Similar to Thursday, futures faded an earlier gain which pushed emini futures briefly above 4000 after the index rallied 1.8% yesterday, as investors were assessing whether a $30BN "deposit injection" rescue package for First Republic Bank is enough to ease the risk of financial contagion, with gains reversing after news that China was cutting its bank reserve ratio and injecting over $70BN in liquidity, which was viewed by the jittery, suspicious market that there may be more unpleasant surprises in the banking sector this time in China which was moving to "ringfence its banking sector." US equity-index futures dropped 0.3%, reversing a similar gain, while the Stoxx Europe 600 index pared an advance and turned negative. A gauge of European banking stocks is heading for a drop of almost 9% this week. Nasdaq 100 futures were flat as the rates-sensitive gauge heads for its best week since November amid expectations the Federal Reserve will temper its tightening path. The 10-year Treasury yield fell eight basis points and a gauge of the dollar declined.

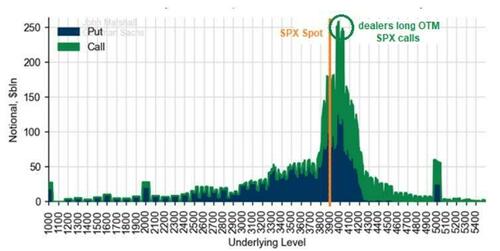

As detailed yesterday, as if the bank bailout bonanza, a larger than expected TLTRO repayment in Europe and China's RRR cuts weren't enough, traders are facing fresh turmoil by today’s $2.9 trillion options expiration after a week of bank drama. Such quad-witching days typically involve portfolio adjustments, spikes in volume and price swings, especially on day so near-record low liquidity such as these.

Financial stocks were lower in premarket trading Friday, in line with the broader market, as doubt persists around First Republic Bank despite a $30 billion rescue effort from large lenders and federal regulators. First Republic’s slide continues since market close Thursday, as the California bank discloses its borrowing from the Fed ranged from $20 billion to $109 billion in the last week while billionaire investor Bill Ackman warned the effort to rescue FRC was creating a “false sense of confidence" a remarkable U-turn from him begging for a bailout of SVB. First Republic Bank and PacWest Bancorp are among the most active financial stocks in early premarket trading, falling 11.9% and 4.7%, respectively. FedEx Corp. shares jumped in premarket trading after the parcel company boosted its profit guidance, beating the average analyst estimate. Nvidia Corp. gained slightly as Morgan Stanley upgraded the biggest US chipmaker to overweight from equal-weight. Here are some other notable premarket movers:

- US Steel shares rise 5.6%, with analysts saying the company’s new first-quarter earnings guidance was much better than anticipated.

- Baidu shares rise 5% in US premarket trading after the Chinese search-engine operator’s newly debuted AI chatbot gained positive reviews from analysts. Other AI-exposed stocks are also higher in premarket trading, with C3.ai (AI US) +3%, BigBear.ai (BBAI US) +8.5%, SoundHound AI (SOUN US) +7.1%.

- Cryptocurrency-exposed stocks rose after Bitcoin extended its gains for a second consecutive session, rising back above the $26,000 threshold. Hive Blockchain (HIVE US) climbed 8.7%, Hut 8 Mining (HUT US) +5.8%, Marathon Digital (MARA US) +5.4%, Riot Platforms (RIOT US) +5.7%, Stronghold Digital (SDIG US) +5.1%.

- Keep an eye at FMC Corp. stock as it was upgraded to buy from neutral at Redburn, which cites “strong” pipeline-driven growth and an expected further increase in the crop chemical producer’s “industry- leading” margins.

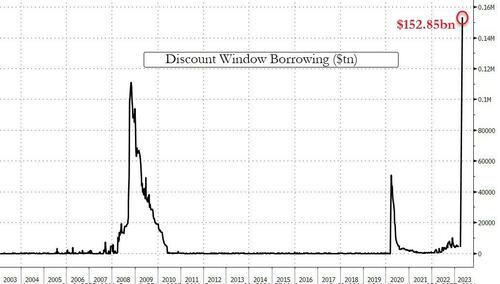

Investors are recovering from a turbulent week that began with banking-sector concerns driving the VIX index of stock volatility to the highest since October and pushing the S&P 500 to the lowest in more than two months. Friday’s quarterly so-called triple witching — where contracts for index futures, equity index options and stock options all expire — could amp up swings in trading. The failure of Silicon Valley Bank prompted the US government to step in, and banks borrowed a combined $164.8 billion from two Federal Reserve backstop facilities in the most recent week.

