Raised Full Year Revenue Guidance to a Range of 26% to 27%, including Total Omnipod of 29% to 30%

Search This Blog

Thursday, November 2, 2023

Israeli Army Has Gaza City Surrounded, But Hamas Tunnels Remain Serious Problem

Update(1555ET): IDF Spokesman Rear Adm. Daniel Hagari has said ground and tank forces have at this point surrounded Gaza City. "Our troops have completed the encirclement of Gaza City, the center of Hamas activity," he said in a late Thursday (local) press conference. The IDF has further announced the deaths of "130 terrorists" in the latest battles.

But Hamas' significant network of tunnels continues to plague IDF troops, given the ability for Hamas mounting successful ambushes from hidden holes in the ground, which the group has been keen to boast about, such as in the following...

Apple Slides After Revenues Drop For 4th Straight Quarter On Unexpectedly Large China Weakness

With all other megatech companies having already reported earnings - some good, some not so good - all eyes were on the results from the last giga-cap kahuna, the world's largest company, Apple and its $2.8+ trillion market cap. According to Bloomberg's Mark Gurman here are the biggest things to watch for in the earnings release:

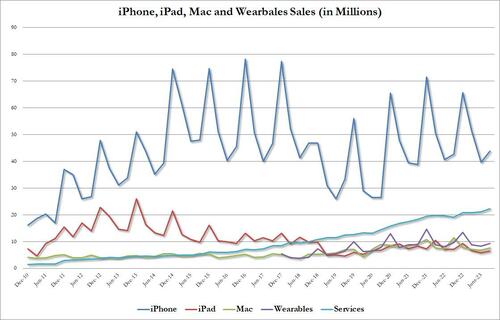

- iPhone sales, given that the quarter includes about a week or so of the new iPhone 15

- Greater China revenue, due to the concerns about consumers there buying iPhones in an expression of nationalism and a government ban on American-developed devices

- Wearables, given some slowdown in that category

- iPad and Mac revenue, given the projected double-digit decline there

Another notable item to watch is, if Apple crosses the $90.1 billion revenue threshold. That will be the difference between Apple returning to growth or seeing an annual revenue decline for the fourth quarter in a row.

One important item to note on the iPhone is that Apple is getting a favorable comparison this year. Last year’s iPhone 14 Pro line was stymied by Covid-related shutdowns at production facilities in China. So Apple wasn’t able to fulfill nearly enough demand in the quarter. That means the iPhone 15 Pro should easily show year over year growth, though we won’t get a complete picture until the end of January or early February when Q1 2024 numbers are announced.

In addition to the iPhone 15 line, Apple introduced slightly modified Apple Watches and AirPods during the quarter. But those are unlikely to truly move the needle for Apple.

With that in mind, this is what Apple just reported for its fiscal Q4:

- EPS $1.46 vs. $1.29 y/y, beating estimates of $1.39

- Revenue $89.50 billion, -0.7% y/y, and while it beat the estimate $89.35 billion, this was the 4th consecutive quarter of annual declines

- Products revenue $67.18 billion, -5.3% y/y, missing estimates of $67.82 billion

- IPhone revenue $43.81 billion, +2.8% y/y, just barely beating estimates of $43.73 billion

- Mac revenue $7.61 billion, -34% y/y, missing estimates of $8.76 billion

- IPad revenue $6.44 billion, -10% y/y, beating estimates of $6.12 billion

- Wearables, home and accessories $9.32 billion, -3.4% y/y, missing estimates of $9.41 billion

