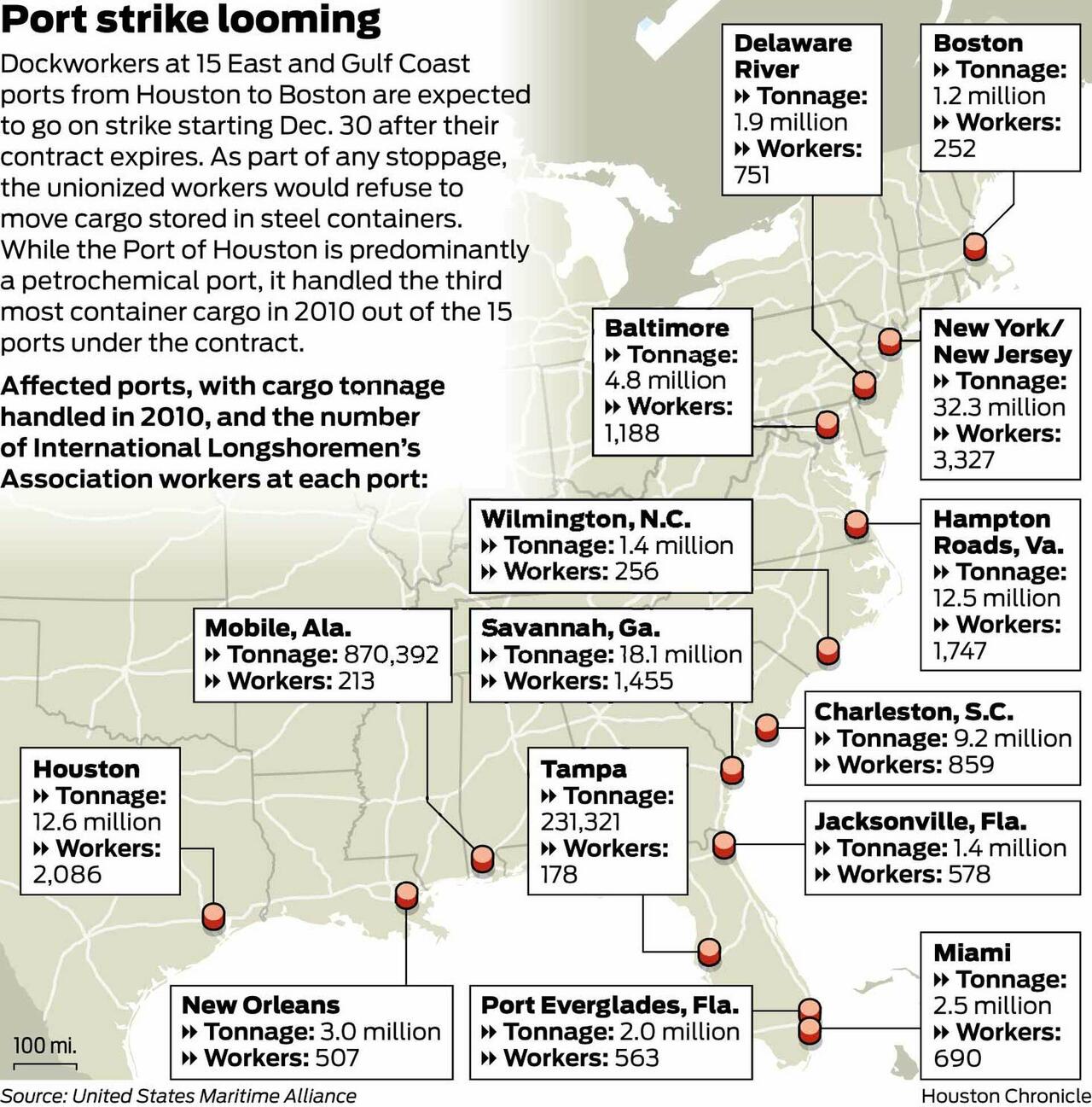

Goldman analyst explained last week that a walkout by ILA members would jeopardize $5 billion in daily international trade coming into the Gulf and East Coast ports.

Goldman's Jordan Alliger told clients, "Upwards of $4.9bn per day is at risk in international trade along the East and Gulf coasts, along with the potential for supply chains to likely become less fluid due to emergent congestion, which in turn could result in a re-emergence of transport price inflation."

