By Nick Colas of DataTrek Research

“Money always goes somewhere” is one of our core beliefs about capital markets. Capital is clearly fleeing US Big Tech. That is because earnings growth for these names has slowed dramatically from the 2020 – 2022 pandemic era. Capital continues to embrace Energy and Health Care, however, our 2 favorite large cap sectors. A lower Big Tech weighting is ultimately good for the S&P 500, as it allows other sectors to have more of an impact on index returns.

One of our core investment mantras is “money always goes somewhere”. Aside from market crashes, when value literally evaporates, capital simply sloshes around. It moves to assets where investors see a potentially better future return from assets where they see diminishing opportunities.

For this week’s Story Time Thursday, we have 2 related examples of this idea and a summary thought at the end of this section:

#1: Let’s start with the elephant in the market’s room – the terrible performance of US large cap tech stocks. Only Apple has outperformed year to date, and just barely (+1.6 percentage points). The rest are lagging the S&P 500’s 20 percent YTD decline, and badly so: Microsoft (-33 pct), Alphabet/Google (-36 pct), Amazon (-33 pct through today’s close, more after hours), Tesla (-36 pct), Meta/Facebook (-71 pct) and Nvidia (-55 pct).

Even with this terrible YTD performance, however, almost all these names are still beating the S&P since the start of 2020:

- S&P 500 since 2019YE: +18 percent

- Apple: +97 percent

- Microsoft: +44 pct

- Alphabet/Google: +38%

- Amazon: +20 pct (note: AMZN is back to flat vs. 2019YE after hours tonight)

- Tesla: +70 pct

- Meta/Facebook: -52 pct (the one egregious exception)

- Nvidia: +124 pct

A substantial increase in earnings power explains why most of these names are still so far above their pre-pandemic levels (save Meta, of course, and now apparently Amazon). The companies of the S&P 500 improved their collective earnings per share by a compounded annual growth rate (CAGR) of 11 percent/year from 2019 – 2022 ($163/share to $223/share).

The Big Tech names mostly did much better:

- Apple: 27 percent 3-year CAGR

- Microsoft: 19 pct

- Alphabet/Google: 25 pct

- Amazon: earnings power reduced to zero in 2022 from $1.17/share in 2019

- Tesla: swung to profit in 2022 ($4.00/share estimate from a 2019 loss of $4.92/share)

- Meta/Facebook: 15 pct

- Nvidia: 14 pct

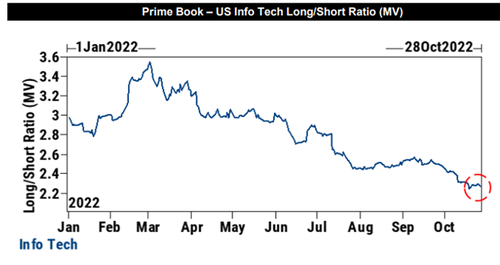

The problem markets have been seeing all year, and why capital is flowing out of these names, is that their expected future earnings growth is typically well below the CAGRs of the last 3 years. Here are the earnings per share growth rates Wall Street analysts expect over the next 12 months:

- Apple: +6 percent

- Microsoft: +6 pct

- Alphabet/Google: +14 pct

- Amazon: not meaningful (a return to modest profitability, $2.26/share)

- Tesla: +37 pct, below Elon Musk’s target of 50 pct growth in unit volumes

- Meta/Facebook: +7 pct

- Nvidia: +37 pct

Takeaway: US Big Tech’s 2020 – 2022’s pandemic era earnings growth rates are proving to be unsustainable, so markets are revising their estimate of fair value for these stocks. That may not seem fair since these companies are all expected to show bottom line growth in 2023, but that’s how markets work. Accelerating growth earns higher valuations, and decelerating growth forces valuations lower. Wall Street has a very short menu.

#2: Now that we have discussed where capital is leaving and why, let’s look at where it is going. Our approach will be to look at YTD changes in S&P 500 weightings by individual names. Here is the change this year in index weightings for the Tech names discussed in the prior point:

- Apple: +0.15 points in S&P 500 weight YTD (positive, since it has outperformed)

- Microsoft: -0.90 points

- Alphabet/Google: -0.82 points

- Amazon: -0.41 points

- Meta/Facebook: -1.17 points

- Tesla: -0.27 points

- Nvidia: -1.0 points

The total here is 4.42 points of S&P 500 weighting, and by our mantra (and simple math) it must have gone somewhere else in the index. It has, and mostly into stocks in our 2 preferred sectors, namely Energy and Health Care:

- ExxonMobil (+76 pct YTD): +0.74 point increase in S&P 500 weighting YTD

- Chevron (+52 pct YTD): +0.43 points

- ConocoPhillips (+76 pct YTD): +0.26 points

- Occidental (+148 pct YTD): +0.11 points

- Schlumberger (+73 pct): +0.13 points

- Johnson & Johnson (+1 pct YTD): +0.46 points

- UnitedHealth (+8 pct YTD): +0.40 points

- Eli Lilly (+29 pct YTD): +0.33 points

- Merck (+30 pct YTD): +0.29 points

- Amgen (+19 pct YTD): +0.13 points

- Cigna (+38 pct YTD): +0.11 points

Takeaway: These 11 names have soaked up just over three quarters (3.39 points, 77 percent) of the index weighting lost by the 7 US Big Tech names this year. Energy is still just 5.2 percent of the S&P 500, less than either Apple (7.0 pct) or Microsoft (5.3 pct). Health Care is 15.0 percent of the index currently, below the 16.0 percent that represents the upper end of its historical band. We believe both sectors can continue to take index weighting “share” from Tech and, by extension, outperform going forward.

Final thought: The only investment positive behind Big Tech’s ongoing declines (such as Amazon after hours tonight) is that they reduce these names’ impact on future S&P 500 returns. That has two benefits. First, it gives other stocks and sectors a better chance to affect overall index performance. Second, it makes the S&P 500 less leveraged to interest rates since it reduces the index’s price/earnings multiple. Bottom line: the S&P 500 doesn’t need Tech stocks to rally to show reasonable gains between now and year end. It does, however, need them to stop falling.

https://www.zerohedge.com/markets/money-always-goes-somewhere

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.