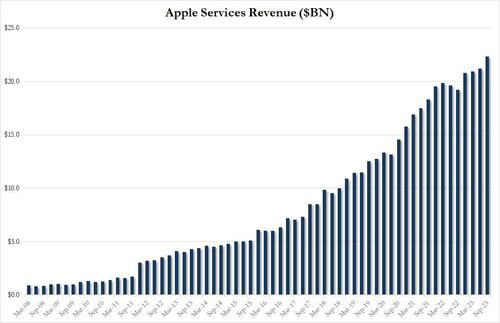

- Service revenue $22.31 billion, +16% y/y, beating estimates $21.37 billion

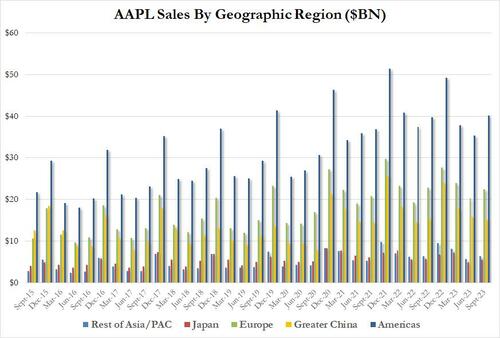

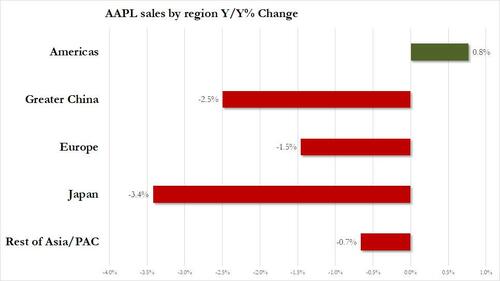

- Greater China rev. $15.08 billion, -2.5% y/y, badly missing estimates of $17.01 billion

- Gross margin $40.43 billion, +6.1% y/y, beating estimates of $39.79 billion

- Cost of sales $49.07 billion, -5.7% y/y, below the estimate of $49.62 billion

- Total operating expenses $13.46 billion, +1.9% y/y, below the estimate $13.6 billion

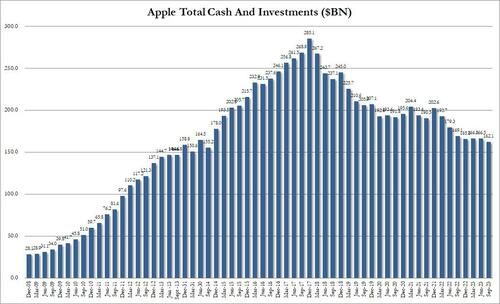

- Cash and cash equivalents $29.97 billion, +27% y/y, missing estimates of $31.77 billion

While the numbers were mixed, with revenue of almost $82 billion coming above expectations thanks to strong service revenue offsetting meh iPhone print and a miss on Products, Macs and wearables, what the market did not like (again) is that this was another quarter without revenue growth and the 4rd consecutive quarter of annual revenue declines: the first time for AAPL since 2001.

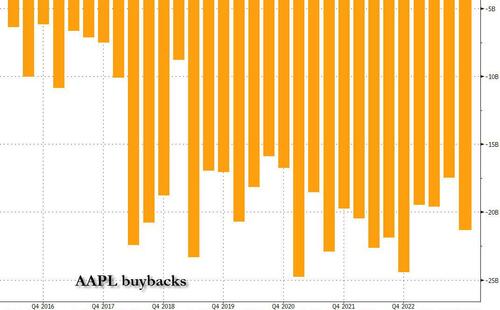

And while we wait for the company's soft guidance during the 5pm call, the company did not surprise the market with another generous shareholder payout unlike earlier this year when it unveiled an additional $90 billion stock repurchase (it did declare a cash dividend of 24 cents a share, payable Nov 16). in fact, buybacks of $21 billion were slightly below consensus and more than $3BN below the $24.4BN last quarter, and could be an area of concern.

Commenting on the quarter, CEO Tim Cook said that “we now have our strongest lineup of products ever heading into the holiday season, including the iPhone 15 lineup and our first carbon neutral Apple Watch models, a major milestone in our efforts to make all Apple products carbon neutral by 2030.”

