Aesthetics franchise is a key franchise for Allergan.

I have run few DCF analyses to show what is a potential valuation of Allergan’s aesthetics franchise.

The outcome of my analysis is that this business alone is worth more than the current valuation of the entire company.

Thus, I think Allergan is strongly poised to outperform because the market is totally missing the quality of Botox and Aesthetics franchises.

Aesthetics franchise is a key franchise for Allergan (AGN), accounting for around $6B in sales in 2018 and still growing at low double-digit rate, thanks to a solid outlook for Botox, fillers, and breast implants.

I like the company’s long-term strategy and its business model, and I think Allergan is strongly poised to outperform from the current valuation of 9x 2018 P/E because the market is totally missing the quality of Botox and aesthetics franchises.

Allergan’s Strategic Review

At Q1/2018 results, Allergan’s management announced that they are not far from announcing the results of the strategic review of the company, where they are evaluating the merits of a potential spinoff of the aesthetics franchise.

Thus, in this article, I have run few DCF analyses to show what is a potential valuation of Allergan’s aesthetics franchise, assuming that the management will pursue a spinoff of this great business, and the outcome of my analysis is that this business alone is worth more than the current valuation of the entire company.

I think that a DCF analysis is the best tool to analyze the intrinsic value of AGN’s aesthetics franchise because it allows to take into account the long-term strengths and threats of this key therapeutic area.

On one hand, this franchise is likely to benefit from the lack of patent expirations compared to the pharmaceutical environment, but on the other hand, it is likely to face biosimilars competition on Botox therapeutic in 2025.

This analysis is based on my own assumptions related to the long-term outlook for this area. I assumed a progressive moderation of the growth rate for these franchises from low double-digit to high single-digit. Lastly, I assumed that the biosimilars competition will put some pressure on the growth outlook for Botox Therapeutics in 2025 and beyond.

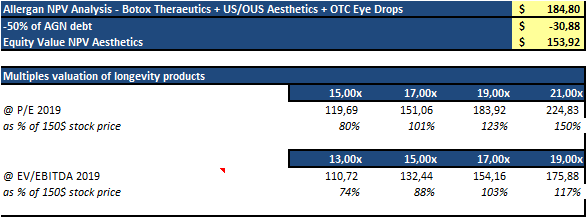

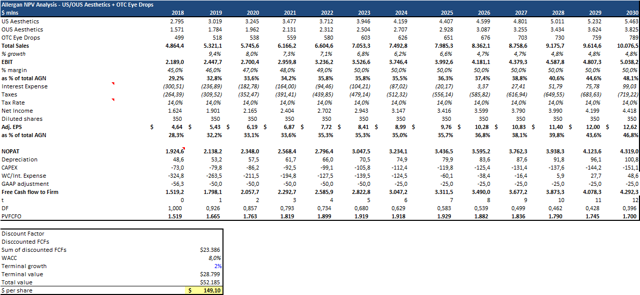

Aesthetics Franchise: NPV Valuation

Source: My Own valuation model

The main takeaway from this analysis is that the NPV valuation of the US/OUS aesthetics franchise is $149 per share.

It’s worth noting that I have assumed a WACC of 8% while the Terminal growth of this franchise is 2%, to reflect that the aesthetics franchise will not face pricing pressure and biosimilar competition over the long term. Lastly, I have assumed a 50% operating margin and a tax rate of 14%.

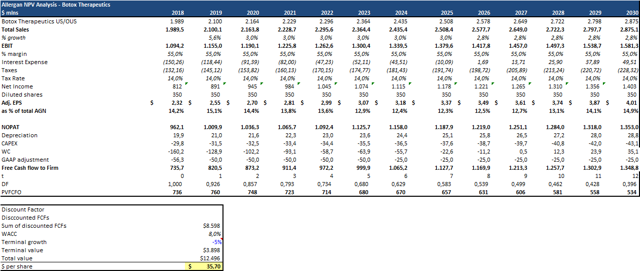

Botox Therapeutics: NPV Valuation

The main takeaway from this analysis is that the NPV valuation of the Botox Therapeutic franchise is $35 per share.

It’s worth noting that I have assumed a WACC of 8% while the Terminal growth of this franchise is -5%, to reflect that this business is likely to face biosimilar competition beyond 2023. Lastly, I have assumed a 55% operating margin and a tax rate of 14%.

Multiples Valuation

The main argument for a potential spinoff of the aesthetics business is that Allergan should re-rate after the spinoff because the Newco will be focused exclusively on consumer franchises, with less reliance on price increase and limited pressure from biosimilars.

Source: My Own valuation model

The main takeaway from this analysis is that Allergan looks strongly undervalued on any metrics, taking into account a potential spinoff of the aesthetics franchise. Assuming that the Newco will trade at a premium to the pharmaceutical sector (e.g. 17x P/E 2018 or 15x EV/EBITDA 2018) and assigning around $10B of net debt to this Newco, I estimate a valuation of $130/150 per share for the Aesthetic franchise alone, which is approximately equivalent to the current market capitalization of the entire Allergan.

What Is The Value Of Allergan If The Break-Up Does Not Happen?

Even assuming that the management will not pursue a breakup of the company, the outlook for this company is healthy. You can see here a more comprehensive analysis of Allergan and few analyses of the intrinsic value of the whole company.

The main arguments behind my bullish thesis on Allergan are:

- Estimates for 2018 seem conservative.

- I don’t believe that Revance’s (RVNC) RT002 will have a meaningful impact on Allergan’s Botox franchise.

- At 9x 2018 P/E, shares trade at the low end of the diversified biopharma group, despite a highly attractive portfolio of assets.

- Allergan could benefit from a broad and underappreciated pipeline with more than ten assets with >$500 mln peak sales in Phase II/III.

- Allergan could benefit from the divestments of few non-core franchises, as women’s health or antibiotics. The company could use the proceeds from these divestments to pay-down debt or to do some bolt-on acquisitions in the aesthetics franchise. This strategy could be the right way to re-focus the company on their leading therapeutic areas (e.g. aesthetics franchise, CNS, GI, and Eye Care), without having to break-up the company.

Risks

Over the next 12 months, Allergan will report the results from some Phase II and III trials:

- Few more Phase III data for Ubrogepant in acute migraine in H1/2018.

- Phase IIb data for Atogepant in migraine prevention in H1/18.

- Phase III data for Abicipar in wet AMD in H2/2018.

- Phase III data for Rapastinel in depression in H1/2019.

Each of these assets is a potential blockbuster opportunity, but if all these trials will fail, the market will question the ability of management in doing research and discovery.

I think this is the biggest risk factor, which could prevent a meaningful re-rating of Allergan from the current depressed valuation.

Conclusion

Despite a beat and raise at Q1/2018 results, Allergan’s shares have been pressured by the uncertainties on the outcome of the strategic review. I do not understand the logic behind these worries, and I think that the investors’ patience will be finally rewarded.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.