The Omicron variant turns out to be all things to all market participants. Buy the vaccine makers (because new demand) but buy Big-Tech (because storm in a teacup); Sell oil (because fears of lockdown/demand), but sell the long-end of the yield curve (because 'mild, moderate' symptoms and so 'inflation/growth').

But for one market participant in particular, it's a great excuse (especially after his re-nomination) as Fed Chair Powell's prepared remarks ahead of The Coronavirus and CARES Act hearing before the Committee on Banking, Housing, and Urban Affairs, offered some insight into his next actions (after a token shift to more hawkish positions by some Fed speakers).

Here is the key paragraph:

The recent rise in COVID-19 cases and the emergence of the Omicron variant pose downside risks to employment and economic activity and increased uncertainty for inflation.

Greater concerns about the virus could reduce people's willingness to work in person, which would slow progress in the labor market and intensify supply-chain disruptions.

That uncertainty can mean only one thing when it comes from The Fed... backing away from the taper's current trajectory (and any guesses at when takeoff may occur).

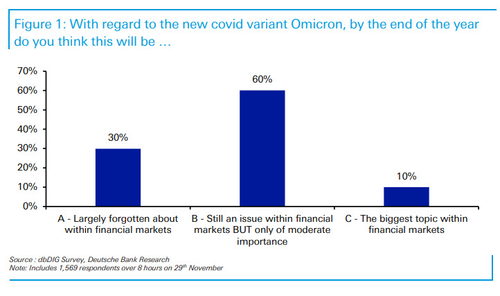

Of course, this is truly amusing because only 10% of Wall Street respondents to a flash DB poll thing Omicron will be a big issue at year end...

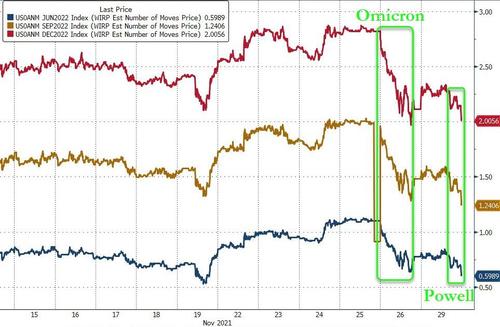

But, this unambiguously dovish comment from Powell sent 2Y Yields lower (now down from Friday's post-Omicron close)...

Notably, STIRs had already pushed more dovish today, extending Friday's move, perhaps leading Powell to make this call...

Interesting timing for a dovish shift... just as we expected. How long before QE is un-tapered?

Chairman Brown, Ranking Member Toomey, and other members of the Committee, thank you for the opportunity to testify today.

The economy has continued to strengthen. The rise in Delta variant cases temporarily slowed progress this past summer, restraining previously rapid growth in household and business spending, intensifying supply chain disruptions, and, in some cases, keeping people from returning to work or looking for a job. Fiscal and monetary policy and the healthy financial positions of households and businesses continue to support aggregate demand. Recent data suggest that the post-September decline in cases corresponded to a pickup in economic growth. Gross domestic product appears on track to grow about 5 percent in 2021, the fastest pace in many years.

As with overall economic activity, conditions in the labor market have continued to improve. The Delta variant contributed to slower job growth this summer, as factors related to the pandemic, such as caregiving needs and fears of the virus, kept some people out of the labor force despite strong demand for workers. Nonetheless, October saw job growth of 531,000, and the unemployment rate fell to 4.6 percent, indicating a rebound in the pace of labor market improvement. There is still ground to cover to reach maximum employment for both employment and labor force participation, and we expect progress to continue.

The economic downturn has not fallen equally, and those least able to shoulder the burden have been the hardest hit. In particular, despite progress, joblessness continues to fall disproportionately on African Americans and Hispanics.

Pandemic-related supply and demand imbalances have contributed to notable price increases in some areas. Supply chain problems have made it difficult for producers to meet strong demand, particularly for goods. Increases in energy prices and rents are also pushing inflation upward. As a result, overall inflation is running well above our 2 percent longer-run goal, with the price index for personal consumption expenditures up 5 percent over the 12 months ending in October.

Most forecasters, including at the Fed, continue to expect that inflation will move down significantly over the next year as supply and demand imbalances abate. It is difficult to predict the persistence and effects of supply constraints, but it now appears that factors pushing inflation upward will linger well into next year. In addition, with the rapid improvement in the labor market, slack is diminishing, and wages are rising at a brisk pace.

We understand that high inflation imposes significant burdens, especially on those less able to meet the higher costs of essentials like food, housing, and transportation. We are committed to our price-stability goal. We will use our tools both to support the economy and a strong labor market and to prevent higher inflation from becoming entrenched.

The recent rise in COVID-19 cases and the emergence of the Omicron variant pose downside risks to employment and economic activity and increased uncertainty for inflation. Greater concerns about the virus could reduce people's willingness to work in person, which would slow progress in the labor market and intensify supply-chain disruptions.

To conclude, we understand that our actions affect communities, families, and businesses across the country. Everything we do is in service to our public mission. We at the Fed will do everything we can to support a full recovery in employment and achieve our price-stability goal.

https://www.zerohedge.com/markets/fed-chair-powell-swings-dovish-blames-omicron-uncertainty

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.