Looking at the revenue breakdown, Apple missed across several product categories, while reporting an in line print in the all important iPhone segment:

- IPhone revenue $43.81 billion, up 2.8% y/y, and just barely beating estimates of $43.73 billion (unclear how much of the new iPhone model benefit is to be accounted for in the quarter which ended Sept 30 when the phone was released just day ahead of quarter end)

- Mac revenue $7.61 billion, -34% y/y, missing estimates of $8.76 billion

- IPad revenue $6.44 billion, -10% y/y, beating estimates of $6.12 billion

- Wearables, home and accessories $9.32 billion, -3.4% y/y, missing estimates of $9.41 billion

- Products revenue $67.18 billion, -5.3% y/y, missing estimates of $67.82 billion

As we noted last quarter, what markets may be concerned about is that AAPL appears to be reaching a "double top" in product revenue, and indeed with the exception of Services, almost every product class did slowdown from a year ago.

As Bloomberg notes, Apple’s computer division appears to be faltering at a time when the worst seems over for the PC industry at large. Other companies have said that the inventory that’s weighed on sales has been worked through and the industry is returning to a healthier environment.

One place where investors were clearly disappointed (unlike last quarter) was China sales, which at $15.08 billion, not only declined 2.5% but missed estimates of $17.01 billion.

While China lost ground in line with other regions in terms of the dollar amount it was down from a year ago, it was much lower than the consensus forecast which had called for revenue of $17 billion. This would indicate that the hoped-for return to spending by Chinese consumers isn’t yet materializing. Then again, most other regions were even worse on a percentage YoY basis.

The silver lining this quarter, as three months ago, was in the sold Services revenue, which at a time when products continue to slowdown, printed at a fresh record high of $22.31 billion, up 16% YoY, beating estimates of $21.4 billion and a reversal to last quarter's miss.

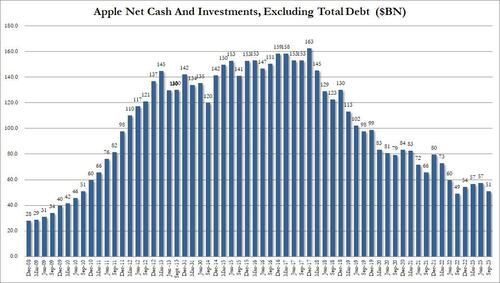

One final note: AAPL's cash - both gross and net - continues to shrink, which at a time when dividends are declining will also be frowned upon by traders. As shown below, gross cash is $162BN, the lowest since June 2014...

... while net cash of $51BN remains near the lowest since 2010.

Putting it all together:

- Revenue declined for a fourth quarter to $89.5 billion

- The company’s iPhone revenue topped estimates at $43.8 billion

- Services sales gained 16% to $22.3 billion

- Apple’s business in China fell short of estimates

As for the market, will it was not happy with what Apple reported, and after a brief kneejerk higher, the stock has since dipped about 1.5% from its close if in line with where it opened this morning.

The silver lining is that there wasn't a huge drop (nor surge), and thus Apple will probably not be the factor that determines if the recent year-end rally will continue. That means that we now have to wait for tomorrow's jobs report for the final verdict.

And now we turn to the earnings call where anything can be said (and happen) and we wouldn't be surprised if the stock reverses the entire drop as Tim Cook speaks...

Novo Nordisk says 80% of insured U.S. patients taking Wegovy pay less than $25 a month

on Thursday said 80% of U.S. patients with insurance coverage who take its highly popular weight loss treatment Wegovy are paying less than $25 a month for the drug.

The remarks suggest that many insured Americans don’t have to shoulder the full cost of a monthly package of Wegovy, which has a list price of around $1,350. It also comes as many U.S. health insurers balk at the extreme cost of Wegovy and other obesity drugs while dropping them from their plans, even as demand for those treatments soar nationwide and outpace supply.

But Doug Langa, Novo Nordisk’s vice president for North America, said on a third-quarter earnings call Thursday that most major health plans and pharmacy benefit managers are covering Wegovy.

