by Simon White, Bloomberg macro strategist,

Regional banks in the US have been outperforming their larger counterparts this month, but that is likely to soon reverse as their larger exposure to real-estate becomes a hindrance.

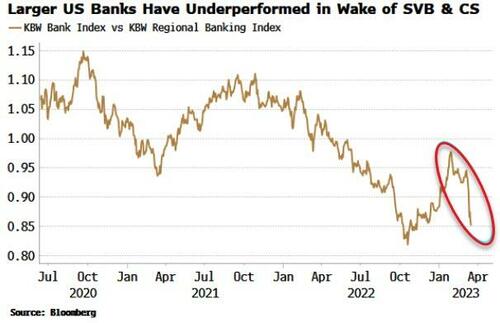

Perhaps counter-intuitively it has been the larger US banks that have been hit the hardest after the collapse of SVB and Signature bank.

Reasons cited have included greater exposure to Credit Suisse and expectation of more regulation on the way.

Systematic selling has also not helped as investors jettisoned bank stocks, fearing the crisis could be become systemic.

But there are several reasons to believe that larger banks will soon begin outperforming again.

Deposits at US banks at the aggregate level have fallen since last summer. Yet total bank balance-sheets have barely declined as banks ramped up their loan-to-deposit ratios (LTDRs).

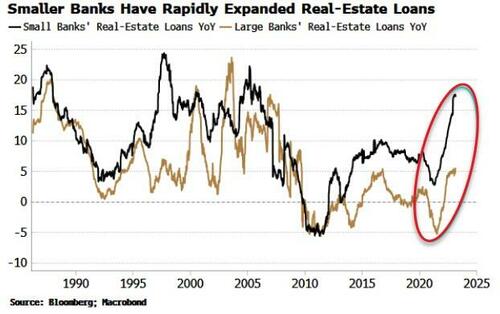

However, digging under the surface, it has been the smaller banks who have done most of the lending.

Their LTDR has risen 11% points since late 2021, versus 7% points for large banks, while their total assets have risen over $300 billion over the same period, while larger banks’ assets have fallen by $400bn.

This extra lending has been in consumer loans, but most of the rise has been in real-estate loans – residential and commercial.

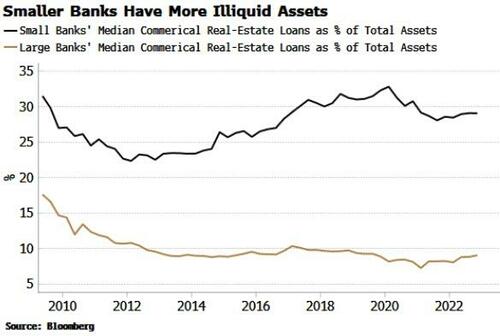

This is a potential problem for smaller banks. They remain prone to deposit flight in the wake of SVB, with larger banks already attracting billions of dollars.

SVB was slightly unusual among the smaller banks in that it had a large fixed-income portfolio, its plummeting value the death warrant for the bank. In response, the Fed has unleashed another acronym on the financial world – the BTFP (Bank Term Funding Program) – where banks can repo in Treasuries and agency securities for up to a year at par.

But the smaller banks have a lot more residential and commercial real-estate on their books relative to the larger banks.

They therefore have a greater proportion of assets that are not “shiftable” onto the Fed’s balance sheet - ultimately this is a greater stress on their liquidity.

Deposit rates will soon rise for small and large banks, and this may have more of an impact on larger banks’ profitability to begin with.

But they may not need to raise them as much as they continue to soak up small-bank deposit migration.

Furthermore, large banks are cheaper on a P/E and P/B basis (comparing the BKX index with the KBW regional bank index).

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.