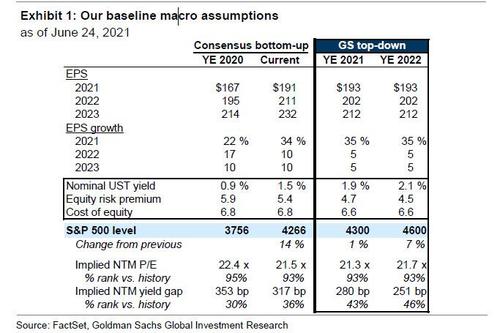

Halfway through 2021, the S&P 500 closed at an all time high and stands just 1% below Goldman's year-end price target of 4300.

So far so good, but as the bank's chief equity strategist David Kostin concedes, his forecasts are conditional on macro assumptions: "Inflation will diminish, interest rates will rise, and a portion of President Biden’s fiscal plan will pass into law." And, as Kostin writes in his Weekly Kickstart note, "this future is not guaranteed" and as a result, Kostin's recent client discussions have focused around the risks to the bank's baseline macro forecast.

To ease client nerves, Kostin, considers three “what if” scenarios that each focus on a key macro assumption and explore the implications of alternative outcomes for US equity returns, earnings, and valuations:

- “What if inflation is not transitory,”

- “What if interest rates fall or rise more than we expect,” and

- “What if tax reform does not materialize?"

So starting at the top, here are Kostin's thoughts first on...

1. "What if inflation does not prove transitory?”

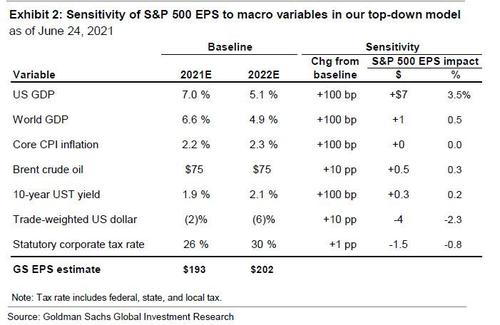

Goldman economists’ - just like the Fed - forecast assumes that the recent surge in inflation will prove transitory and core CPI will decline to 2.3% next year from the most recent print of 3.8% (Bank of America here is a major outlier expecting far higher inflation for the next 2-4 years). To justify its view, Goldman's chief equity strategist says that economists' “trimmed core PCE” shows that outliers had an outsized effect on the recent spike in inflation, and they attribute most of the above-consensus inflation readings to temporary re-opening factors that should subside within the next 3-6 months (which is bizarre in a world where container shipping rates continue to rise at an exponential pace confirming supply chains remain hopelessly broken). In addition, they believe labor supply will rebound significantly by year-end as coronavirus concerns continue to diminish and temporary supplemental unemployment benefits expire. This should ease wage pressures and reduce investor concerns about persistently high inflation in coming years.

Ok, but what if none of this leads to lower prices?

As Kostin admits, "higher inflation than we expect would boost sales but weigh on corporate profit margins.Inflation has been positively correlated with sales but negatively correlated with margins." Rising input costs, including wages, could weigh on margins if companies fail to raise prices sufficiently to offset inflation. As discussed previously, many firms had begun taking price action but also expect inflation to be transitory. Based on Goldman's top-down model, each percentage point of core CPI inflation above our forecast would lift S&P 500 sales growth by about 1 percentage point, reduce net profit margins by about 10 bp, and, for moderate changes in inflation, on net leave S&P 500 EPS unchanged relative to our baseline.

Persistently high inflation would also "represent a substantial headwind to valuation multiples", Kostin admits, adding that "elevated inflation would likely lead to more Fed tightening than we now expect, raising rates and reducing equity valuations." Currently Goldman economists believe the Fed will announce in December that tapering will begin in early 2022 and Fed funds hikes will start in 2H 2023. As a result, Kostin expects the S&P 500 P/E will be roughly flat during the next year, resulting in equity prices appreciating roughly in line with EPS growth.

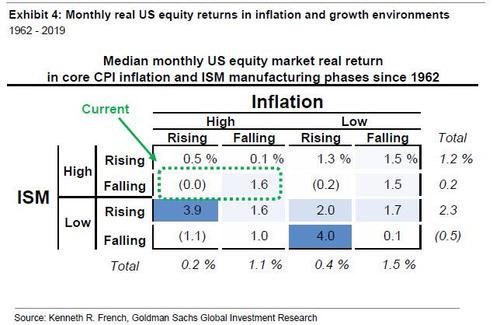

That said, it is certainly true that historically US equities have performed best in low inflation environments. Since 1960, the median annualized real S&P 500 return during periods of low inflation has been 15% vs. 9% in periods of high inflation. In periods of high inflation, stocks have performed better alongside falling inflation (15%) than alongside rising inflation (2%) (we discussed this in "Goldman's Clients Are Asking How Various Inflation Regimes Affect Stocks: Here Is The Answer")

Elevated inflation would boost the relative performance of stocks with high pricing power. The performance of high (GSXUSHGM) vs. low (GSXULVGM) pricing power stocks has been volatile in recent weeks alongside shifting investor views on inflation risk. At the sector level, high inflation has historically corresponded with the outperformance of the Health Care, Energy, Real Estate, and Consumer Staples sectors.