While that demand for emergency liquidity shows continued caution, the overall rescue efforts have eased the risk of a broader banking-sector contagion, according to Richard Hunter, head of markets at Interactive Investor. “The generally swift and decisive actions which have been taken have removed some of the sting from market volatility,” he said.

“We do not expect a full-blown financial crisis, but one must not dismiss the underlying dynamics,” said Karsten Junius, the chief economist at Bank J Safra Sarasin AG. “Financial conditions will most likely tighten further and increase recession risks. We therefore advocate a defensive positioning with regard to risk assets and a tactically cautious stance on the banking sector, even though the constructive case for banks remains intact over the medium to longer term.”

Bank of America strategist Michael Hartnett said investors should sell any rally in stocks as fund flows don’t yet reflect deep enough concern about a looming recession. The strategist, who correctly warned of a stock exodus in 2022, recommended selling the S&P 500 above 4,100 points, about 3.5% above its last close.

The Stoxx Europe 600 index erased an advance with energy, miners and tech the best-performing sectors. A gauge of European banking stocks is heading for a drop of more than 9% this week as yet another early rally lost steam Friday. Shares in Credit Suisse resumed a decline, falling as much as 10% as the idea of a forced combination with a larger rival UBS Group AG was shot down. The stock had rallied almost 20% Thursday after the Swiss central bank stepped in with support. Bonds across Europe gained, with Germany’s 10-year yield down 10 basis points. Here are the most notable European movers:

- European mining stocks rebound from two sessions in the red, with copper, aluminum and steel-exposed names leading the bounce, and Glencore gaining 4.2% as of 10:32 a.m. CET

- European logistics and freight stocks gain, after US peer FedEx’s results beat expectations and it upgraded its forecast, sending its shares surging in postmarket trading

- Telenor shares rise as much as 3.2%, after a Financial Times report that CK Hutchison is in talks with the Nordic telecom operator about merging their operations in Denmark and Sweden

- Webuild shares rise as much as 8.1% to add to a 12% post-earnings jump in the prior session, with Akros raising the Italian construction firm to accumulate from neutral

- Nel shares gain as much as 6%, the most since Feb. 7, as Goldman Sachs raises the Norwegian electrolyzer firm to buy, from neutral, on an increasingly strong growth outlook

- Enel shares gain as much as 2.4% in early trading. The Italian utility’s FY net income is ahead of expectations, while guidance on its debt and dividend looks robust, analysts say

- LSE Group shares rise as much as 3% as UBS upgrades the exchange operator to buy from neutral, saying the risk-reward on the stock is “very favorable”

- Credit Suisse fell as investors examine its prospects after a central bank backstop. The firm and UBS are opposed to a forced combination, Bloomberg News reported

Earlier in the session, Asia stocks rebounded, led by Hong Kong-listed shares as risk appetite was helped by a rescue package for First Republic Bank. The MSCI Asia Pacific Index advanced as much as 1.6%, reversing Thursday’s drop. Hong Kong’s Hang Seng China Enterprises Index jumped more than 2%, leading indexes in the region, as Baidu drove China’s artificial intelligence stocks higher after brokers tested its ChatGPT-like service. China’s central bank announced an unexpected cut to its reserve requirement ratio after domestic markets closed. Gains in Asia were broad-based with most markets in the green, after the biggest US lenders agreed to contribute $30 billion in deposits to First Republic. Bank stocks rose as jitters about the health of the US financial system and economy eased. The MSCI Asia gauge was still on track for a second straight week of losses, albeit with smaller declines, as rolling headlines on troubled lenders from Silicon Valley Bank and Signature Bank to Credit Suisse Group AG led to choppy trading. The stock measure came close to entering correction territory prior to Friday’s rebound, with markets also digesting a 50-basis-point rate hike by the European Central Bank ahead of the Federal Reserve’s meeting next week. Shares in Taiwan, South Korea and the tech hardware sector “have over-delivered” this year and are looking particularly vulnerable to shockwaves from the US banking stress, according to Goldman Sachs Group

