by Robert Kogon via DailySceptic.org,

German scientists have uncovered startling evidence that a substantial portion of the batches of the Pfizer-BioNTech COVID-19 vaccine deployed in the European Union may in fact have consisted of placebos – and that the German regulator knew this and did not subject them to quality-control testing.

The scientists, Dr. Gerald Dyker, Professor of Organic Chemistry at the Ruhr University Bochum, and Dr. Jörg Matysik, Professor of Analytical Chemistry at the University of Leipzig, are part of a group of five German-speaking scientists who have been publicly raising questions about the quality and safety of the BioNTech vaccine (as it is known in Germany) for the last year and a half.

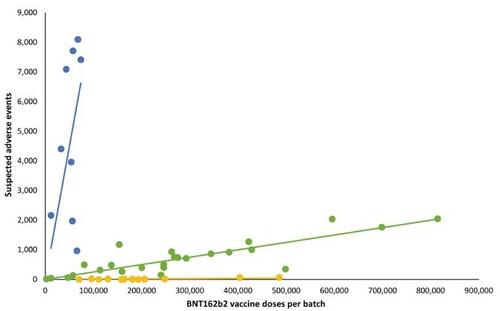

They recently appeared on the Punkt.Preradovic online programme of the German journalist Milena Preradovic to discuss batch variability. Their starting point was the recent Danish study showing enormous variation in the adverse events associated with different batches of the Pfizer-BioNTech vaccine, or BNT162b2 per its scientific codename. The below figure from the Danish study illustrates this variation.

It shows that the batches used in Denmark, which are represented by the points in the graph, essentially break down into three groups.

The ‘green batches’ clustered around the green line have a moderate or moderately-high level of adverse events associated with them. In the discussion with Preradovic, Gerald Dyker takes the example of the green point furthest to the right.

As he explains, it represents the batch that was the used the most in Denmark, with somewhat over 800,000 doses having been administered. These 800,000 doses are associated with around 2,000 suspected adverse events, which gives a reporting rate of one suspected adverse event per approximately 400 doses. As Dyker puts it, “That’s not a small amount if we compare to what we know otherwise from influenza vaccines.” According to Dyker’s calculation, the green batches account for more than 60% of the Danish sample.

There are then the ‘blue batches’ clustered around the blue line, which are obviously associated with an extraordinarily high level of adverse events. As Dyker notes, no more than 80,000 doses of any of the blue batches were administered in Denmark – suggesting that these especially bad batches may perhaps have been quietly pulled from the market by public health authorities.

Nonetheless, these batches had as many as 8,000 suspected adverse events associated with them. Eight thousand out of 80,000 doses would give a reporting rate of one suspected adverse event for every 10 doses – and Dyker notes that some of the blue batches are indeed associated with a reporting rate of as high as one suspected adverse event for every six doses!

On Dyker’s calculation, the blue batches represent less than 5% of the total number of doses included in the Danish study. Nonetheless, they are associated with nearly 50% of the 579 deaths recorded in the sample.

Finally, we have the ‘yellow batches’ clustered around the yellow line, which, as can be seen above, barely gets off the x-axis.

On Dyker’s calculation, the yellow batches represent around 30% of the total.

Dyker notes that they include batches comprising some 200,000 administered doses which are associated with literally zero suspected adverse events.

As Dyker puts it, “malicious” observers might note that “this is how placebos would look”.

And malicious observers might be right.

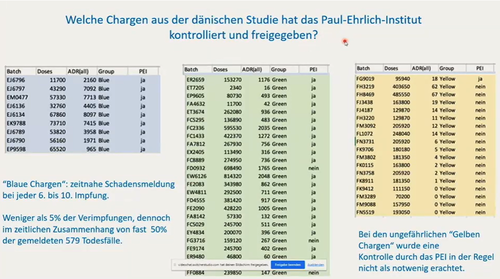

For Dyker and Matysik compared the batch numbers contained in the Danish study with publicly available information on the batches approved for release, and they made the startling discovery that almost none of the harmless batches, unlike the very-bad and not-so-bad batches, appear to have been subject to any quality-control testing at all.

Unbeknownst to most observers, it is precisely the German regulatory agency, the Paul Ehrlich Institute (PEI), which is, in principle, responsible for quality control of all the Pfizer-BioNTech vaccine supply in the EU. (The institute is named after the German immunologist and Nobel Prize winner Paul Ehrlich, not, of course, the Stanford biology professor of the same name.)

This reflects the fact that the actual legal manufacturer of the vaccine, as well as the marketing authorisation holder in the EU, is the German company BioNTech, not its more well-known American partner Pfizer.

Dyker and Matysik found that the PEI had tested and approved for release all the very bad ‘blue’ batches, the overwhelming majority of the not-so-bad ‘green’ batches, but almost none of the harmless ‘yellow’ batches – as if the PEI knew in advance that these batches were unproblematic.

This is shown in the below slide from Dyker’s presentation during the Punkt.Preradovic interview. The title reads: ‘Which batches from the Danish study did the Paul Ehrlich Institute test and approve for release?’

In the PEI column of each of the tables, “ja” means, of course, that the batch was tested, “nein” means that it was not. Note that only the first batch in the ‘yellow’ table was tested.

The caption under that table reads: “The PEI did not generally regard testing of the harmless ‘yellow batches’ as necessary.”

As Dyker put it, with notable restraint, “this would support the initial suspicion that they are maybe in fact something like placebos”.

Or, in short, to paraphrase the German scientists’ findings on the variability of the Pfizer-BioNTech batches, it would appear that the good was bad, the bad was very bad, and the very good was saline solution.

* * *

(The full Punkt.Preradovic interview with Gerald Dyker and Jörg Matysik is available here in German. The above translations are by your writer. A full, presumably machine-translated, English version of the interview is also available on the Punkt.Preradovic webpage.)

Robert Kogon is a pen name for a widely-published financial journalist, translator and researcher working in Europe. Subscribe to his Substack and follow him on Twitter.

https://www.zerohedge.com/covid-19/some-pfizer-vaccine-batches-eu-were-placebos-say-scientists