This is a true story.

I went to high school with a guy named Frankie. He was a hothead – always in trouble because he couldn't control his temper. Sassing teachers, getting into fights – there may have even been a few run-ins with the law. We called him Frankie the Fuse, but never to his face.

Jump ahead 20 years. I'm at a minor-league baseball game, and sitting across the aisle is none other than Frankie the Fuse. He looks at me, I look at him, and soon we're fast friends again. By the end of the game, we've made plans to golf the following weekend.

And so began what would become a tortuous and ultimately ill-fated renewal of our relationship. Even though Frankie was pushing 40, his fuse hadn't grown any longer. During our first round of golf, he duffed a chip shot, unleashed a string of curses, and threw his wedge into a pond. On other outings, he bent a 5-iron around a tree and cracked the windshield on our cart with his fist. If we were paired with golfers we didn't know, I'd have to take them aside beforehand and warn them of Frankie's outbursts.

Finally, things got so bad I started inventing excuses when he called or emailed until he got the hint.

The Age of the Jerk?

Everyone gets frustrated, upset, and angry. It's even normal to yell, curse, throw things, or beat up a cushion now and then. But some people, like Frankie, can get out of control.

Judging from news reports and my social media feed, the number of "Frankies" in the world seems to be multiplying. Maybe we're getting angrier as a society, or perhaps we're just less inhibited about acting out.

We've all seen videos of road rage, or someone on an airplane yelling at a flight attendant, or an irate customer busting up a fast-food restaurant.

