Increasingly influential drug cost-effectiveness watchdog ICER still doesn’t think that the drugs approved to treat Duchenne muscular dystrophy have so far proved their value to patients. On Thursday, they used significantly higher price estimates for two therapies in their models, making them look even less attractive — and acknowledged that the estimates used in their draft report in May were incorrect.

ICER’s updated report on PTC Therapeutics’ $PTCT steroid deflazacort and Sarepta’s $SRPT Exondys 51 arrives ahead of a meeting of experts that will discuss the body of evidence underlying the landscape of existing and incoming Duchenne muscular dystrophy (DMD) therapies. In their analysis, ICER has used a price that exceeds $1 million a year for Exondys 51 and $81,400 for Emflaza — an old corticosteroid that many families once imported from overseas at a cost of about $1,000 a year.

In the United States, roughly 6,000 young boys suffer from the muscle wasting disease — caused by the absence of dystrophin, a protein that helps keep muscle cells intact. Symptoms tend to kick in and progressively worsen between the ages of 3 to 5, typically causing the patient to become wheelchair-bound by their early teens. Eventually, patients succumb to the disease by their 30s. Corticosteroids, which work by diminishing inflammation and limiting the immune system’s activity, are commonly used to treat DMD.

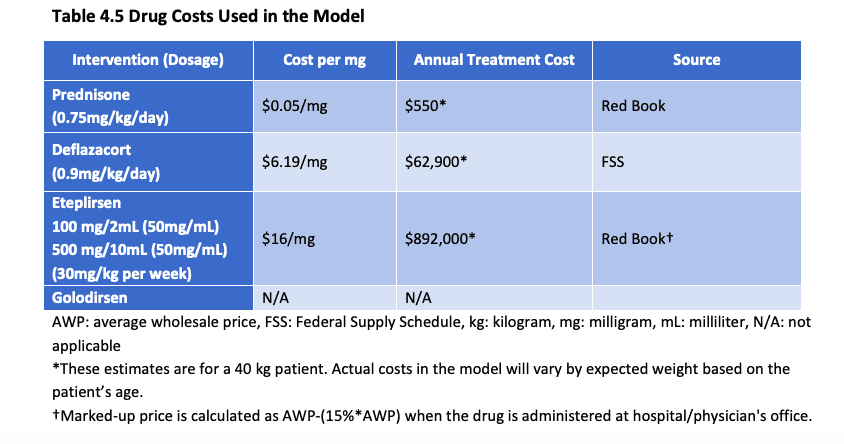

ICER evaluated the efficacy, safety and cost-effectiveness of four treatments in its evidence report. It looked at the steroids deflazacort (sold as Emflaza) and prednisone — as well as the exon-skipping drugs: the approved eteplirsen (marketed as Exondys 51) and the experimental golodirsen (both come from Sarepta, and each treatment is designed to treat a different subset of DMD patients). As it concluded in its draft report in May, ICER reiterated that the evidence supporting each of the four treatments is lacking, and their impact on patients unclear.

ICER evaluated the efficacy, safety and cost-effectiveness of four treatments in its evidence report. It looked at the steroids deflazacort (sold as Emflaza) and prednisone — as well as the exon-skipping drugs: the approved eteplirsen (marketed as Exondys 51) and the experimental golodirsen (both come from Sarepta, and each treatment is designed to treat a different subset of DMD patients). As it concluded in its draft report in May, ICER reiterated that the evidence supporting each of the four treatments is lacking, and their impact on patients unclear.

In the evidence report published on Thursday — which precedes an advisory panel meeting that will make its recommendations to ICER on July 25 — used higher annual cost estimates for Exondys 51 and Emflaza to conduct various cost-effectiveness calculations.

DMD drug dosing is based on weight, which typically varies among patients. Akin to its May report, ICER used annual cost estimates for a 40 kg patient to calculate cost-effectiveness in its latest update, putting a fresh spotlight on the existing controversy surrounding DMD drugs.

In the evidence report, ICER presented this chart:

Source: ICER, July 2019

In May, when ICER published its draft report, the non-profit presented this chart:

Source: ICER, May 2019

“We do not know what factors ICER used in their modeling. We have not raised the price of the drug since launch and are not planning any price increases,” a Sarepta spokesperson told Endpoints News.

PTC concurred. There has been no change in Emflaza’s pricing or discounts, a spokesperson told Endpoints News.

Later on Friday, a spokesperson for ICER clarified that the table in the earlier draft report displayed incorrect annual costs for both Emflaza and Exondys 51. ICER’s final report is expected in August.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.