Something remarkable happened yesterday: just after midnight on Sunday night, the FDIC announced that a small bank which almost nobody had heard of before, First-Citizens Bank & Trust (FCNCA) would scoop up the remaining assets of the now defunct Silicon Valley Bank,which imploded on March 9 following a furious bank run, that saw $42BN in deposits drained in hours (and where another $100 billion in deposits were about to be yanked on Friday, which is why the FDIC stepped in and shuttered the bank before market open on Friday March 10)...

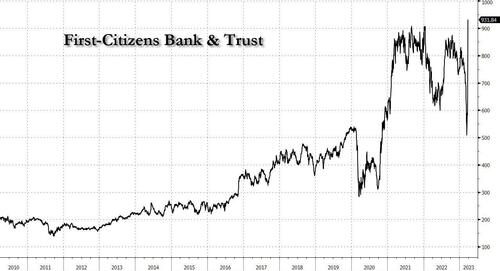

... and what happened next shocked everyone" FCNCA stock almost doubled, soaring to the highest on record.

But why would the value of the Raleigh, North Carolina-based First Citizens double in seconds if all it did buy assets which until just a few weeks ago were viewed as worthless.

Well, because they were not worthless. Yes, SIVB certainly had its sahre of massive MTM losses on its HTM book (consisting primarily of Mortgage Backed Securities), but it also had solid loans and it is these loans that First Citizens bought for a song.

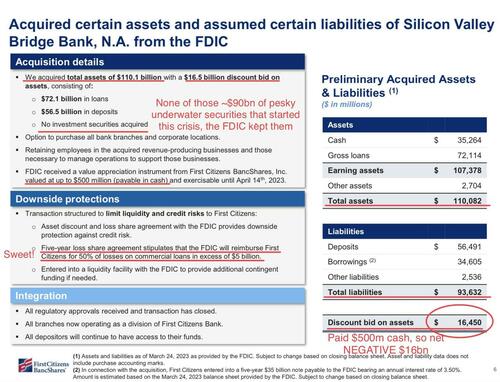

As the following chart annotated by Wasteland Capital shows, the deal that First Citizens inked was nothing short of spectacular and explains how the small bank managed to double its stock price overnight. Here is what happened:

- In exchange for a discount bid of $16.5 billion, First Citizens acquired total assets of $110.1BN (including $35.3BN in cash), and $93.6BN in liabilities, including $56.5BN in deposits and $34.6BN in assumed borrowings.

- More importantly, none of the $90BN in underwater HTM "investment securities" that sparked the crisis in the first place were acquired; no the US taxpayers got to keep those courtesy of the FDIC.

- There's more: to further sweeten the deal, the FDIC pledged even more taxpayer funds to "incentivize" First Citizens not to walk away, and it did so by signing a five-year loss share agreement according to which the FDIC will reimburse First Cititzens for 50% of losses on commercial loans in excess of $5 billion.

Bottom line: virtually no risk - and what little risk is left after acquiring this portfolio of deeply discounted loans is shared 50-50 with US taxpayers - and only upside.

And how much did this sweet taxpayer-funded deal cost First Citizens? Why a "whopping" $500 million... when when netting out the actual asset bid of $16.5 billion means that First Citizens "paid" a negative $16 billion. Confused by the double negative? Here's the bottom line: courtesy of US taxpayers (who ended up getting stuffed with the toxic garbage on Silicon Valley Bank's balance sheet), First Citizens got $16 billion (and arguably much more) in assets for free. What's more, FCNCA not only got $16BN in assets for free, but the combination of the two banks creates a $143 billion loan portfolio and turns the little-known North Carolina bank into one of the country’s largest lenders to the venture capital and private equity industries. It also means First Citizens will now be one of the top 15 US banks, with more assets than the likes of Morgan Stanley or American Express Co., according to Federal Reserve data!

One can see why the bank's market cap doubled instantly (and has a lot more to go once the bank crisis fizzles, once rates are cut and once loan prices resume their climb).

To be sure, one could argue if this was such a sweetheart deal for First Citizens, why did other banks not join the bidding process. The answer to that has to do with the unique expertise of the bank's CEO Frank B. Holding Jr., who has now scooped up at least a dozen failed banks since 2008.

“Let me say that this acquisition is compelling financially, strategically and operationally,” Holding, the 61-year-old chief executive officer of First Citizens and one of its largest individual shareholders, told analysts on a conference call on Monday. First Citizens’ stock soared after the announcement. “It is also a great illustration of regulators and banks working together to protect depositors.”

