With all other megatech companies having already reported earnings - some good, some not so good - all eyes were on the results from the last giga-cap kahuna, the world's largest company, Apple and its $2.8+ trillion market cap. According to Bloomberg's Mark Gurman here are the biggest things to watch for in the earnings release:

- iPhone sales, given that the quarter includes about a week or so of the new iPhone 15

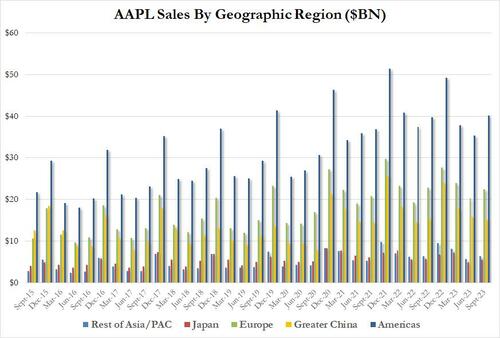

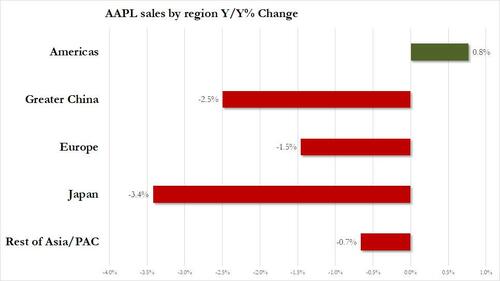

- Greater China revenue, due to the concerns about consumers there buying iPhones in an expression of nationalism and a government ban on American-developed devices

- Wearables, given some slowdown in that category

- iPad and Mac revenue, given the projected double-digit decline there

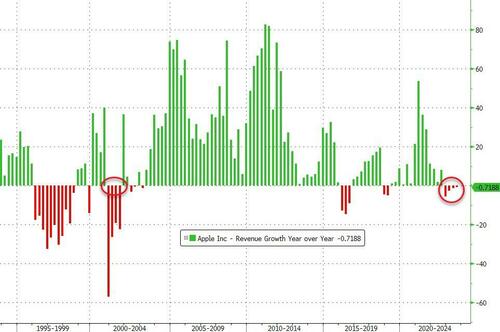

Another notable item to watch is, if Apple crosses the $90.1 billion revenue threshold. That will be the difference between Apple returning to growth or seeing an annual revenue decline for the fourth quarter in a row.

One important item to note on the iPhone is that Apple is getting a favorable comparison this year. Last year’s iPhone 14 Pro line was stymied by Covid-related shutdowns at production facilities in China. So Apple wasn’t able to fulfill nearly enough demand in the quarter. That means the iPhone 15 Pro should easily show year over year growth, though we won’t get a complete picture until the end of January or early February when Q1 2024 numbers are announced.

In addition to the iPhone 15 line, Apple introduced slightly modified Apple Watches and AirPods during the quarter. But those are unlikely to truly move the needle for Apple.

With that in mind, this is what Apple just reported for its fiscal Q4:

- EPS $1.46 vs. $1.29 y/y, beating estimates of $1.39

- Revenue $89.50 billion, -0.7% y/y, and while it beat the estimate $89.35 billion, this was the 4th consecutive quarter of annual declines

- Products revenue $67.18 billion, -5.3% y/y, missing estimates of $67.82 billion

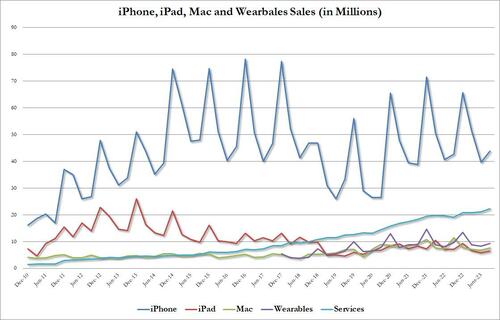

- IPhone revenue $43.81 billion, +2.8% y/y, just barely beating estimates of $43.73 billion

- Mac revenue $7.61 billion, -34% y/y, missing estimates of $8.76 billion

- IPad revenue $6.44 billion, -10% y/y, beating estimates of $6.12 billion

- Wearables, home and accessories $9.32 billion, -3.4% y/y, missing estimates of $9.41 billion

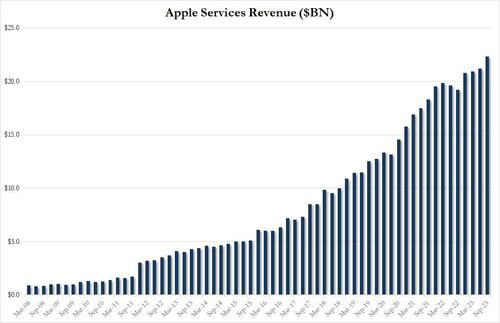

- Service revenue $22.31 billion, +16% y/y, beating estimates $21.37 billion

- Greater China rev. $15.08 billion, -2.5% y/y, badly missing estimates of $17.01 billion

- Gross margin $40.43 billion, +6.1% y/y, beating estimates of $39.79 billion

- Cost of sales $49.07 billion, -5.7% y/y, below the estimate of $49.62 billion

- Total operating expenses $13.46 billion, +1.9% y/y, below the estimate $13.6 billion

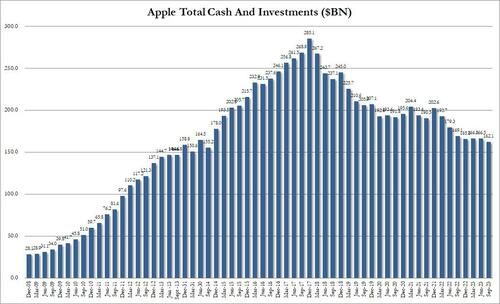

- Cash and cash equivalents $29.97 billion, +27% y/y, missing estimates of $31.77 billion

While the numbers were mixed, with revenue of almost $82 billion coming above expectations thanks to strong service revenue offsetting meh iPhone print and a miss on Products, Macs and wearables, what the market did not like (again) is that this was another quarter without revenue growth and the 4rd consecutive quarter of annual revenue declines: the first time for AAPL since 2001.