Japanese stocks rose, following US peers higher, as sentiment improved after Wall Street banks stepped in to rescue First Republic Bank. The Topix Index rose 1.2% to 1,959.42 as of market close Tokyo time, while the Nikkei advanced 1.2% to 27,333.79. Sony Group Corp. contributed the most to the Topix Index gain, increasing 3.5%. Out of 2,159 stocks in the index, 1,567 rose and 509 fell, while 83 were unchanged. Japan equities were also buoyed by growth stocks, which “are outperforming value stocks today, especially tech stocks,” said Rina Oshimo, a senior strategist at Okasan Securities. Meanwhile, the European Central Bank went ahead with a planned half-point rate hike. “The reality of overseas banking problems is still unclear,” said Hajime Sakai, chief fund manager at Mito Securities. “While U.S. seems to be calming down, outlook in Europe remains uncertain.”

Key stock gauges in India advanced on Friday but registered their third weekly drop in four amid risk-off sentiment triggered by worries over global growth and future course of interest rates. The S&P BSE Sensex rose 0.6% to 57,989.90 in Mumbai, while the NSE Nifty 50 Index advanced 0.7% to 17,100.05. For the week, the Nifty 50 fell 1.8%, while the BSE Sensex declined 1.9%. Indian stocks have sharply underperformed Asian and emerging markets, both today and for the week, as investor concerns persist over the South Asian country’s relatively high valuations and slowing growth momentum. HDFC Bank contributed the most to Sensex’s gain, increasing 1.4%. Tata Consultancy Services was among the worst performing NIFTY IT stocks, and underperformed most of its listed Indian peers, as its CEO’s sudden resignation surprised investors. Out of 30 shares in the Sensex index, 21 rose and 9 fell.

In FX, the Dollar Index is down 0.2% as the greenback falls versus all its G-10 rivals to head for a weekly. The New Zealand dollar and Australian dollar are the best performers. US overnight indexed swaps are now pricing for an 80% probability of a quarter-percentage point Fed rate hike next week, up from a coin toss earlier this week.

In rates, treasuries have recouped some of Thursday’s losses, led by bunds and gilts as euro-zone money markets trim rate-hike premium for May after Thursday’s post-ECB selloff. Intermediate sectors lead a limited advance for Treasuries as US stock futures hold most of Thursday’s steep gains. Two-year US yields fell 3bps to 4.11% while the 10-year rate slipped seven basis points to 3.49% vs Thursday’s close and paced by bunds and gilts. Fed-dated OIS contracts price around 20bp of rate-hike premium for next week’s policy decision, in line with Thursday’s close, while around 75bp of rate cuts are priced from May peak into year-end.

Oil headed for the biggest weekly decline this year after investor confidence plunged following the worst banking sector turmoil since the financial crisis. WTI futures in New York were down about 10% this week, even though they edged higher by 1.6% to trade near $69.40 to pare some of the decline. The failure of Silicon Valley Bank and troubles at Credit Suisse Group AG, compounded by oil options covering, triggered a three- day rout earlier this week that sent prices to the lowest in 15 months. Gold is headed for its biggest weekly gain since November after attracting haven demand due to banking turmoil in the US and Europe. U.S. Steel is among the most active resources stocks in premarket trading, gaining about 4%.

Looking to the day ahead now, and data releases from the US include the University of Michigan’s consumer sentiment index for March, industrial production for February, and the Conference Board’s leading index for February. Over in Europe, we’ll get the final Euro Area CPI reading for February. Lastly, central bank speakers include the ECB’s Simkus.

Market Snapshot

- S&P 500 futures down 0.3% to 3,981

- STOXX Europe 600 up 1.0% to 446.26

- MXAP up 1.4% to 157.20

- MXAPJ up 1.5% to 506.60

- Nikkei up 1.2% to 27,333.79

- Topix up 1.2% to 1,959.42

- Hang Seng Index up 1.6% to 19,518.59

- Shanghai Composite up 0.7% to 3,250.55

- Sensex up 0.4% to 57,866.02

- Australia S&P/ASX 200 up 0.4% to 6,994.80

- Kospi up 0.7% to 2,395.69

- Brent Futures up 0.7% to $75.22/bbl

- Gold spot up 0.5% to $1,929.89

- U.S. Dollar Index down 0.33% to 104.07

- German 10Y yield little changed at 2.25%

- Euro up 0.4% to $1.0653

- Brent Futures up 0.7% to $75.22/bbl

Top Overnight News from Bloomberg

- China cut the amount of cash banks must keep in reserve at the central bank in an effort to support lending and strengthen the economy’s recovery from pandemic restrictions and a property market slump: BBG

