By George Lei, Bloomberg markets live reporter and strategist

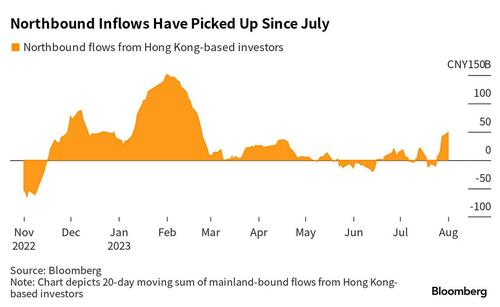

Chinese equities in July posted their best returns in six months, yet US-based investors have refrained from chasing the rally, according to data tracking flows into exchange-traded funds. They instead have bolstered stock holdings in other emerging markets, in contrast to Hong Kong-based investors whose purchases of onshore equities have reached a 23-week high.

The MSCI China Index was up 9.3% last month and rallied a total of 12.7% between June and July, the kind of performance unseen since the heyday of the reopening trade. On a 20-day basis, total purchases of mainland stocks from Hong Kong-based investors reached 49.2 billion yuan ($6.85 billion), the highest since February 23.

US buyers, in contrast, have largely soured on China Inc. since February. On a 20-day basis, the iShares MSCI China ETF saw total outflows of $75 million as of July 31, despite stimulus bets and stock-market rallies over the past two months. Meanwhile, the iShares MSCI EM ex-China ETF received constant inflows throughout the year, with the 20-day total reaching $369 million as of July 31.

MSCI’s China ETF now has assets of around $8.4 billion, 70% above that of the other fund. If present trends continue, however, the ETF dedicated to EM ex-China will eventually exceed the China fund in terms of assets under management in the coming years.

Recent rallies in Chinese stocks appear to be “mostly driven by short covering” and few global funds are “buying into China in any meaningful way yet,” Michael J. Oh, a San Francisco-based portfolio manager at Matthews Asia, told Bloomberg. “Beijing has said a lot of positive things but there’s still a lack of actions,” Oh noted.

US sanctions on some Chinese firms and other forms of regulatory crackdowns may have also scared away American investors. This week, a US House committee demanded information from BlackRock about the inclusion of Chinese companies in its funds, alleging facilitation of American investment into parts of China Inc. blacklisted by the White House. Similar requests were also made to MSCI. As President Joe Biden is reportedly planning for new curbs on US tech investment in China, American appetite for companies in the world’s second largest economy will only wane further.

https://www.zerohedge.com/markets/us-buyers-shy-away-china-inc-no-regrets

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.