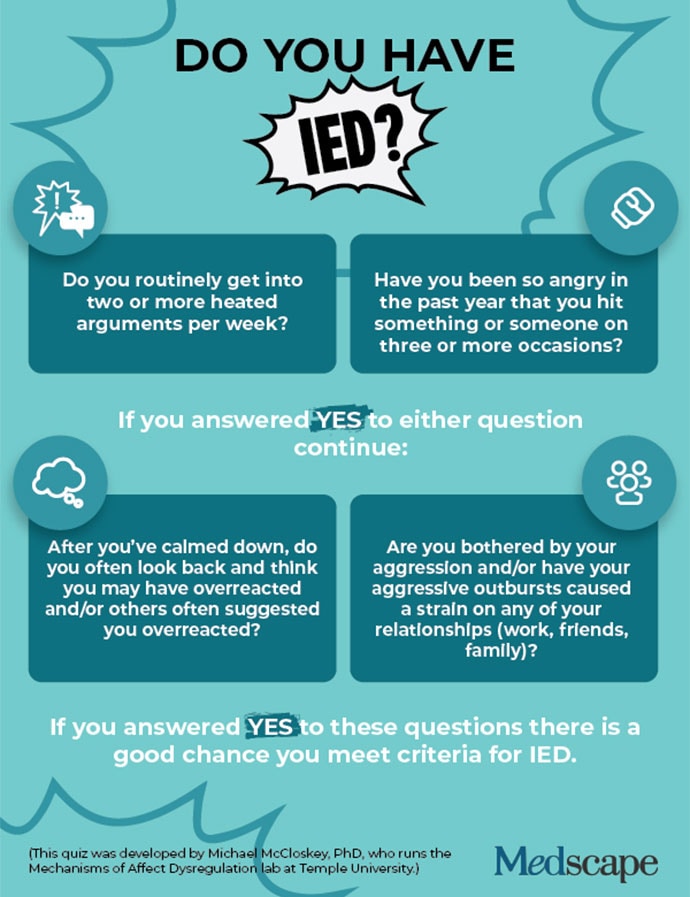

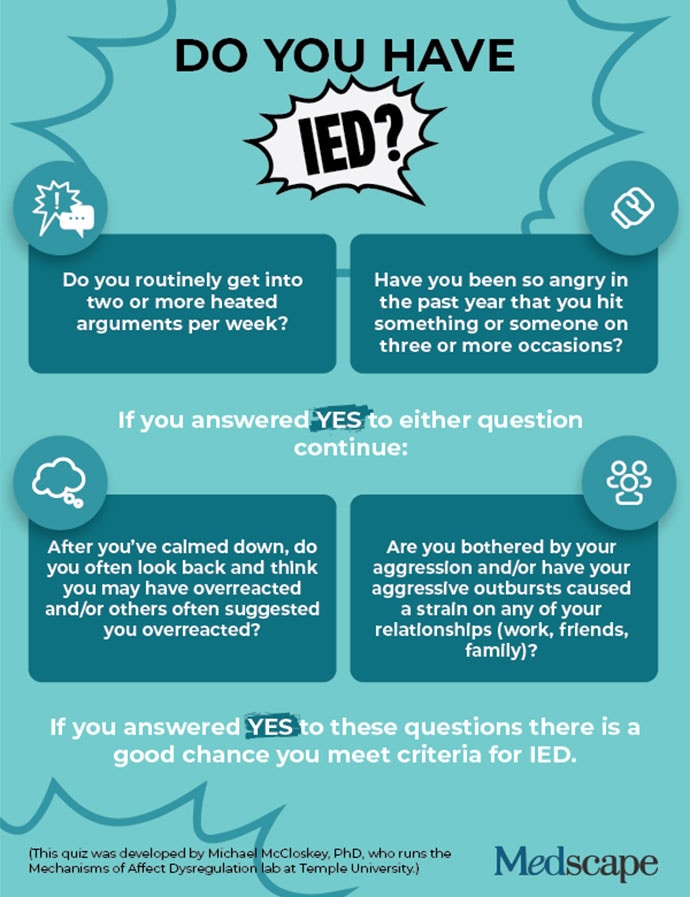

I used to think these people were just jerks, but it turns out these angry outbursts may be caused by a little-known psychological condition called intermittent explosive disorder, or IED. Those who have it may not realize they have it or that it can be treated.

In the last few decades, science has been steadily unraveling IED, and in the most recent version of the Diagnostic and Statistical Manual of Mental Disorders (DSM5), there's a whole section on it. (The fact that it shares an acronym with improvised explosive device is an unintended but convenient coincidence, experts contend.)

The disorder is more than being "quick to anger," said Michael McCloskey, PhD, a professor of psychology and neuroscience at Temple University and a leading IED researcher. "When they get angry, they act out aggressively – yelling and screaming, breaking things, and getting into physical altercations."

That reaction is out of proportion to the trigger, he said. "For example, if someone tries to punch you and you punch them back, that's not IED. But if someone says they don't like what you're wearing and you punch them, that could be indicative."

About 1 in 25 (or 13.5 million) Americans have the disorder, said Emil Coccaro, MD, the vice chair of research in the Department of Psychiatry and Behavioral Health at Ohio State University and the recognized world expert on IED.

"We don't have any data on whether it's increasing or not," he said. "But clearly life is faster paced, people feel more stressed, and that could be promoting it." Or we're just seeing more incidents because everyone has a cellphone now, or the DSM5 entry makes diagnosis easier.

About 80% of those with IED are untreated, said Coccaro. (To my knowledge, Frankie never sought help for his angry outbursts and probably never heard of IED. But when I described his behavior to the experts, they agreed he probably has it.)

The Science of Anger

There are two things happening in the brain that are believed to cause this type of reaction. Coccaro points out that aggression is an evolutionary necessity. We need a defense mechanism to protect ourselves from threats. So, when a threat is perceived, "the amygdala, which is the reptilian part of our brain, kicks in to trigger either a fight or flight response," he explained. "But in people with IED, the amygdala reacts more quickly and strongly. Their fuse is shorter."

"Overly aggressive people tend to have lower levels of brain serotonin function," Coccaro said. This naturally occurring chemical messenger, among other jobs, works to ease aggression. "Think of serotonin as your braking system," he said. If your brake fluid is low, you won't be able to stop.

People with IED don't plan to have their outbursts. They just happen. Nor do they typically use them to manipulate or intimidate others. (That would be antisocial or psychopathic behavior.) Rather they simply misperceive threats and then can't control their reaction to those threats. They snap.

But they're not oblivious to their behavior. Although they may not apologize directly, "they feel the impact it has on their family and friends and how it's alienating them," said McCloskey. "It's not something they enjoy. They're distressed by it."

IED tends to be a bit more common in men. Males are typically more physically aggressive, while women with IED are more verbally so. IED is most common among those in their teens, 20s, and 30s, after which it gradually eases with age, although the threat of an outburst always remains.

Research hasn't determined if any jobs or socioeconomic conditions make people more likely to have IED, but genes certainly can. "The more severe the manifestation of aggression, the more genetic influence underlies that aggression," said Coccaro. That influence is less strong (mid-20%) for verbal aggression, stronger (mid-30%) for hitting things, and strongest (mid-40%) for hitting others.

