By Vishwanath Tirupattur, Head of Morgan Stanley US Fixed Income Research

The Hawkish Tilt Matters

Some Fed meetings are more consequential than others. We would put last week's meeting and Chair Powell's subsequent press conference in the eminently consequential category. While the precipitous sell-off in broad risk markets in the aftermath of the meeting has reversed, the uncertainties it unleashed have not. Legitimate questions about the direction of monetary policy and the Fed’s reaction function are now front and center in the minds of market participants. After all, memories of the 2013 taper tantrum are still fresh, and its scars run deep. Considering the role of the Fed’s ultra-accommodative policy in charting the course of the markets since the onset of the COVID-19 crisis, heightened policy uncertainties have profound consequences.

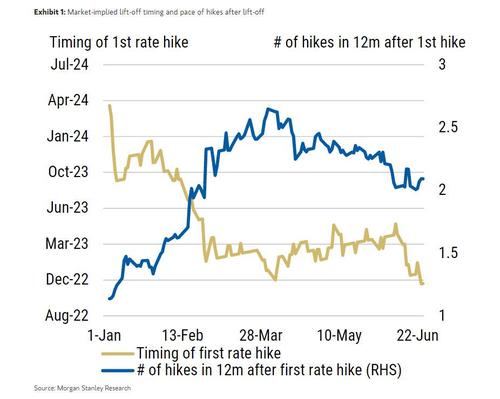

Not surprisingly, the US Treasury market is reflecting substantial changes in policy expectations. The Treasury yield curve has flattened dramatically. The three-day flattening in the 5s30s curve after the meeting was a six standard deviation move. Breakeven inflation rates have fallen and real yields have risen. The market-implied timing of interest rate hikes has come forward by three months, with the Treasury market now pricing the first rate hike in December 2022. Ironically, the dot plot reveals that FOMC participants project a pace of 3-4 hikes a year after the first hike, even though the market currently expects just ~2.1 hikes in the first 12 months after the first rate hike.

At the annual Jackson Hole symposium in August 2020, the Fed announced important changes to its monetary policy framework:

- First, the Fed indicated that it would no longer raise rates preemptively on the basis of low unemployment figures alone, and progress on realized inflation would become the primary yardstick for removing policy accommodation.

- Second, the Fed formally adopted a flexible average inflation targeting framework (FAIT), which seeks to achieve inflation that averages 2% over time and will allow inflation to overshoot after a period of undershooting, more firmly anchoring inflation at the 2% objective.

Since last year’s Jackson Hole, the Fed has repeatedly emphasized actual progress over forecast progress. It is also worth noting that as the US economy rebounded from the pandemic slump, Chair Powell has been spotlighting broader labor market measures beyond headline unemployment to determine when it will be time to raise interest rates under the new framework, which redefines the goal of maximum employment as “broad-based and inclusive”.

Against this backdrop, last week’s meeting signaled a surprisingly hawkish divergence. Our US interest rate strategist, Guneet Dhingra, delineated two U-turns that have decreased market confidence in FAIT.

- First, in contrast to the emphasis on actual over forecast progress, the Fed sounded upbeat on the prospects of a labor market recovery, even though recent data have disappointed expectations and progress on broader labor market metrics remains uninspiring. For example, African-American unemployment at 9.1% remains well above headline unemployment at 5.8%.

- Second, the Chair acknowledged upside risks to inflation after consistently labeling inflation as transitory over recent months. This focus on projected (not actual) strength in inflation and the labor market data culminated in a dot plot that shows higher rates in 2022 and 2023, leading to our conclusion that this was a decidedly hawkish meeting.

While our economists have not changed their Fed policy views (they expect the FOMC to discuss tapering in July in order to provide forward guidance at the September meeting, with a formal announcement of tapering in March 2022 and first rate hike in 3Q23) and continue to believe that the Fed will avoid another taper tantrum, we see the pace of tapering and the projected pace of rate hikes as the biggest risks to our view. Related issues on the table, including the composition of the taper in terms of Treasuries versus agency mortgages as well as the intervals between advance notice and the start of the taper, and between taper and lift-off, are additional risks worth flagging.

Given that our and the market's expectations for the course of policy are largely based on a single observation – the playbook from the last cycle – any real or perceived policy shift could heighten market uncertainties. In this environment, the impact of incoming data on employment and inflation (both realized and expected) on markets would be magnified. Stronger economic data could intensify the hawkish tilt. So buckle up.

https://www.zerohedge.com/markets/buckle-morgan-stanley-says-any-strong-data-could-cause-chaos

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.