Alternatively, it is a great illustration of how clueless government regulators use taxpayer funds to backstop deals that make billionaires even richer and while Elizabeth Warren still hasn't figured out what happened here, she "native American" will sooner or later, at which point we will get countless kangaroo court hearings seeking an explanation from the FDIC how this wealth transfer was allowed to happen.

And while we wait, here is a snapshot of First Citizens' unique history courtesy of Bloomberg:

First Citizens got its start with $10,000 in capital as the Bank of Smithfield in 1898, primarily serving North Carolina’s Johnston County. In 1935, Frank Holding’s grandfather R.P. Holding took over as president and chairman, leading the company until his death in the 1950s.

At that point, leadership of the bank transferred to his three sons, Robert Holding, Lewis R. Holding and Frank B. Holding. In the 1970s, the firm moved its headquarters to Raleigh as assets surpassed $1 billion for the first time, according to the company’s website.

It wasn’t until 1994 that First Citizens began opening branches outside its home state after acquiring a bank in West Virginia. A few years later, the company added a federal thrift subsidiary, allowing it to expand further across the country.

Frank B. Holding Jr. was named CEO of First Citizens in 2008, then chairman the following year, at the height of the global financial crisis. A handful of other bank executives – including Vice Chairman Hope Holding Bryant and President Peter Bristow – are also Holding family members.

“He sort of does look like the family banker,” said Lawrence Baxter, a Duke University School of Law professor who once was a First Citizens customer himself and regularly sees Holding in ads that are part of the bank’s PBS North Carolina sponsorship.

Family banker or not, Holding certainly is experienced in quickly assessing and scooping up distressed assets: since the global financial crisis, First Citizens has acquired lenders in a series of deals from Washington state to Wisconsin and Pennsylvania.

“First Citizens has a history of troubled banks,” said Herman Chan, an analyst with Bloomberg Intelligence. “It’s a strategy to grow the bank when times are difficult — to conduct M&A at advantageous prices."

Like now.

Growth has come not only from failed-bank deals though: First Citizens last year completed the acquisition of the formerly high-profile CIT Group in a deal valued at more than $2 billion.

“In the long run, what you’ll get is more — more services, more ways to manage your money, more places to find us,” Holding told customers in a video announcing the takeover. “We’re not just making a bigger bank, we’re making an even better bank.”

The moves have meant First Citizens is now a national player, with more than 500 branches and private-banking offices spread across states as far away from its headquarters as Hawaii. With more than 10,000 employees, the lender offers the traditional businesses of banking to individual consumers and companies, and is also one of the largest lenders to the rail industry — even owning a fleet of rail cars and locomotives that it leases to railroads and shippers.

* * *

While nowhere near close to Monday's multi-billion gift, Frank Holding had already taken advantage of SVB’s collapse by joining other regional bank executives in snapping up shares of their companies. He spent $260,000 buying up First Citizens stock in early March for $650 a share, 30% below the company’s current share price of $910.

Some younger members of the Holding family are already working for the bank. Perry Bailey, Frank’s daughter, earned $224,082 working at First Citizens last year, while her cousin and Frank’s nephew John Patrick Connell pocketed $105,116 during the same period, according to regulatory disclosures.

Not surprisingly, Holding and his relatives have became part of the world’s ultra-rich through their banking business, becoming a billionaire finance dynasty split across at least five branches.

Like other billionaire dynasties, such as the Murdochs, the family has maintained a tight grip on the direction of their major asset, even though they don’t hold a majority of its equity, by employing a dual-class share structure. Frank Holding and his relatives hold Class B shares with 16 voting rights each, compared with the single vote for each of the Class A shares the banking dynasty also holds, and they’ve passed down their wealth generation to generation by shifting stock to scores of trusts.

Frank Holding and relatives listed as First Citizens shareholders oversee a stake worth more than $1.7 billion in First Citizens after the company’s shares surged 54% on Monday, erasing their sudden wealth slump from SVB’s collapse, according to the Bloomberg Billionaires Index. They’ve also received at least $35 million through dividends and share sales over the past four decades and diversified their fortunes into commercial real estate, farming and philanthropy.

And now, courtesy of the SIVB collapse, they are about to become even richer.

https://www.zerohedge.com/markets/how-collapse-svb-led-16-billion-taxpayer-funded-handout-one-bank

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.