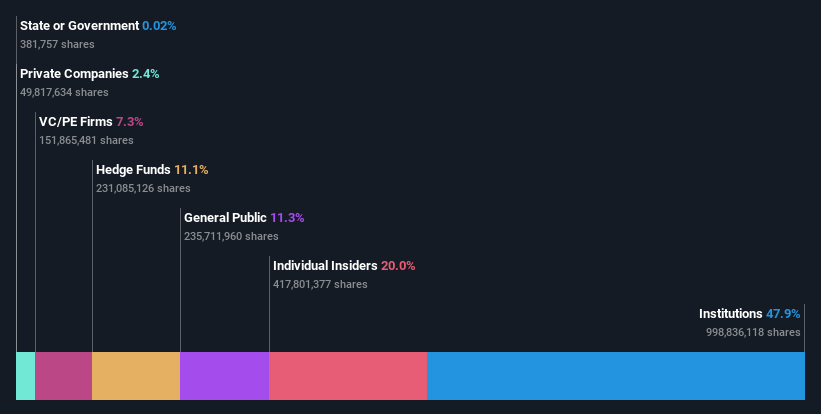

If you want to know who really controls Ginkgo Bioworks Holdings, Inc. (NYSE:DNA), then you'll have to look at the makeup of its share registry. And the group that holds the biggest piece of the pie are institutions with 48% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

And so it follows that institutional investors was the group most impacted after the company's market cap fell to US$3.3b last week after a 15% drop in the share price. This set of investors may especially be concerned about the current loss, which adds to a one-year loss of 39% for shareholders. Also referred to as "smart money", institutions have a lot of sway over how a stock's price moves. As a result, if the downtrend continues, institutions may face pressures to sell Ginkgo Bioworks Holdings, which might have negative implications on individual investors.

In the chart below, we zoom in on the different ownership groups of Ginkgo Bioworks Holdings.

See our latest analysis for Ginkgo Bioworks Holdings

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

As you can see, institutional investors have a fair amount of stake in Ginkgo Bioworks Holdings. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Ginkgo Bioworks Holdings, (below). Of course, keep in mind that there are other factors to consider, too.

Our data indicates that hedge funds own 11% of Ginkgo Bioworks Holdings. That's interesting, because hedge funds can be quite active and activist. Many look for medium term catalysts that will drive the share price higher. Baillie Gifford & Co. is currently the largest shareholder, with 12% of shares outstanding. Meanwhile, the second and third largest shareholders, hold 11% and 7.9%, of the shares outstanding, respectively. In addition, we found that Jason Kelly, the CEO has 4.4% of the shares allocated to their name.

We did some more digging and found that 7 of the top shareholders account for roughly 52% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders maintain a significant holding in Ginkgo Bioworks Holdings, Inc.. Insiders own US$668m worth of shares in the US$3.3b company. That's quite meaningful. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

The general public-- including retail investors -- own 11% stake in the company, and hence can't easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private equity firms hold a 7.3% stake in Ginkgo Bioworks Holdings. This suggests they can be influential in key policy decisions. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time they may look to sell and redeploy capital elsewhere.

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Ginkgo Bioworks Holdings , and understanding them should be part of your investment process.