An odd narrative which emerged following the dramatic collapse of Silicon Valley Bank was that it was the "first Twitter-fueled bank run," with notables such as Peter Thiel and Bill Ackman taking the blame for influencing businesses to withdraw funds from the bank.

Also promoting this absurd narrative (without a clue about the underlying causes of the collapse, such as failure to hedge against interest-rate risk) was the 'woman-owned and operated' Alethea Group, which circulated a dossier of sorts accusing ZeroHedge and others of potentially contributing "to increased online panic about SVB."

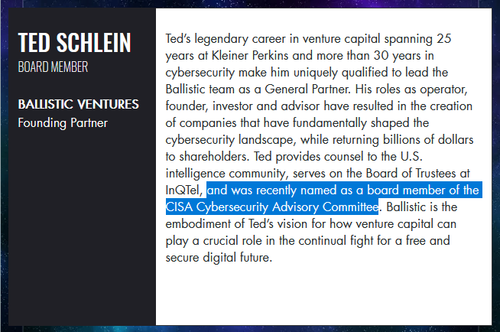

Interestingly, Alethea - run by a former staffer for Sen. Angus King - cropped up in 2019, and last November received $10 million from Ballistic Ventures, whose general partner is Ted Schlein. Ted "provides counsel to the U.S. intelligence community, serves on the Board of Trustees at InQTel, and was recently named as a board member of the CISA Cybersecurity Advisory Committee."

Connecting the dots...

What did we learn recently from the latest "Twitter Files" from Matt Taibbi?

Last June, the advisory board recommended that CISA [on whose board Schlein sits] should work with and provide support to external partners “who identify emergent informational threats,” and find ways to mitigate “false and misleading narratives.”

So, the US Government is farming out 'misinformation' research, and a CISA board member doled out $10 million to Alethea as part of that effort.

Bloomberg, (which excluded ZeroHedge from their report referencing the Alethea dossier after we told them what bullshit it is), now reports that "SVB's demise swirled on private VC founder networks before hitting Twitter."

"It wasn’t phone calls; it wasn’t social media," said one Silicon Valley startup founder who wishes to remain anonymous. "It was private chat rooms and message groups."

By the time most people figured out that a bank run was a possibility on Thursday, March 9, it was already well underway. -Bloomberg

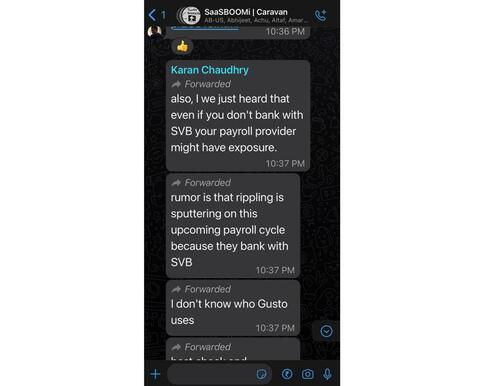

Source: Avinash Raghava

According to the report;

Gunjit Singh, the San Francisco-based co-founder of Electric Sheep Robotics, first heard chatter about Silicon Valley Bank’s financial straits in January via WhatsApp messages. Initially he dismissed it. His company, which makes robotic lawn mowers, had a line of credit and most of its cash with the bank, but the worry at that point was mostly theoretical. “There are rumors about everything,” he said.

The rumors, of course, turned out to be true. Silicon Valley Bank had liquidity issues thanks to the combination of rising interest rates and a large portfolio of long-term, low-interest assets. When it moved to shore up its financial position in early March, many people started taking the risks more seriously.

It was Wednesday, March 8, the day before the company’s stock tumbled 60%, when Alfred Chuang became aware of worries over Silicon Valley Bank’s health, mostly via email and phone calls. Chuang, an investor at VC firm Race Capital, said chief executive officers of public companies began warning him about the bank that evening. “I knew it meant one thing: They were withdrawing money,” Chuang said. Race Capital “exited out of SVB in record time.”

The rest of the Bloomberg report, available to BBG subscribers, lays out what happened in painstaking detail. But the bottom line is this;

This was not a "Twitter-fueled bank run," and those accusing ZeroHedge or other financial media outlets of contributing to it for accurately reporting on what was going on can go pound sand.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.