- Central bank interest-rate hikes really started hitting home this week: BBG

- Banks borrowed a combined $164.8 billion from two Federal Reserve backstop facilities in the most recent week, a sign of escalated funding strains in the aftermath of Silicon Valley Bank’s failure: BBG

- If there’s one lesson from the European Central Bank’s latest monetary policy meeting, it’s that bond market volatility is here to stay: BBG

- China's Xi Jinping will visit Moscow next week for talks with Russian President Vladimir Putin, showcasing the deepening ties between the countries. WSJ

- TikTok said that the Biden administration was pushing the company’s Chinese owners to sell the app or face a possible ban. But there are probably few companies, in the tech industry or elsewhere, willing or able to buy it, analysts and experts say. NYT

- ECB officials (including Muller, Simkus, and Kazimir) deliver hawkish comments, warning that rates still have further to go on the upside. BBG

- Banks borrowed a combined $164.8 billion from two Fed facilities in the week ended March 15, a sign of escalated funding strains. Discount window borrowing shot up to $152.85 billion, eclipsing the prior all-time high of $111 billion in 2008. Another $11.9 billion was borrowed from the new emergency backstop launched Sunday known as the Bank Term Funding Program. BBG

- The US is committed to replenishing the Strategic Petroleum Reserve but won’t rush to do so immediately despite the recent decline in oil prices, a top Biden administration official said. BBG

- Poland will send four of its MiG fighter jets to Ukraine in the coming days in what amounts to the first shipment of combat aircraft to the Zelensky gov’t. FT

- Fresh turmoil for traders may be sparked by today's options expiration after a week of bank drama. An estimated $2.7 trillion of derivatives contracts tied to stocks and indexes will mature, typically involving portfolio adjustments, spikes in volume and price swings. Demand for bearish options has been on the rise and market makers will be "short gamma," requiring them to ride the prevailing trend. BBG

- PacWest Corp is in talks about a liquidity boost with Atlas SP Partners and other investment firms. RTRS

- Charles Schwab saw $8.8 billion in net outflows from its prime money market funds this week as investors rattled by turmoil at US banks plowed even more money into the brokerage’s other portfolios that favor assets with government backing. BBG

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were positive amid the improved global risk appetite after recent bank lifelines including the SNB liquidity backstop for Credit Suisse and with large US banks teaming up to deposit USD 30bln in First Republic Bank. ASX 200 was marginally higher with the index kept afloat amid outperformance in energy and as the top-weighted financial industry benefitted from the recent banking sector relief, although gains were limited by losses in real estate and the defensive sectors. Nikkei 225 made headway above the psychological 27,000 level with railway stocks among the top gainers, while automakers lagged at the opposite end of the spectrum. Hang Seng and Shanghai Comp. were in an upbeat mood as energy and tech spearhead the advances in Hong Kong and with Baidu eyeing double-digit percentage gains, while the mainland also benefitted from the PBoC’s continued liquidity efforts.

Top Asian News

- China Securities Journal noted that the Chinese economy requires more fiscal and monetary support, as well as reiterated that the economic rebound is not yet solid.

- Japan's government and BoJ will hold a meeting on Friday evening after the SVB collapse, with the MoF, FSA and BoJ poised to exchange information on financial markets, according to Nikkei.

- Japanese Finance Minister Suzuki said Japanese financial institutions have ample capital base and liquidity, while the financial system is stable as a whole. Suzuki added they are closely coordinating with the BoJ and other central banks regarding responding to financial situations.

- Japanese Union Rengo says overall wages to rise 3.8% in Spring wage talks.

European bourses are firmer across the board, Euro Stoxx 50 +0.4%, as recent liquidity action settles sentiment on Quad Witching Friday. Sectors, are all in the green with the defensively-inclined names lagging and upside in Basic Resources and Banking names, SX7P +0.4%; note, Credit Suisse has dropped into negative territory despite opening in the green. Stateside, futures are essentially unchanged having eased from initial best levels around the European open ahead of Michigan data and as attention turns to the upcoming FOMC.

