Biosimulation software and services provider Certara launches IPO

- Certara (CERT) launches initial public offering of 24.39M common shares, of which 14.63M shares offered by the company and 9.76M shares by certain selling stockholders at an initial expected price between $19-$22 per share.

- Selling stockholders to grant the underwriters an option to purchase additional ~3.7M shares.

- Incorporated in 2017, the company uses its biosimulation software and technology to conduct virtual trials using virtual patients to predict how drugs behave in different individuals, which it believes can transform traditional drug discovery and development. Its integrated, end-to-end platform is used by more than 1,600 biopharmaceutical companies and academic institutions across 60 countries, including the top 35 biopharmaceutical companies by R&D spend in 2019.

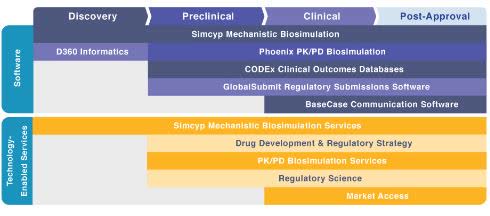

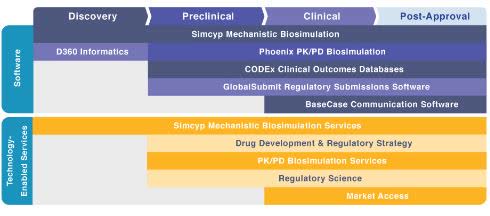

- The company's end-to-end platform:

- The company primarily compete with companies smaller than it, such as Simulations Plus and NONMEM, a division of ICON. Other competitors include Schrodinger, open-sourced solutions such as R and PK-Sim, and internally-developed software in biopharmaceutical companies.

- https://seekingalpha.com/news/3641361-biosimulation-software-and-services-provider-certara-launches-ipo

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.