"The biggest wild card in the presidential election that nobody's talking about? The looming port strike that could shut down all East and Gulf Coast ports just 36 days before the election," Flexport CEO Ryan Petersen wrote on X earlier this month.

On Monday morning, with just a little over half the day left, a team of Goldman analysts led by Brooke Roach provided clients with the "current state of the supply chain and freight environment for the retail industry."

What is happening: The International Longshoreman Association and US Maritime Alliance contract is set to expire on September 30th. Our US transports analyst, Jordan Alliger, detailed the potential ramifications should labor disruption arise at East / Gulf Coast Ports in this note published on 9/26. While we take no view on the likelihood of any outcome, our team has fielded an increased number of investor queries focused on potential disruption to US retail as a result of potential congestion, which could come at a critical shipping period for US retailers ahead of the holidays.

Comments from retail associations: The American Apparel and Footwear Association estimates that 53% of all US apparel, footwear, and accessories imports are routed through the East and Gulf Coast ports. The AAFA also noted risk from East Coast / Gulf port disruption to impact West Coast port operations, creating strains/delays across the supply chain. Separately, the Retail Industry Leaders Association has also stated that while retailers have activated contingency plans to mitigate potential effects of work disruption, it becomes harder to mitigate the longer a work stoppage goes on.

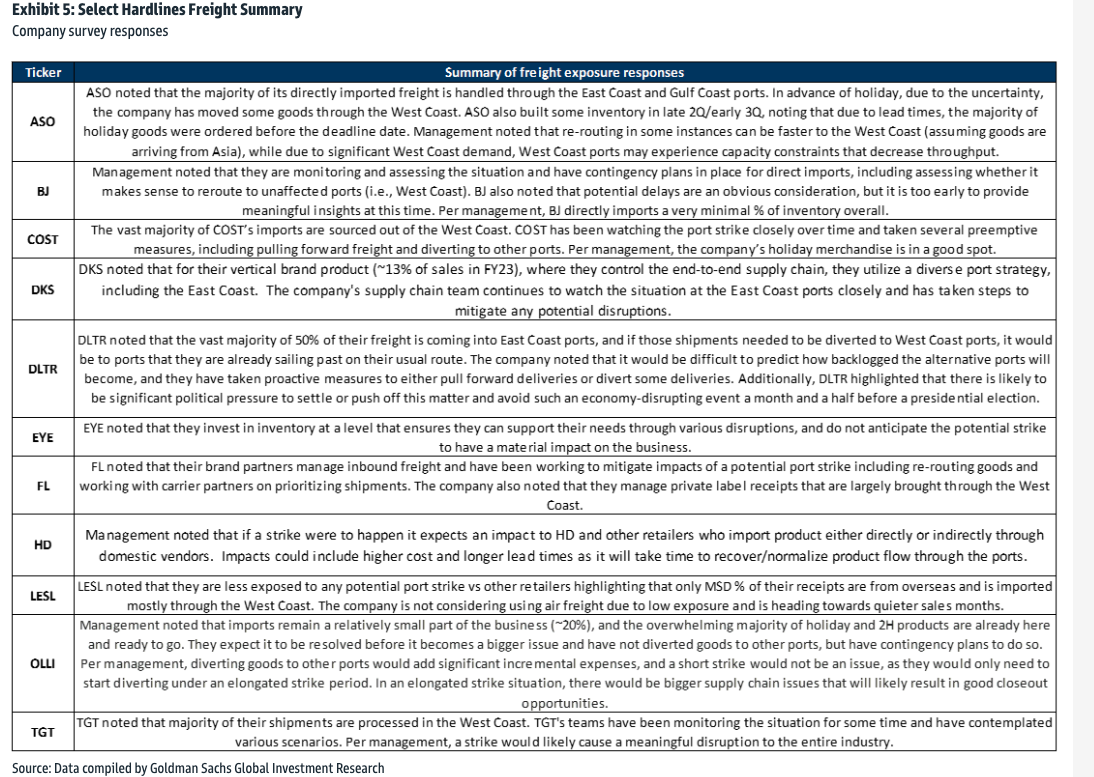

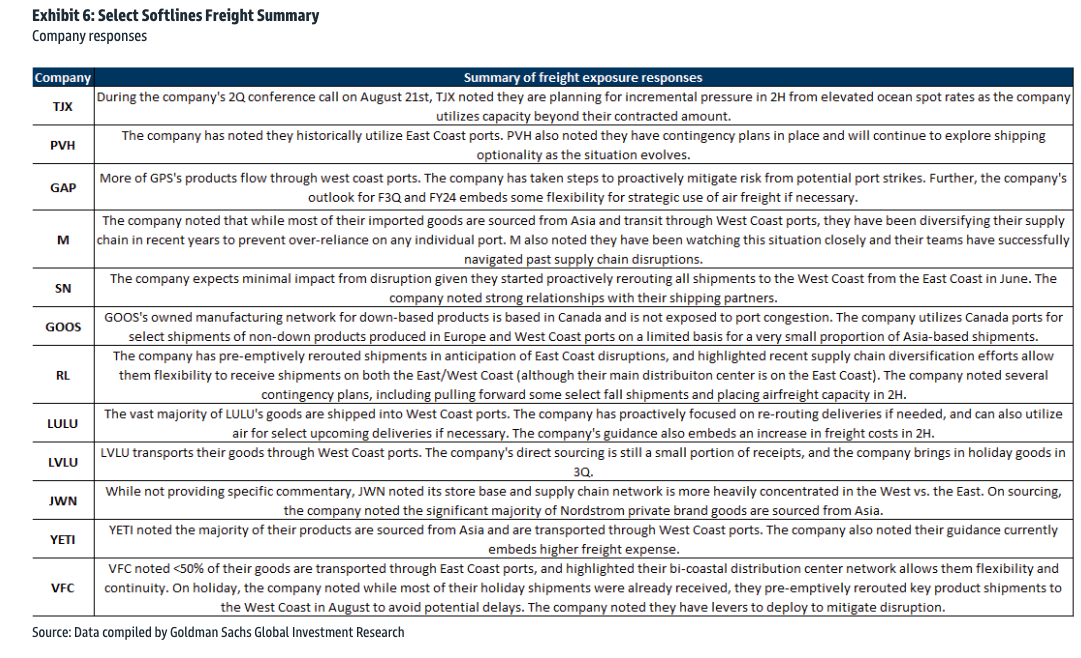

Our view on potential impact: We surveyed our hardlines and softlines coverage universe to assess exposure, and we found the majority of companies who responded pointed to the following: (1) A higher rate of reliance on West Coast ports for their primarily Asia-sourced product; (2) Proactive rerouting and other plans ahead of potential disruption to ensure critical product arrives on-time for holiday; (3) Other contingency plans in place, including airfreight for select items. Many companies indicated they were already planning for higher freight expense in 2H due to a variety of risk factors, with port contract negotiations one factor