by Simon White, Bloomberg macro strategist,

Bank deposits at US commercial banks are starting to decline. This is an early warning sign of a weakening US economy – not of higher spending and rising inflation – and so does not necessitate tighter Fed policy than is currently priced.

Total deposits at US banks swelled almost $5 trillion through the pandemic to peak at over $18 trillion, taking the bank loan-to-deposit level to the lowest in at least 50-years at under 60%. Deposits -- driven by the checkable deposits of households -- rose, primarily as stimulus checks were paid into people’s accounts while consumer spending plummeted.

But now, deposits are beginning to fall from their high level.

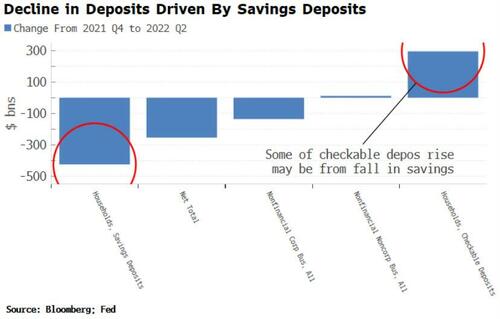

To see why, we have to drill down into the data. The chart below shows that main driver of the fall is a decline in household savings deposits. Some of this drop may be reflected in the rise in household’s checkable deposits, as people shift money out of their savings account into their current account, but overall the fall in savings deposits is larger than the rise in checkable ones.

This represents a drawing-down of pre-pandemic savings, as savings deposits did not rise through the pandemic (all the government stimulus went into checkable accounts).

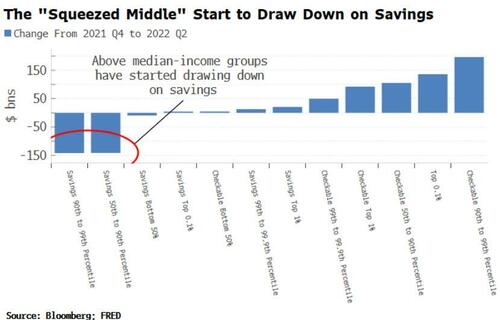

If we drill down further, we can see it is those in the 50th to 99th percentile income groups who have driven this fall in household savings deposits, which is approximately those households who earn $70k to $570k.

A reasonable inference to make is it is those at the lower end of this range who are experiencing the most hardship from the rising cost-of-living -- the so-called squeezed middle, who face rising costs but miss out on government help -- and are eating into savings to maintain their standard of living.

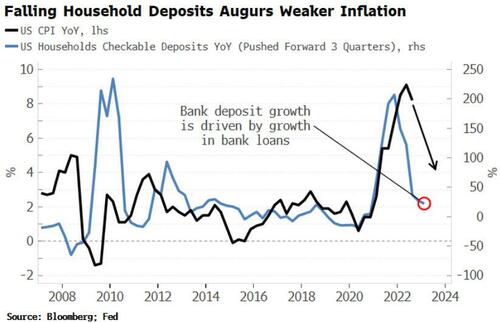

This a sign of a weakening economy, not one that is about to face an imminent and renewed inflationary impulse. In fact, falling deposit growth is empirically a sign of declining inflation. This is counter-intuitive on first glance, but banks create deposits when they create loans, so at the margin deposit growth is driven by loan growth.

Loan growth is starting to ease back, which along with a weakening economy points to inflation continuing to weaken. This is not an environment where the Fed is likely to up its rate-tightening ante.

https://www.zerohedge.com/personal-finance/us-bank-deposite-flight-not-sign-higher-rates-come

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.