It finally happened.

After markets had ignored for months the rising tension between China's artificial Covid Zero lockdowns - which are there not to protect the economy from covid as even the wokest mask-breathers realize by now that the latest diluted iteration of Wuhan's most infamous export is no different than the flu...

... but to provide the Xi regime with a scapegoat for China's slow-motion implosion, over the weekend said tension finally erupted as millions of Chinese took to the streets in protest of Beijing's ongoing lockdown lunacy which late last week led to multiple fire deaths in a building whose doors were literally bolted down as China's ingenious "covid quarantine", in many cases accompanied by violence.

As reported earlier, protests spread over the weekend as citizens in major cities including Beijing and Shanghai took to the streets to express their anger on the nation’s Covid controls in a rare show of defiance which some believe raises the threat of a government crackdown, prompting investors to re-think investment plans after jumping back in on reopening hopes.

This culminated in a violent selloff across Chinese stocks, the yuan, US equity futures, crude oil, and cryptos, which all tumbled as China's protests cast a shadow over the nation’s reopening path and putting investors on edge.

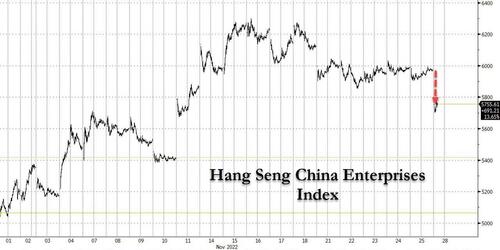

The Hang Seng China Enterprises Index was hardest hit, tumbling more than 4% out of the gate, and paring this month’s sharp advance to less than 16%.

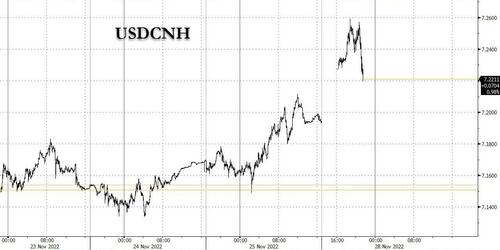

The onshore yuan plunged 1%, the most since May, to 7.2592 per dollar as risk appetite faded.

“We might see some derisking around Chinese markets,” said Chris Weston, head of research at Pepperstone Group Ltd. “We are seeing some outflows of the offshore yuan, which I think is a pretty good indication of how Chinese markets may fare.”

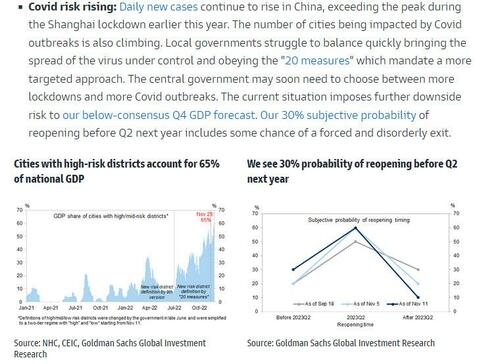

In a note from Goldman China economist Hui Shan (available to pro subs in the usual place), he warned that there is some chance of a "disorderly" exit from Covid Zero in China, as the "central government may soon need to choose between more lockdowns and more Covid outbreaks." The bank added that "the current situation imposes further downside risk to our Ielow-consensus Q4 GDP forecast."

Ironically, the Chinese rioting takes place right after the PBOC cut RRR by 25bps last Friday unleashing (a paltry) RMB 500bn in long-term liquidity. While the economic impact may be more limited if the PBOC offsets it with a partial rollover of maturing MLF loans next month, the significance of the RRR cut lies in its signal value: policymakers are attentive to incoming data and the central bank will likely keep monetary policy accommodative in the face of a challenging growth outlook in the next quarter or two.

Needless to say, widespread rioting across China will not ensure peaceful and prosperous golden years for China's dictator-for-life, Xi Jinping. On the contrary, the latest developments underscore China’s rocky path to reopening as the nation grapples with a record number of Covid cases. Just as ironically, Chinese assets rallied in November as directives for a less-restrictive pandemic approach, coupled with strong support for the property sector, gave investors confidence that the worst is well behind.

But not any more: Hong Kong’s Hang Seng Index fell as much as 4.2% and a separate gauge of Chinese tech stocks down more than 5%. On the mainland, the CSI 300 Index declined as much as 2.8%, while yields on the benchmark note gained one basis point to 2.83%.

The shockwave from China's riots quickly spread across the Pacific as US equity futures tumbled as much as 0.7% to hit a session low of just above the "nice, round number", at 4,001.5.

Oil was slammed too, with WTI tumbling as much as $3 from Friday's close to a session low of $73.75, or right above the level when the Biden admin lied it would restart purchasing oil to refill the SPR which it has drained by more than 200 million barrels in the past year.

Finally, and not like anyone will be surprised by this, crypto which now tumbles to any news, both good and bad, tumbled right on cue, with bitoin sliding from the $16,500 level right back down to $16,000, as even the faintest attempt to reverse the relentless selling of 2022 is promptly crushed.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.