy tickets in GOOGL (bought ~1mn and reloading) and AMZN (bought 500k between multiple buyers...mostly HFs). LOs surprisingly still in sell mode at 480bps better for sale (will see if this changes tomorrow after today's developments).

But while bears remain in denial, those who bought the November bottom (in names such as Facebook, for example, which has doubled in two months!) have made their year and then some, prompting investors in the laggards to ask what is going on and why are all these "value investors" once again sucking.

And so, as the LOs realize that whether they want to or not they will have to - kicking and screaming - chase higher, just as we warned last night...

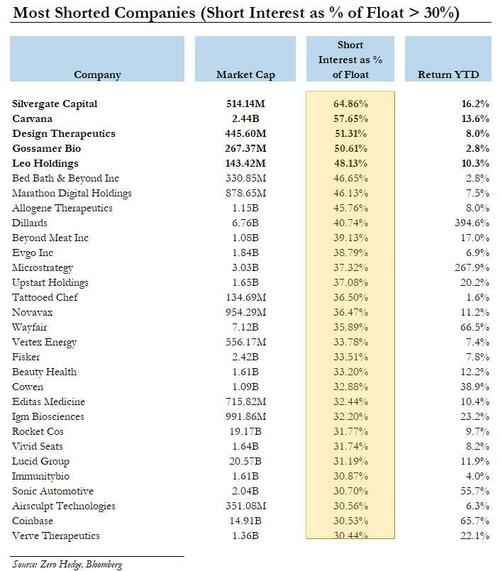

... here, for their benefit, is a list of the most shorted names in the market, those with a short interest as % of their float between 30% and a Volkswagen-like 65%! As shown below, virtually all of these are already up double digits YTD and in some cases triple.

https://www.zerohedge.com/markets/here-are-most-shorted-companies-they-are-all-exploding-higher

Karuna to license mood and anxiety disorder candidate

Karuna to obtain exclusive global license to develop, manufacture, and commercialize multiple TRPC4/5 candidates, including lead clinical-stage candidate GFB-887

Goldfinch Bio assignment estate to receive $15 million upfront payment and up to $520 million in potential milestone payments plus royalties for each TRPC4/5 candidate

Karuna to share details on the planned development of GFB-887 for the treatment of mood and anxiety disorders in the second half of 2023

https://finance.yahoo.com/news/karuna-therapeutics-announces-exclusive-global-113000479.html

Bristol Myers' profit beats on better-than-feared Revlimid sales

Bristol Myers Squibb Co on Thursday reported quarterly earnings that beat analysts' estimates due to a smaller-than-expected drop in sales of cancer drug Revlimid, which is facing competition from cheaper generic rivals.

Fourth-quarter Revlimid sales of $2.26 billion topped Wall Street estimates of $1.89 billion, according to Refinitiv data.

The company expects Revlimid sales to fall to $6.5 billion in 2023 from $9.98 billion last year.

The forecast suggests Revlimid's "generic erosion will accelerate," William Blair analysts said in a note.

To help offset the decline in Revlimid sales, Bristol Myers has been betting on newer products, such as cancer therapies Opdualag and Abecma.

With the momentum of the new product portfolio, the company expects to roughly double sales of its more recent offerings in 2023 versus last year to about $4 billion, Chief Financial Officer David Elkins said on a call to discuss the company's results.

The New York-based drugmaker reported a nearly 5% decline in sales in the fourth quarter to $11.41 billion, but that was above analysts' expectations of $11.2 billion.

Excluding the effect of foreign exchange, sales grew 3% in 2022, the CFO said.

"This is the first year of generic (competition for Revlimid) and everybody wanted to see if we could grow through the year. We did that," Elkins said.

Bristol Myers shares were up about 1% at $72.06.

The company reported sales of $2.69 billion for the blood thinner Eliquis that it shares with Pfizer Inc in the quarter, and $2.22 billion for cancer immunotherapy Opdivo, up 1% and 11% over a year earlier, respectively.

Bristol Myers said it earned $1.82 per share in the quarter, down from $1.84 a year ago. Analysts, on average, had expected earnings of $1.72 per share.

The company forecast 2023 earnings of $7.95 to $8.25 a share, on revenue it sees increasing by about 2% from 2022 sales of $46.16 billion.

https://finance.yahoo.com/news/1-bristol-myers-profit-beats-155219174.html

Clearside: Positive 6-Month Results in Wet AMD Study

Suprachoroidal CLS-AX Resulted in Favorable Safety Data, Durability and Biologic Effect Over 6 Months in Treatment-Experienced Anti-VEGF Sub-Responders -

- 67% of Extension Study Participants Went at Least 6 Months Without Needing Additional Treatment -

- Extension Participants Experienced a 77 - 85% Reduction in Treatment Burden Over 6 Months -

- Webcast and Conference Call Today at 8:30 A.M. ET Hosted by Management and Including Key Opinion Leader, Mark R. Barakat, M.D. -

Clearside will host a webcast and conference call with accompanying slides today at 8:30 a.m. ET, including comments by management and retinal expert, Dr. Mark R. Barakat. The live and archived webcast may be accessed on the Clearside website under the Investors section: Events and Presentations. The live call can be accessed by dialing (888) 506-0062 (domestic) or (973) 528-0011 (international) and entering conference code: 676850.

https://finance.yahoo.com/news/clearside-biomedical-announces-positive-6-120500797.html

IRadiMed beats views

Reports fourth quarter 2022 revenue of $14.9 million, GAAP diluted EPS of $0.29 and non-GAAP diluted EPS of $0.32.

Reports full-year 2022 revenue of $53.3 million, GAAP diluted EPS of $1.02 and non-GAAP diluted EPS of $1.10.

The Board of Directors approved a special cash dividend of $1.05 per share. This special cash dividend is payable on February 21, 2023, to shareholders of record at the close of business on February 13, 2023.

Pliant: FDA Clears Application for PLN-101095 for the Treatment of Solid Tumors

Pliant Therapeutics, Inc. (Nasdaq: PLRX), a clinical stage biotechnology company focused on discovering and developing novel therapeutics for the treatment of fibrosis, today announced that the U.S. Food and Drug Administration (FDA) has cleared the company’s Investigational New Drug (IND) application for PLN-101095, an oral, small molecule, dual selective inhibitor of integrins αvβ8 and αvβ1. A Phase 1 first-in-human study evaluating PLN-101095 in patients with solid tumors that are resistant to immune checkpoint inhibitors (ICIs) is expected to initiate in the second quarter of 2023.

https://finance.yahoo.com/news/pliant-therapeutics-announces-fda-clearance-130200435.html