After a shockingly large upside surprise surge (+5.6% MoM) in December, analysts expected preliminary January durable goods orders to tumble (-4.0% MoM). The actual print came in worse with a 4.5% MoM drop - the biggest drop since April 2020.

Source: Bloomberg

But, everything else was super strong...

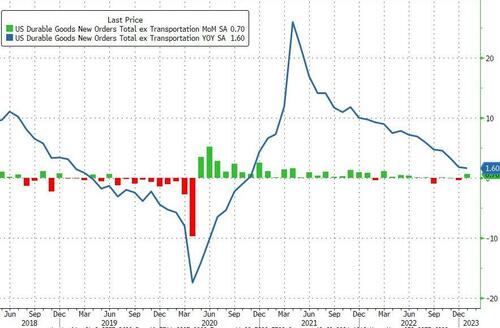

Core Durable Goods (ex-Transports) jumped 0.7% MoM (+0.1% exp) - biggest jump since March 2022 (but YoY Core is up just 1.6%)...

Source: Bloomberg

Additionally, the value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, increased 0.8% last month after a downwardly revised 0.3% decline in December, Commerce Department figures showed Monday.

The big swing factor was no Boeing orders as non-defense aircraft new orders tumbled 54.6% MoM...

We see the same picture with capital goods (non-defense) orders: Total (incl aircraft) -15.3%, Ex aircraft +0.8%

Core capital goods shipments, a figure that is used to help calculate equipment investment in the government’s gross domestic product report, jumped 1.1%.

So, all in all, this is 'good' news for the economy and thus 'bad' news for The Fed.

https://www.zerohedge.com/economics/us-durable-goods-orders-plunged-most-covid-lockdowns-january

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.