We may not (yet) be at Jan 2021, when an army of Reddit apes sniffed out some of the most shorted names in the market (such as GME, AMC) and with the financial benefit of trillions in freshly printed stimmies, sparked unprecedented short squeeze havoc in capital markets, including the obliteration of one of the marquee hedge funds du jour: that of Steve Cohen protege Gabe Plotkin's Melvin Capital, who was aggressively (with leverage) short most of these companies... but we are not that far off, either.

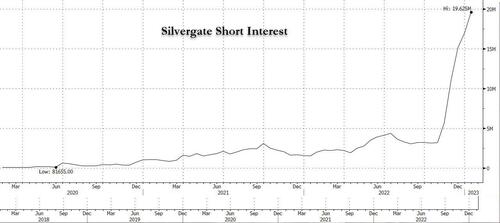

After some of the highest beta names suffered a historic obliteration in 2022 courtesy of the Fed's fastest tightening campaign since Volcker, yesterday's unexpectedly dovish presentation by Jerome Powell has sparked a historic meltup, one that is straight out of the Jan 2021 playbook, and the result has been that the most heavily shorted names such as Silvergate...

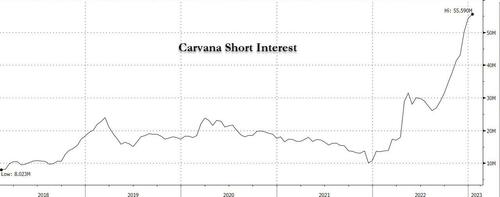

... and Carvana...

... are soaring the most on record.

Of course, none of this should be a surprise to regular readers in a market where technicals, positioning and liquidity are all that matter - as we won't tire of repeating again and again. In fact, it was the technicals and positioning that led us to correctly predict that "We Are Setting Up For A Tech-led Squeeze Higher As Shorting Gets Extreme" one month ago, even as everyone on Wall Street - including such "reputable" banks as JPM, GS, MS and so on - were urging clients to sell and go short, while those who listened to us are up 33% in 3 weeks!

And while there may not be fiscal stimmies this time, the monetary spigots are starting to turn. Consider the following:

- Powell says "disinflation" 13 times

- BOC pausing

- BOE pausing

- ECB one more and done, turns to "climate QE"

Furthermore, since there will not be a fiscal boost this time (thank you divided Congress) it means the Fed will have to work overtime to offset the slowdown.

Yet what is strange is how stubborn the bears have become in light of clearly shifting monetary sands, instead focusing entirely on the shitty fundamentals, as if those have ever matters. Consider what Goldman's John Flood said last night: while hedge funds are starting to turn bullish, vanilla "Long Onlies" still refuse to chase:

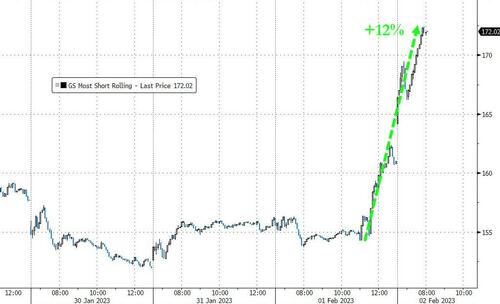

Slight uptick in HF buy skew post fed with HF 430bps to buy - clear pain trade to the upside here with signs of covering and HFs buying Supercap tech to get on some exposure. Our most short basket squeezed another +305bps...

[ZH: Most Shorted basket is now up 12% from the start of the Powell press conference]

...

We have seen large buy tickets in GOOGL (bought ~1mn and reloading) and AMZN (bought 500k between multiple buyers...mostly HFs). LOs surprisingly still in sell mode at 480bps better for sale (will see if this changes tomorrow after today's developments).

But while bears remain in denial, those who bought the November bottom (in names such as Facebook, for example, which has doubled in two months!) have made their year and then some, prompting investors in the laggards to ask what is going on and why are all these "value investors" once again sucking.

And so, as the LOs realize that whether they want to or not they will have to - kicking and screaming - chase higher, just as we warned last night...

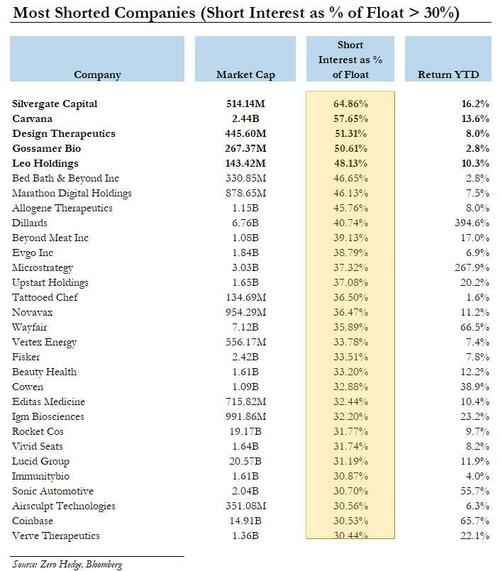

... here, for their benefit, is a list of the most shorted names in the market, those with a short interest as % of their float between 30% and a Volkswagen-like 65%! As shown below, virtually all of these are already up double digits YTD and in some cases triple.

https://www.zerohedge.com/markets/here-are-most-shorted-companies-they-are-all-exploding-higher

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.