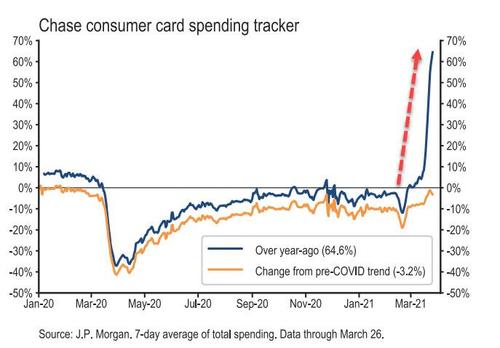

Last week, ahead of both the March payrolls and a burst of closely watched economic data in the coming weeks, we warned readers that we are about to experience the craziest base effect since the great depression, as the US economy laps the 1-year anniversary of the Covid shutdowns which ground the US economy to a halt virtually overnight last March, and which now mean that when looked at on a year-over-year basis, March (and onward) data will looks like this.

But while it's true that the base effect will lead to some impressive if mostly meaningless Y/Y charts, the reality is that the US economy is about to ramp even higher not just on the simple accounting of calendar effects, but because of the continued flood of fiscal stimulus that is about to send the US economy overheating to never before seen levels.

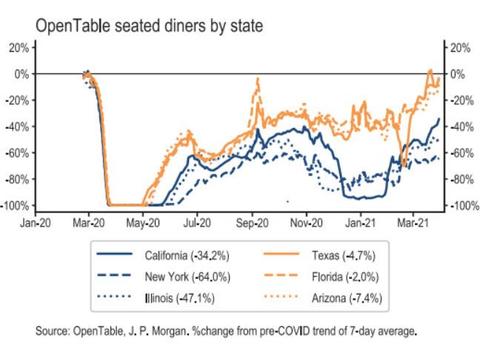

First consider the latest observation from JPMorgan economist Jesse Edgerton, who looks at the latest credit card/high frequency data contained in JPM's Quant Econ Dashboard and notes that a meaningful portion of the US never fully shutdown or had minimal restrictions. So as we approach April 19, the date when Biden says that 90% of all US adults will have vaccine access within 5 miles of their home, JPMorgan urges its clients to consider the magnitude of what could happen: the combined population of California, Illinois, Massachusetts, and New York is ~78.5mm people.

These are states that had some of the more stringent lockdowns and are poised to reopen. In the chart below you can see the differential in perhaps the most popular reopening activity, dining out, in some of those states relative to Florida and Texas. Florida and Texas did not have the same magnitude of restrictions as the states mentioned.

In short, in just two weeks, the US could experience a spending spree the likes of which have never been seen before.

But wait, there's more... and for that we go to Goldman head of hedge fund sales Tony Pasquariello who - as we noted earlier - is becoming concerned about "fat tail" outcomes after the subsurface turmoil of the first quarter, although as he expounded, the risk/reward "will be on the right tail" as the US quickly moves towards herd immunity. Specifically, he says to consider the following three data points:

- i. $4.44tr currently sits in US money market funds ($1.5tr is held by retail, $2.94tr is held by institutions). since February of 2020, that $4.44tr pile has grown by … $830bn.

- ii. US households have accumulated about $1.5tn in 'excess' or 'forced' savings, and Goldman expects that to rise to about $2.4tn, or 11% of GDP, by the time that normal economic life is restored around mid-year

- iii. attendant to the largest jump in US consumer confidence in 18 years: a record share of respondents said they plan to purchase a home in the coming months. a measure of consumers' plans to buy cars and major appliances also rose. A separate report Tuesday showed U.S. home prices surged to the highest since February 2006.

His conclusion: after the change observed in the markets in Q1, which presents a different setup for Q2, Pasquariello notes that "if April and May are THE peak growth months for US economic activity - perhaps as robust as anything we'll see in the remainder of our careers - there's still a lot to play for, and I still believe a reflationary framework is the right place to anchor your risk-taking."

Which, however, is not necessarily good news: judging by the ramp higher in yields after the blockbuster, goldilocks payrolls report on Friday which has nonetheless triggered a new round of the reflationary dynamic, the Goldman strategist warns that "the path higher from here is apt to be choppier and risk/reward is not what it was four or five months ago" and "in practical terms, this argues for a more tactical trading stance where illiquid positions - and recency bias - are the enemy."

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.