The company — the world’s largest cancer drugmaker — lifted its full-year sales forecast, spurred by a 12% jump to about $36.7 billion in pharmaceutical sales. Sales were fueled by demand for Roche’s multiple sclerosis drug Ocrevus, hemophilia treatment Hemlibra, and its oncology products: checkpoint inhibitor Tecentriq and monoclonal antibody Perjeta and older Avastin — which more than offset declines in the sales of its cancer drugs Herceptin and MabThera/Rituxan.

Sales in Europe were down 1% due to Herceptin (-44%) and MabThera/Rituxan (-33%), but the strong growth of newer treatments almost steadied the ship.

“The impact of biosimilars (in Europe) is tailing off,” noted Roche’s head of pharmaceuticals Bill Anderson in a post-earnings conference call on Wednesday. Herceptin biosimilars launched in Europe about two years ago, while MabThera biosimilar erosion in the region kicked off last year.

Roche’s three legacy oncology drugs — Rituxan, Herceptin, and Avastin — are ripe for biosimilar competition in the United States — and earlier this year the company saw the launch of the first Herceptin and Avastin biosimilar. (Although if other biosimilar launches are any kind of barometer, the erosion of drug franchises in the United States is fairly muted compared to Europe.)

Still, Anderson preached caution. “We do expect there to be significant impact from biosimilars in the US, because there will be biosimilars to all three of our legacy oncology products — but also because there’s a need for additional competition, and we’ve been expecting it.”

He predicted the first five biosimilars for Rituxan will come sometime over the next quarter, with at least a couple of more Herceptin biosimilars in the next six months, and another Avastin biosimilar at the end of the year and/or early 2020.

International sales grew a healthy 20% mainly due to a strong uptake in China, where rates of cancer are high due to pollution and smoking. At some point the company will see limited biosimilar competition in China, although “there may be some questions about the quality of some of those early biosimilars so I think will we see ourselves as able to compete,” Anderson said. “In fact, one of the ways that will be competing in China is getting drugs like Perjeta and Hemlibra added to the national drug reimbursement list.”

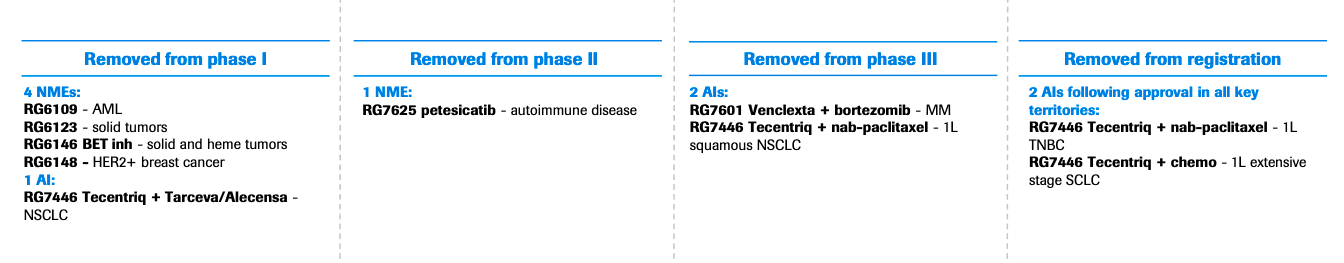

As is the tradition, the company also culled a number of experimental drugs across its pipeline:

Source: Roche, 2019

One of the key cuts is petesicatib (RG7625), which was being developed to treat coeliac disease and autoimmune disorders, including Sjögren’s syndrome and psoriasis. The oral compound was engineered to target cathepsin-S. Years ago, Merck had touted the commercial potential of its cathepsin K inhibitor for osteoporosis, although it was forced to terminate the program after it was linked to an increased risk of cardiovascular events.

At the tail end of the conference call, the question of the Spark acquisition finally cropped up. Roche chief Severin Schwan did not go into specifics but reiterated that he was confident the deal would be completed by year-end.

With biosimilar threat under control (for now), Roche savors demand for its new drugs

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.