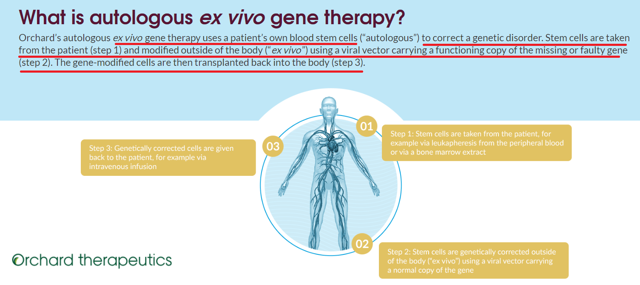

Orchard is a biopharmaceutical company developing and commercializing autologous ex vivo gene therapies for life-threatening rare diseases.

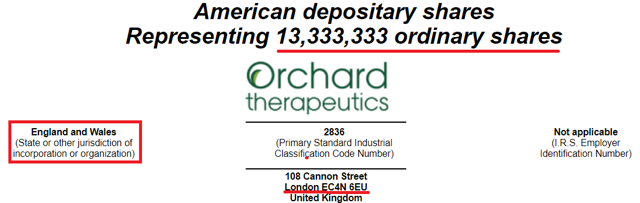

The company is offering 13.333 million American Depositary Shares at $14-16 per ADS. Each ADS represents one ordinary share.

Orchard does seem a bit undervalued.

Orchard’s enterprise value is $868 million, and competitors like Editas Medicine and CRISPR have larger enterprise value with product candidates that are not much more developed.

The company is expected to submit data from its clinical trials in 2020. The investors buying shares should get to know that they will have to wait for stock returns.

With an enterprise value of $868 million, Orchard (ORTX) seems a bit undervalued as compared to peers. Other competitors have larger enterprise value with a pipeline that seems similar to that of Orchard. In addition, investors will find interesting that GlaxoSmithKline (GSK) licensed product candidates to Orchard, and it is a shareholder.

Source: Prospectus

With that, the most relevant issue is that the company expects to deliver data to the FDA in 2020. This means that stock catalysts may not appear until 2020, which is not ideal. Investors may have to wait for a long time until stock returns are delivered.

Some of the best people on Wall Street are working on this deal. It will retain the interest of many investors:

Source: Prospectus

Business

Founded in 2015, Orchard is a biopharmaceutical company developing and commercializing autologous ex vivo gene therapies for life-threatening rare diseases. The company uses a gene therapy approach intended to transform hematopoietic stem cells into a gene-modified drug product to treat the disease. The image below provides further details on the technology designed by Orchard:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.