Top European News

- UK Chancellor Hunt abandoned plans for sovereign wealth funds to pay corporation tax on property and commercial enterprises, according to FT.

- Negotiations for the UK's re-entry into the EU's Horizon research scheme may begin within weeks following a resolution, in principle, of the post-Brexit Northern Ireland dispute, according to BBC's Parker.

- German Chancellor Scholz said he does not see the threat of a new financial crisis and the monetary system is no longer as fragile as it was before the financial crisis, according to Handelsblatt. It was also reported that Germany's Economy Ministry said a technical recession can now no longer be ruled out.

FX

- The USD is subdued, though has convincingly reclaimed the 104.00 mark after dropping to a 103.89 low earlier; action which comes to the benefit of G10 peers.

- Antipodeans are the stand-out outperformers given their high-beta status amid the improvement in risk appetite, though NZD/USD peaked above 0.6250 and AUD/USD failed to surpass the 0.6720 21-DMA convincingly.

- Other G10s are deriving upside, though magnitudes slightly less pronounced, with USD/JPY holding above 133.00, Cable above 1.21 and EUR around 1.0650.

- Yuan saw some modest, but ultimately shortlived, pressure on the PBoC's 25bp cut while the Scandis are benefitting from risk, though the SEK less so given unfavourable unemployment data.

- PBoC set USD/CNY mid-point at 6.9052 vs exp. 6.9017 (prev. 6.9149).

Fixed Income

- EGBs are markedly more contained thus far, though Bunds have still posted a +100tick range and are currently holding near 136.40 with the 10yr yield around 2.25%.

- EGBs have largely disregarded numerous ECB speakers, who overall have added little, and the final EZ HICP reading for February while Gilts are following suit given a lack of specific drivers ahead of next week's BoE.

- Stateside, the direction and magnitude of price action is in-fitting with the above though the US yield curve is slightly mixed with the short-end a touch firmer and the long-end end dipping slightly.

Commodities

- Commodities are, generally, deriving support from the firmer risk tone and as the USD remains under pressure; with the crude benchmarks choppy but most recently extending to incremental session highs.

- Albeit, this upside places WTI Apr'23 just USD 0.30/bbl above USD 69.00/bbl and as such well within the week's USD 65.65-77.47/bbl parameters.

- Spot gold is similarly bid and at the top-end of USD 1918-1934/oz ranges, with base metals benefitting from the improved tone though the complex is still in the red for the week.

- OPEC+ delegates are reportedly still encouraged by Asian demand; Delegates largely blame the recent sell-off on speculative money leaving the derivatives oil market rather than weakness in the physical market, according to Bloomberg.

- US energy envoy Hochstein said US President Biden is committed to replenishing the petroleum reserve.

- China to lower retail fuel prices from Saturday, according to NDRC.

- Increasing oil demand from China has lifted shipping costs markedly, via WSJ; highlighting that the daily chartering cost for VLCC has roughly doubled MM.

- Russia's Kremlin said Russia is extending the Black Sea grain deal for 60 days.

- China is reportedly mulling efforts to maintain iron ore supply and prices, according to NDRC; warn iron ore trading firms to avoid hoarding and price gouging.

Geopolitics

- North Korea said its missile launch on Thursday was a Hwasong-17 ICBM which sent a warning to enemies and proved the capability to respond overwhelmingly if needed. North Korea added its launch was a response to US-South Korea military drills and its leader Kim called for boosting deterrence of nuclear war, while it noted the launch did not have any negative impact on the safety of neighbouring countries, according to NK News and KCNA.

- Chinese President Xi is to visit Moscow on March 20-22, according to state media; Both presidents are set to sign "important documents", and discuss strategic partnership, according to Tass.

- Russia's Kremlin said President Putin and President Xi will meet on March 20th, hold negotiations on March 21st, and there will be a press statement.

- German Federal Education/Research minister is to visit Taipei, Taiwan on Tuesday, via FT citing sources; Foreign Minister Baerbock intends to visit Beijing, China in April/May.

