As discussed yesterday in "Buyers Balk At Russian Oil Purchases Despite Record Discounts, Sanction Carve Outs" the bevy of Russian sanctions have had the unintended consequence of also freezing Russian oil exports - despite explicit carve outs in terms set by Western nations - as buyers balk and boycott Russian crude sales amid fears that the country's energy supplies may eventually fall under a sanctions regime anyway, leaving buyers stuck with millions in barrels they can't then sell to downstream clients.

Today was a clear example of just that: citing traders with knowledge of tenders, Bloomberg reported that Surgutneftegaz (better known as Surgut) failed to award two tenders with combined volume of 880k tons of Urals for March loading.

This was the third time that Surgut failed to sell any of the crude it was offering, "highlighting the difficulty for Russian producers to find buyers after the nation’s invasion into Ukraine."

In a separate, smaller tender, Surgut was offering 8 cargoes of 100k tons each from Baltic ports, and another 80k tons cargo from Black Sea in a separate tender. It was unclear if any bidders stepped up for those.

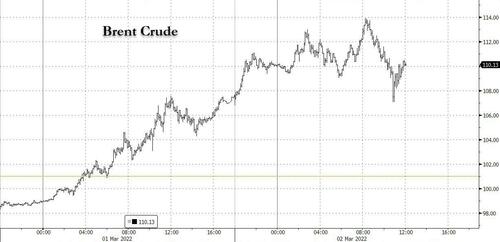

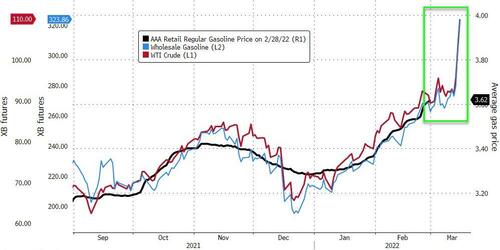

Of course, the longer Russia, and its roughly 6 mm barrels in daily oil exports remain stuck, the greater the cumulative price shock will be. Commenting on this, Bloomberg's Alaric Nightingale said that there’s a clear and obvious short-term supply shock for Russian oil and that’s why prices are marching ever higher, having hit a decade high of $114 earlier today before stabilizing around $110.

As Nightingale continues, "tanker companies don’t want to take it and refineries are looking elsewhere. There is a huge risk in being involved in Russian barrels. Imagine you are a trader of Russian crude. You have to get the barrels and freight cheap enough, and then you have to know you have an end buyer who’ll take the cargo no matter what. Some tanker owners will go at the right price, some won’t. Some refineries are already voting with their feet."

In short, there is a sense across the petroleum supply chain that sanctions aren’t done yet or aren’t well-enough understood yet. That’s why things are getting blocked.

Meanwhile, Energy Aspects estimates that 70% of Russia’s crude trade is frozen but that will drop to 20% when there’s greater visibility on sanctions.

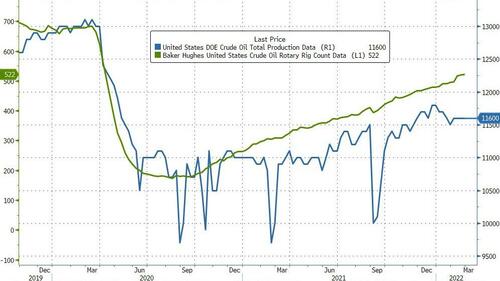

While that’s a reasonable proposition but there is an x-factor: could the final sanctions package actually be even more punitive for the country’s exports? Even if 20% were to end up frozen, that would still be a very bullish final scenario for the oil market; as a reminder, Goldman recently noted that even assuming full Russian output, the market remains undersupplied and continued disruptions will push oil much higher.

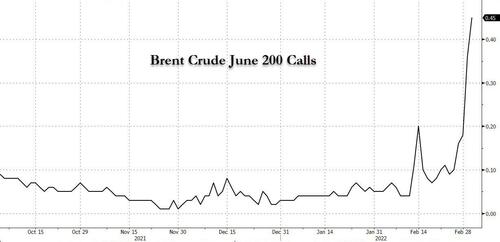

So what does the market think? Well, the 10x increase in Brent $200 June calls in the past week should give you a sense of what may be coming.