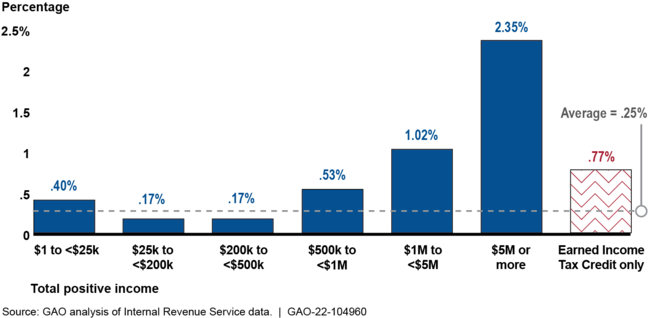

Audit Rates. From tax years 2010 to 2019, audit rates of individual income tax returns decreased for all income levels. On average, the audit rate for these returns decreased from 0.9 percent to 0.25 percent. Internal Revenue Service (IRS) officials attributed this trend primarily to reduced staffing as a result of decreased funding. Audit rates decreased the most for taxpayers with incomes of $200,000 and above. According to IRS officials, these audits are generally more complex and require staff's review. Lower-income audits are generally more automated, allowing IRS to continue these audits even with fewer staff.

Although audit rates decreased more for higher-income taxpayers, IRS generally audited them at higher rates compared to lower-income taxpayers, as shown in the figure. However, the audit rate for lower-income taxpayers claiming the Earned Income Tax Credit (EITC) was higher than average. IRS officials explained that EITC audits require relatively few resources and prevent ineligible taxpayers from receiving the EITC.

Audit Rates by Total Positive Income, Tax Year 2019

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.