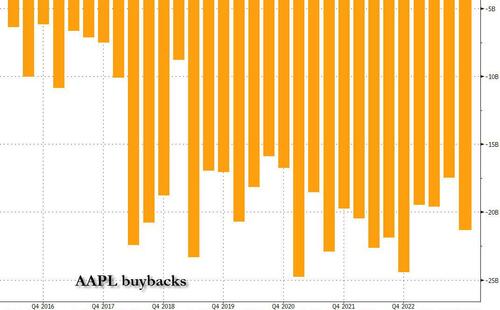

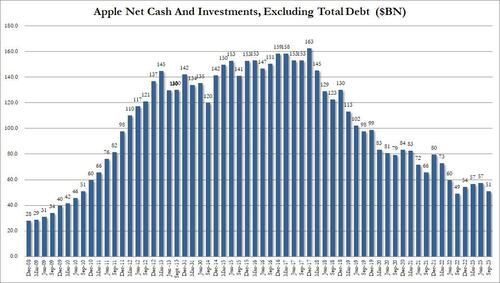

And while we wait for the company's soft guidance during the 5pm call, the company did not surprise the market with another generous shareholder payout unlike earlier this year when it unveiled an additional $90 billion stock repurchase (it did declare a cash dividend of 24 cents a share, payable Nov 16). in fact, buybacks of $21 billion were slightly below consensus and more than $3BN below the $24.4BN last quarter, and could be an area of concern.

Commenting on the quarter, CEO Tim Cook said that “we now have our strongest lineup of products ever heading into the holiday season, including the iPhone 15 lineup and our first carbon neutral Apple Watch models, a major milestone in our efforts to make all Apple products carbon neutral by 2030.”

Looking at the revenue breakdown, Apple missed across several product categories, while reporting an in line print in the all important iPhone segment:

- IPhone revenue $43.81 billion, up 2.8% y/y, and just barely beating estimates of $43.73 billion (unclear how much of the new iPhone model benefit is to be accounted for in the quarter which ended Sept 30 when the phone was released just day ahead of quarter end)

- Mac revenue $7.61 billion, -34% y/y, missing estimates of $8.76 billion

- IPad revenue $6.44 billion, -10% y/y, beating estimates of $6.12 billion

- Wearables, home and accessories $9.32 billion, -3.4% y/y, missing estimates of $9.41 billion

- Products revenue $67.18 billion, -5.3% y/y, missing estimates of $67.82 billion

As we noted last quarter, what markets may be concerned about is that AAPL appears to be reaching a "double top" in product revenue, and indeed with the exception of Services, almost every product class did slowdown from a year ago.

As Bloomberg notes, Apple’s computer division appears to be faltering at a time when the worst seems over for the PC industry at large. Other companies have said that the inventory that’s weighed on sales has been worked through and the industry is returning to a healthier environment.

One place where investors were clearly disappointed (unlike last quarter) was China sales, which at $15.08 billion, not only declined 2.5% but missed estimates of $17.01 billion.

While China lost ground in line with other regions in terms of the dollar amount it was down from a year ago, it was much lower than the consensus forecast which had called for revenue of $17 billion. This would indicate that the hoped-for return to spending by Chinese consumers isn’t yet materializing. Then again, most other regions were even worse on a percentage YoY basis.

The silver lining this quarter, as three months ago, was in the sold Services revenue, which at a time when products continue to slowdown, printed at a fresh record high of $22.31 billion, up 16% YoY, beating estimates of $21.4 billion and a reversal to last quarter's miss.

One final note: AAPL's cash - both gross and net - continues to shrink, which at a time when dividends are declining will also be frowned upon by traders. As shown below, gross cash is $162BN, the lowest since June 2014...

... while net cash of $51BN remains near the lowest since 2010.

Putting it all together:

- Revenue declined for a fourth quarter to $89.5 billion

- The company’s iPhone revenue topped estimates at $43.8 billion

- Services sales gained 16% to $22.3 billion

- Apple’s business in China fell short of estimates

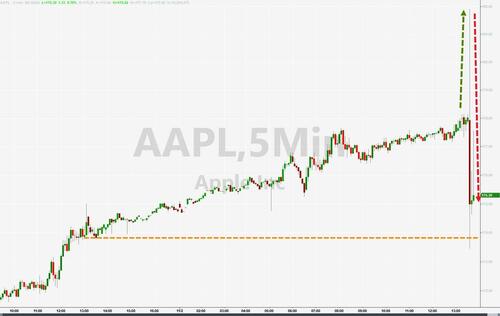

As for the market, will it was not happy with what Apple reported, and after a brief kneejerk higher, the stock has since dipped about 1.5% from its close if in line with where it opened this morning.

The silver lining is that there wasn't a huge drop (nor surge), and thus Apple will probably not be the factor that determines if the recent year-end rally will continue. That means that we now have to wait for tomorrow's jobs report for the final verdict.

And now we turn to the earnings call where anything can be said (and happen) and we wouldn't be surprised if the stock reverses the entire drop as Tim Cook speaks...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.