As Goldman's Matt Fleury wrote earlier today, since Nick Timiraos, also known as NikiLeaks, tweeted that the Fed was going to slow its pace of hiking last Friday...

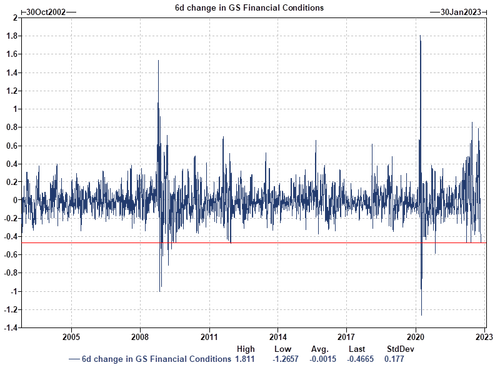

... we have had one of the largest bouts of financial conditions easing this century.

But, according to the Goldman trader, in the latest series of NikiLeaks tweets this morning, the WSJ's Fed mouthpiece is seen as aggressively trying to dial that back ahead of the Fed’s meeting on Wednesday by suggesting that the US consumer is much stronger than otherwise perceived (this is dead wrong, of course, but as a reminder, this is all about setting up the narrative that contains the Fed's reaction function):

“Consumers have a big cushion of savings. Corporations have lowered their debt-service costs. For the Fed, a more resilient private sector means that when it comes to rate rises, the peak or “terminal” policy rate may be higher than expected“ (Cash-Rich Consumers Could Mean Higher Interest Rates for Longer).

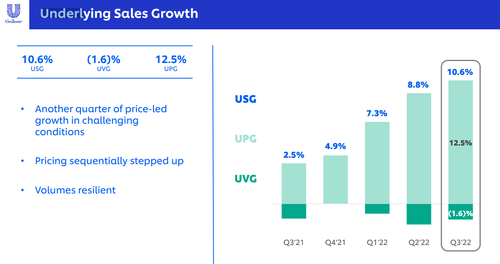

As Fleury adds, one particular comment in the WSJ article was "This is not the earnings season the [Fed] wanted to see" – indeed this slide from Unilever results this week highlights that corporations are pushing through price increases at increasing pace.

Incidentally, Goldman's chief economist Jan Hatzius updated his Fed hike estimates yesterday heading into this week’s FOMC and adds a 25bp hike at the March meeting. Which simply means that he is now aligned with consensus. His note is available to pro subs in the usual place.

Finally, here is Nikileaks appearing on the Sunday morning circuit, with an even more vocal hawkish warning "Even though the risk of doing too much is a recession, the risk of not doing enough is that inflation just stays high and you have to have a bigger downturn later."

Translation: those who think the Fed would not dare crash the market 6 days before the midterms may want to reassess.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.