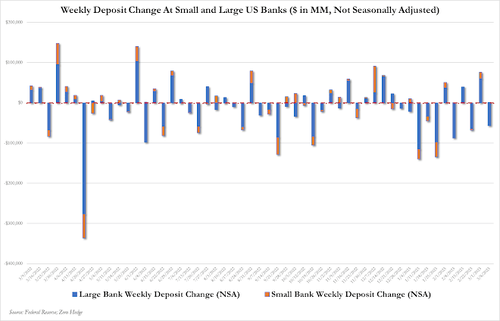

Of course, as we first said last week, and as BBG echoes today, "just how many deposits fled small banks for the systemically-important competitors will go some way into shaping the market’s view of how enduring or systemic the pressure on small financial institutions will be moving forward."

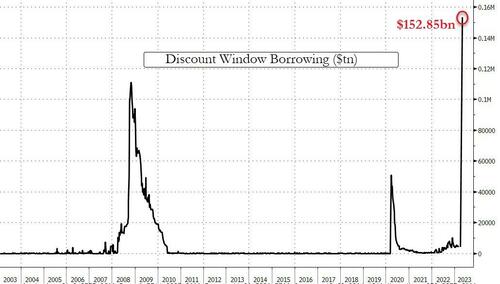

Meanwhile, the Fed's more timely H.4 release from last week confirmed that GSIBs saw a significant inflow of funds given the large increase in bank reserves in Fed regions hosting the headquarters of the money-center banks, offset by substantial outflows at small banks which piled into the Discount Window to fund liquidity shortfalls; in fact, as we observed last week, the Discount Window saw a record one-week surge of $152.8 BN...

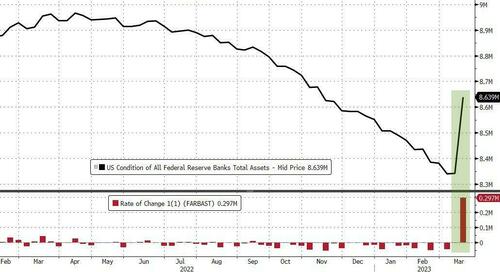

... which when coupled with "Other credit extensions" - which include various FDIC loans - saw the Fed's balance sheet soar by $300 billion, the biggest jump since April 2020 and erasing half of the Fed's QT balance sheet shrinkage.

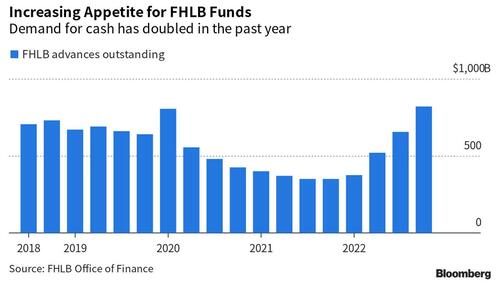

And while we wait for this Friday's H.8 update which will come too late to influence the Fed's Wednesday decision one way or another (where estimates are for anything from a 50bps hike to a -25bps cut), today we got another glimpse into the severity of the ongoing bank run when Bloomberg reported that the Federal Home Loan Bank System issued $304 billion in debt last week. That’s almost double the $165 billion that liquidity-starved lenders tapped from the Federal Reserve, and when combined is not too far off JPMorgan's estimate of $550 billion in deposit flight in the past week.

The debt issued last week included notes, which mature in less than a year, and $151 billion in longer-term bonds. The bond issuance eclipsed the nearly $55 billion supplied for the entire month of February and roughly $130 billion for January.

Drilling down, total debt issued for Monday was $112 billion, one of the biggest-ever days of financing for the FHLB system, according to the person familiar with the matter. The next day, the system issued $87 billion in notes and bonds.

As a reminder, the FHLBs are a Depression-era backstop originally created to boost mortgage lending, and is now a key source of cash for regional banks, also known as the “lender of next-to-last resort” for those banks who refuse to use the Fed's primary emergency funding facility - the highly stigmatizing Discount Window.

The role of FHLBs as a secondary backstop attracted scrutiny after the March 10 collapse of Silicon Valley Bank, which was the single biggest user of the Federal Home Loan Bank of San Francisco. SVB borrowed $15 billion in the fourth quarter of 2022, 17% of the San Francisco home loan bank’s lending.

According to Bloomberg, as of the end of 2022, the 11 FHLBs in the US had $823 billion in outstanding loans, known as advances; the number is updated quarterly so those keeping tabs on FHLB advance usage need to focus on the funding side of their balance sheet.

The FHLB System “is not intended or structured to function as a lender of last resort,” said Joshua Stallings, deputy director for bank regulation at the Federal Housing Finance Agency, the FHLB System’s regulator, in a March 13 statement. Ironically, along with the Discount Window, that's precisely what it has become at least until the Fed restarts QE.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.