Learning also plays a role. It's not uncommon for people with IED to have been raised in angry households with violent parents.

Another potential cause of IED is inflammation, which also plays a role in other behavioral disorders, such as depression, schizophrenia, and bipolar. "There's some research with cats that show when you introduce inflammatory molecules to their brains, they become more aggressive," said Coccaro. IED can also result from a head strike that damages the brain's temporal lobe, where the amygdala is located.

We don't yet know whether anger outbursts, left untreated, can get more severe. In other words, can years of tantrums lead to an especially violent outburst – toward others or oneself?

"We don't know if it progresses like that," said Coccaro, "but we do know that about 20% of people with IED attempt suicide or some other form of self-harm." And alcohol or drugs can make people more sensitive to provocation and more uncontrolled in their outbursts. IED could lead to domestic violence, but the experts we spoke with don't connect it to mass shootings. Those are planned, while IED is spontaneous.

Getting Help

Fortunately, there are ways to manage IED.

The first is cognitive behavioral therapy, the classic form of psychotherapy used to treat common behavior problems. "We teach patients how to tell if their perception of an anger-inducing situation is based in fact and then how to not act out aggressively. This type of therapy has been shown to reduce aggression by 50% or more over 12 weeks," said McCloskey.

The second treatment, which can be combined with the first, is medication. "Serotonin reuptake inhibitors have been shown to be effective," said Coccaro. These antidepressant-type drugs improve the behavioral braking system mentioned earlier. Anti-epileptic drugs also appear to have some benefit.

McCloskey's lab is also working on a new computer intervention that shows some promise in treating aggression. It teaches coping skills by having people view threatening and nonthreatening words or pictures on a screen. "Technology could make treatment more accessible and more engaging," he said.

These treatments require the patient to realize (or be convinced) that they need help. As with alcoholism or drug addiction, that's not an easy threshold to cross.

"We all have our defense systems," said Jon Grant, MD, a professor of psychiatry and behavioral neuroscience at the University of Chicago. "It's easier to blame others than ourselves."

And if you encounter someone raging? "Don't tell them to calm down or try to reason with them, just walk away and get to a position of safety," he said. "And don't video them. That's insensitive. There's no reason to make them a topic of ridicule or embarrassment. In fact, if they see you filming them, they might get angrier."

But later, when they've settled down, Grant recommends talking with them. "Say listen, you just threw your club into a pond, and you scared the hell out of me. I'm not going to play golf with you anymore if you continue to do this." Season the ultimatum with sympathy. Say you'd like to understand better why they react this way and ask if you can help.

"Most people think it's just bad behavior, and the person who's acting out needs an attitude adjustment," said Coccaro. "But the truth is, there's lots of biological evidence that IED is a real thing. It's not simply an attitude."

"It takes a brave person to admit to this disorder," said Grant. "Even though many athletes, celebrities, and politicians probably [have] it, no one is stepping forward as the poster child."

Depression evokes sympathy, but aggression scares us, Grant said. "And when someone admits to abuse, we automatically want to give our attention to the victim, not the abuser."

Should We Let Our Rage Out?

You may have heard of rage, anger, or smash rooms. These are commercial places you can go and, for a fee, destroy computers, furniture, mannequins, or just about anything you'd like. The theory is that venting your anger in a controlled setting is better and safer than letting it out in the real world.

"If you don't have an aggression problem, it's probably just good fun," said McCloskey. "But if you do, then it's unlikely that it'll be an effective strategy for managing it. All it's doing is reinforcing the way to approach a problem is to act out aggressively."

"There's also a concept called 'acquired capability,'" he continued. "If you get more comfortable with a behavior and it becomes part of your repertoire, then you're more likely to do it."

McCloskey stressed that anger is a normal human emotion and expressing that anger (within limits) can be healthy. Occasional small acts of excessive aggression are normal. But if it goes beyond that, get help.

"What's interesting about all this," said McCloskey, "is that people with depression or anxiety will say, 'Oh, I get treatment for that.' But people with IED tend to think, 'I'm just an aggressive person, and there's nothing that can be done about it.' That's just not true."

Sources

Michael McCloskey, PhD, professor of psychology and neuroscience, Temple University.

Emil Coccaro, MD, vice chair of research, Department of Psychiatry and Behavioral Health, Ohio State University.

Jon Grant, MD, professor of psychiatry and behavioral neuroscience, University of Chicago.

https://www.medscape.com/s/viewarticle/996032