alongside ongoing Red Sea disruption and higher rates on spot product. That said, we note that the magnitude of potential disruption is likely a function of the length of any work disruption and subsequent port congestion (which could likely impact both West and East Coast ports). Historically, a longer period of congestion for retailers has typically been associated with a higher risk of delayed product arrival, which can be a headwind to full-price sales for holiday or seasonal items. Full detail of exposure by company is listed in the tables below.

Here is the historic labor action example the analysts laid out:

- While not an exact corollary given the higher level of importance of West Coast ports to the retail industry (a function of Asia-based supply chains), we note one historical example in 2014/15. The West Coast port labor dispute between the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association lasted from June 2014 through February 2015, with the situation worsening in January and February as an apparent work slowdown escalated to closure of 29 ports for several days around Presidents' Day weekend in 2015 before reaching an agreement on February 20th, 2015. Delayed product impacted seasonal timing of spring apparel product launches, with inventory drawdown during the initial period of disruption (likely due to delayed shipments) and then a subsequent build in inventories which lasted through the year for many companies. Several of our covered companies cited port delays as a driver of gross margin pressure, with promotional pricing in mid-2015 seen across department stores, specialty retail, mass retailers and apparel/accessories brands.

The analysts then surveyed retailers about their freight exposure at US ports. In one instance, Dollar Tree warned that half its products pass through Gulf and East Coast ports.

Some retailers warn that supply chain snarls could spark chaos for them:

Another industry survey found which retailers will be the most flexible in an East Coast port strike environment.

Earlier this morning, when Biden was asked about "Yemen strikes," the president responded incoherently to reporters: "I've spoken to both sides. They gotta settle the strike. I'm supporting the collective bargaining effort. I think they'll settle the strike."

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.