2.“What if interest rates fall or rise more than we anticipate?”

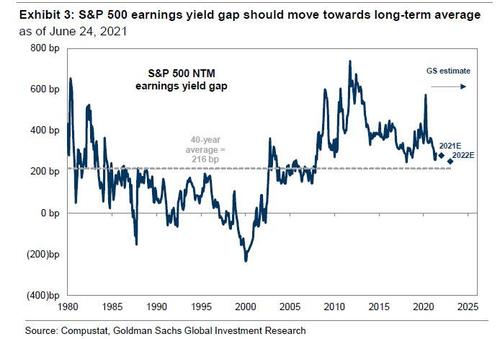

Goldman's baseline 2021 S&P 500 price target of 4300 assumes that the 10-year Treasury yield will rise to 1.9% by end-2021 and that the P/E multiple remains stable around 22x. The bank's rates strategists expect the increase in nominal Treasury yields will be led primarily by real rates and driven in part by higher global bond yields. Kostin expects the equity risk premium (ERP) will decline in the second half of this year, offsetting some of the impact of higher rates on equity valuations and leading to a roughly flat P/E multiple through year-end.

In other words, if - all else equal - interest rates remain roughly flat through the end of this year, Goldman's S&P 500 dividend discount model (DDM) would suggest a fair value of 4700, or 9% above the bank's current baseline price target of 4300. If rates fail to rise because of weakening growth, then lower earnings or a higher ERP would suggest a lower S&P 500 price despite lower interest rates. However, holding baseline ERP constant, a 10-year US Treasury yield of 1.6% (the 3-month average) would lift Goldman's DDM-implied fair value estimate to around 4700. Using the bank's 2022 EPS estimate of $202, this would imply an NTM P/E of 23x.

Under a different scenario, if interest rates were to overshoot Goldman's forecast and end the year at 2.5%, but nothing else were to change, the bank's S&P 500 DDM would imply a fair value of just 3550, or 17% below today’s price. Goldman economists expect the Fed will begin tapering its current monthly debt purchases in early 2022. This decrease in demand will likely coincide with more deficit spending and potentially greater bond issuance following the passage of President Biden’s infrastructure bill. Holding baseline ERP and EPS growth forecasts constant, Kostin says that the bank's DDM would imply a P/E multiple contraction to 18x.

3.“What if tax reform does not pass?”

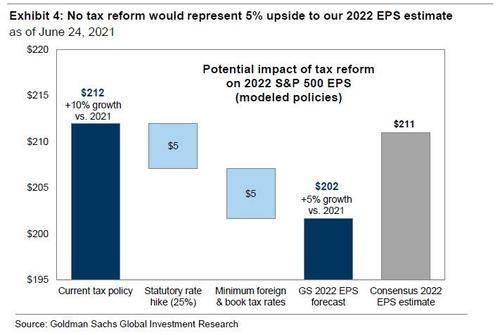

Kostin's baseline earnings forecast assume that a portion of Biden’s full tax proposal will become law by year-end and take effect in 2022, reducing S&P 500 EPS by 5% relative to the forecast under current tax law. Goldman's political economist expects that the federal statutory corporate tax rate will be raised to 25% from 21%, rather than the 28% rate proposed by Biden. He also believes that roughly half of the proposed foreign income tax hike will become law and that the capital gains tax rate for upper income individuals will be raised to 28%. Based on these assumptions, Kostin expects the S&P 500 will generate EPS of $202 in 2022 (+5% growth vs. 2021) and half the 10% EPS growth anticipated under current tax policy which sees EPS of $212 in 2022.

Using Goldman's baseline year-end 2021 P/E forecast of 21.3x, a “no tax reform” scenario would lift the bank's 2022 S&P 500 EPS estimate and our year-end 2021 S&P 500 fair value estimate by 5%, supporting a price target of 4500.

As Kostin notes, a failure to lift corporate and capital gains tax rates would generally favor Growth stocks, an assumption few find questionable. Digging deeper, although the ultimate implications of corporate tax reform are hard to predict without knowing which parts of the proposal will be enacted and in what size, it is likely that foreign-facing sectors with low effective tax rates including Communication Services, Info Tech, and Health Care appear most vulnerable. With regards to capital gains taxes, Growth stocks such as those in the Tech sector have generated the strongest returns in recent years, suggesting the largest potential risk from tax-related investor selling ahead of a potential tax hike later this year.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.