US Event Calendar

- 09:15: Feb. Industrial Production MoM, est. 0.2%, prior 0%

- Feb. Manufacturing (SIC) Production, est. -0.3%, prior 1.0%

- Feb. Capacity Utilization, est. 78.4%, prior 78.3%

- 10:00: March U. of Mich. Expectations, est. 64.8, prior 64.7; Current Conditions, est. 70.5, Sentiment, est. 67.0,

- U. of Mich. 1 Yr Inflation, est. 4.1%, prior 4.1%

- U. of Mich. 5-10 Yr Inflation, est. 2.9%, prior 2.9%

- 10:00: Feb. Leading Index, est. -0.3%, prior -0.3%

DB's Jim Reid concludes the overnight wrap

Some optimism has returned to markets over the last 24 hours, with bank stocks stabilising on both sides of the Atlantic and 2yr yields surging back. Even the ECB’s decision to pursue a 50bp hike went without incident, and investors grew in confidence that the Fed would follow up with their own 25bps hike next week, so we’re starting to see a modest change in the mood music. It's also telling this morning that in Asia, US yields and equity futures are fairly stable. Well, they were at the time of typing.

As we'll see below, the concerns haven't gone away though, as while Credit Suisse saw its equity price increase, its bonds/CDS were generally flat to weaker. Let's start with the US banks as there was a lot of news surrounding First Republic Bank. The equity opened down a further -12% taking it to its lowest levels since going public, before recovering slowly as reports started filtering out about additional capital injections. Following numerous reports early yesterday that the US government was trying to agree to a rescue package with some of the major US banks, a deal was announced just before the US equity market closed. In a joint statement the consortium of banks including JPMorgan, Citigroup, Bank of America and Wells Fargo tried to reassure the public that their actions, “reflects their confidence in First Republic and in banks of all sizes.” Overall 11 banks are contributing $30bn of uninsured deposits to First Republic, with $5bn coming from JPMorgan, Citigroup, Bank of America and Wells Fargo. The banks' commitment will extend for 120 days initially and could be extended at that point as necessary. In after-hours trading, First Republic's shares fell c.-17% as the bank announced that it was suspending its dividend and plans to trim its debt burden. That leaves the stock nearer to where it was trading prior to the news of the deposit injection but still higher.

In terms of bank funding, last night the Fed released the weekly data of how its various lending facilities were used in the week ending March 15. The most anticipated release of the data since Covid did not disappoint in scale. In total, there was $164.8bn of borrowing between the Fed’s discount window ($152.85bn) and the Bank Term Funding Program ($11.9bn) that the Fed announced last week. The discount window figure blows away the previous high of $111bn during the 2008 financial crisis. However, as a function of overall deposits level yesterday’s data was about 1% of deposits, while at the height of the GFC the discount window usage in a week was as much as 1.8% of deposits. This data will be parsed more in coming weeks if stress persists but the 11 bank consortium into First Republic will be hoped to be enough to prevent that.

Nevertheless, we shouldn’t get ahead of ourselves, and it’s worth remembering that we’ve already had a temporary period of stability on Tuesday that was then dented by the Credit Suisse worries on Wednesday. Indeed, their bonds stayed fairly stressed yesterday even with the market bounceback. The 5yr credit default swaps stayed around the +1000 level, whilst there were further declines in the value of their debt – notably their ’29 EUR bonds are trading under €70. That was in spite of the announcement we highlighted yesterday that they’d be using a SNB liquidity facility, which initially saw the share price surge +40% at the open, before paring back around half those gains to “only” close up +19.15%.

With regard to Credit Suisse, if you’re looking for the positives in European banking see my CoTD here yesterday that shows the rest of the sector is more tightly packed together in 5yr CDS terms and that CS has been an outlier for months. So if the authorities manage to contain it, the immediate contagion risk is limited. However, the CoTD also highlights how we think the financial risk will eventually spread to corporates. If relatively lowly levered financials can get hit then highly levered corporates won’t be immune further down the line with the appropriate lag. Our YE targets for US and EU HY for YE 2023 have been around 860bp for 12 months now, but with most of the pain expected to occur in H2 2023. Our US Lev Loan target is +1000bp for the same time period. If you're not on my CoTD (chart of the day), send an email to jim-reid.thematicresearch@db.com to get added.

