While 'hard' data has been improving recently (albeit then downwardly revised a month later), it is the 'soft' survey data that has collapsed amid Bidenomics.

Source: Bloomberg

And this morning continued that trend as S&P Global's US Manufacturing PMI (survey) fell from 51.9 in March to 50.0 as the final print for April (49.9 flash). ISM's Manufacturing survey also missed, dropping from 50.3 to 49.2 (contraction).

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“Business conditions stagnated in April, failing to improve for the first time in four months and pointing to a weak start to the second quarter for manufacturers. Order inflows into factories fell for the first time since December, meaning producers had to rely on orders placed in prior months to keep busy.

“However, there are some encouraging signs. The drop in orders appears to have been largely driven by reduced demand for semi-manufactured goods – inputs produced for other firms – as factories adjust their inventories of inputs. In contrast, consumer goods producers reported a further strengthening of demand, hinting that the broader consumer-driven economic upturn remains intact.

“Producers on the whole also seem confident enough in the business outlook to continue adding to payroll numbers at a pace that compares well with the average seen over the past two years, investing further in operating capacity.

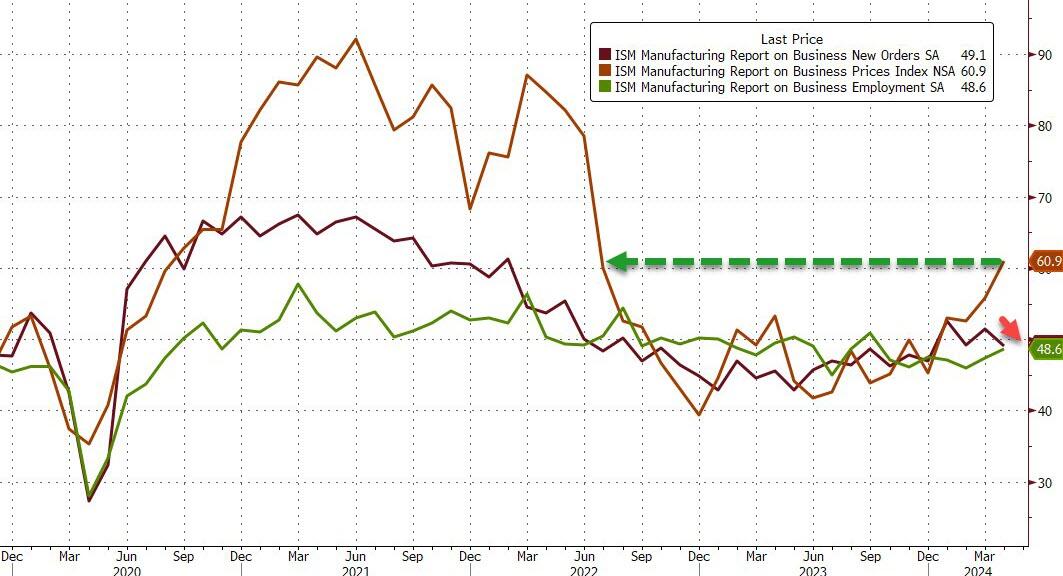

But, under the hood it was not pretty - ISM New Orders tumbled, Employment rose modestly, but Prices Paid soared (to their highest since June 2022)...

Source: Bloomberg

Prices charged for goods rose at a slower rate than the 11-month high seen in March. But, as S&P Global notes, the rate of increase nevertheless remains elevated by historical standards – and well above the average seen in the decade prior to the pandemic – as firms continued to pass higher commodity prices on to customers.

However, input costs increased sharply, with the rate of inflation quickening for the second consecutive month. Higher prices for oil and metals were mentioned in particular.

So, stagnating growth and sharply rising input costs... Stagflation signals everywhere.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.