Banks in aggregate recovered a bit yesterday, though the CS fallout continued to weigh as Europe’s STOXX Banks was up just +1.16% vs the -8.40% the day before. Meanwhile, the news of the further First Republic support saw the KBW Banks index up +2.57% - roughly 1.4% of that came after news hit that First Republic would get $30bn of deposits. We shouldn’t forget that both are still down more than -10% over the week as a whole, but the more positive tone supported a broader equity rally that left the S&P 500 (+1.76%) and Europe’s STOXX 600 (+1.19%) with solid performances on the day. That’s the best day for the S&P 500 in over 2 months and is entering today up +2.56% through the last four days, while the STOXX 600 is down -2.67% on the week so far.

Whilst all that was going on, the ECB followed through on their previous commitment to hike by 50bps at yesterday’s meeting, which takes the deposit rate up to a post-2008 high of 3%. President Lagarde said this was supported by a “large majority”, but in other respects the decision was a dovish one, and their statement dropped the previous guidance that they expected to raise rates further. Instead, the message was that they’d take a “data-dependent” approach at subsequent meetings, and there wasn’t much indication about what they were planning to do next. Their inflation forecasts (which were finalised before the current turmoil) were also revised down on the back of lower energy prices, and now see inflation falling from +5.3% in 2023 to +2.9% in 2024 and +2.1% in 2025. On the other hand, the core inflation forecast for 2023 was revised up to +4.6%, which shows that they still see underlying price pressures staying resilient.

When it came to the current turmoil, the ECB’s statement said that they were “monitoring current market tensions closely”, and it also affirmed that the “euro area banking sector is resilient, with strong capital and liquidity positions.” President Lagarde went on to deflect comparisons to 2008, saying that “the banking sector is in a much, much stronger position”. Looking forward, our European economists maintain their 3.75% baseline terminal rate call based around a 50bp hike in May and then 25bps in June. That view is predicated on the relatively rapid normalisation of the current global financial shock. Please see their report here for more.

With the ECB hike now delivered, there was a growing expectation among investors that the Fed would similarly follow through with a hike at their own meeting on Wednesday. Futures are now pricing in a +19.2bps move, which is a decent increase from the +11.8bps priced by the previous day’s close. In turn, that confidence led to a rebound in shorter-dated yields, with the 2yr yield up +27.0bps to 4.157%, and the 10yr yield also recovered +12.2bps to 3.577% although it is slightly lower (-2.26bps) in Asia as we go to press. In Europe it was much the same story, with yields on 10yr bunds (+16.0bps), OATs (+13.5bps) and gilts (+10.4bps) all rising. Another key factor behind that was growing scepticism that central banks were about to pursue substantial rate cuts this year. For instance, the futures-implied rate for the Fed’s December meeting rose by +40.7bps on the day to 4.097%, which demonstrates how rate cuts are starting to be priced out again.

The latest data has been far down the agenda lately, but the weekly initial jobless claims from the US for the week ending March 11 came in at 192k (vs. 205k expected). That’s a -20k decline on last week, which had seen the biggest weekly increase since September. Otherwise, the US housing data was more resilient than anticipated in February, with housing starts up by an annualised rate of 1.450m (vs. 1.310m expected), and building permits up by 1.524m (vs. 1.343m expected).

Asian equity markets are higher overnight. As I type, Chinese stocks are advancing with the Hang Seng (+1.85%) emerging as the top performer across the region while the Shanghai Composite (+1.58%) and the CSI (+1.57%) are also sharply higher. Elsewhere, the Nikkei (+1.20%) and the KOSPI (+0.67%) are also trading in the green as risk sentiment improved after the turmoil in the US and European banking sector eased. Outside of Asia, US stock futures are trading flattish with those on the S&P 500 (+0.06%) and NASDAQ 100 (+0.12%) taking a bit of a breather after a hectic week.

In the energy markets, oil prices are slightly higher this morning with Brent futures (+1.04%) trading at $75.48/bbl and WTI (+1.05%) at $69.07/bbl amid positive market sentiment as well as strong China demand expectations.

To the day ahead now, and data releases from the US include the University of Michigan’s consumer sentiment index for March, industrial production for February, and the Conference Board’s leading index for February. Over in Europe, we’ll get the final Euro Area CPI reading for February. Lastly, central bank speakers include the ECB’s Simkus.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.