Langa acknowledged that some employers are opting out of coverage, but noted that the company overall is seeing more insurers opt in to cover the weekly injection.

He estimated that about 50 million Americans with obesity could be eligible for Wegovy coverage under their health plans.

“Directionally, we’re heading in the right direction and our focus will be continuing on securing employer coverage as well as stronger access for Americans overall,” Langa said during the call.

However, the $25 out-of-pocket cost will likely add up over time. Most patients have to take Wegovy for several months to see – and sustain – significant weight loss.

Wegovy, for example, leads to 15% weight loss after 68 weeks, according to clinical trials on the drug.

The longer treatment duration is also one reason why some health insurers are hesitant to cover Wegovy and similar weight loss drugs, which typically work by mimicking a hormone produced in the gut to suppress a person’s appetite.

At roughly $1,000 per month on average for medications that are typically taken for months or even a year, the drugs are straining insurers’ budgets.

But Novo Nordisk is hoping that new data demonstrating the heart health benefits of Wegovy will put more pressure on insurers to cover the medication and similar weight loss treatments.

A recent late-stage trial found that Wegovy reduced the risk of cardiovascular events like heart attack and stroke by 20%. The results suggest that Wegovy and similar obesity and diabetes medications like those in development by Eli Lilly and others could have long-lasting health benefits beyond shedding unwanted pounds.

Novo Nordisk CFO Karsten Munk Knudsen told CNBC on Thursday that Wegovy could receive expanded approval from the U.S. Food and Drug Administration as a treatment for reducing the risk of cardiovascular disease within six months.

More than two in five adults have obesity, according to the National Institutes of Health.

About one in 11 adults have severe obesity.

https://www.cnbc.com/2023/11/02/wegovy-insured-patients-25-dollars-month.html

Dentsply Sirona guides lower

- Net sales of $947 million were flat year-over-year, organic sales decreased (0.3%)

- GAAP gross margin of 52.2%, GAAP net loss of ($266) million or ($1.25) per share

- Adjusted EBITDA margin of 18.2%, adjusted EPS of $0.49

- Revised FY23 outlook: organic sales growth of ~1% (from ~3%); adjusted EPS of $1.80 to $1.85 (from $1.92 to $2.02)

- Company expects to repurchase $150 million of its common stock in Q4 2023

Beyond Meat Slashes Outlook As Fake Meat Demand Falls

The implosion of Beyond Meat Inc. suggests that the plant-based meat trend might just be a fad. Consumers are now favoring real meat as the company issued a profit warning for the third quarter as demand for fake meat sags.

On Thursday, Beyond Meat slashed its revenue forecast for the year for the second time in months:

Year Forcast

Sees net revenue $330 million to $340 million, saw $360m to $380m, estimate $366 million (Bloomberg Consensus)

Still sees operating expenses up to $245 million, estimate $239.9 million

Still sees capital expenditure $10 million to $15 million, estimate $21.7 million

The plant-based food company expects revenue of about $75 million for the third quarter, well below $88.5 million Bloomberg Consensus.

Preliminary Third Quarter Results

3Q Prelim Rev About $75M, Est. $88.5M

3Q Prelim FCF $7.6M, Est. $12.4m

Doesn't Expect to Sustain Positive FCF in 4Q, Est. -$24.9m

The company's net revenues for the third quarter were primarily affected by:

Decreased sales volumes in U.S. retail and foodservice channels, largely due to continued and increased weakness in the plant-based meat category

Less effective promotions, worsened by fixed-fee promotional programs that failed to boost sales as expected

A shift in product sales mix towards lower sales of core products like Beyond Burger, Beyond Beef, and Beyond Sausage, compared to certain non-core products such as Beyond Steak, Beyond Chicken Tenders, Beyond Popcorn Chicken, and Beyond Chicken Nuggets.

The struggling plant-based food company also said its global operations are 'under review' as it cuts 19% of its global non-production workforce after growth failed to materialize.

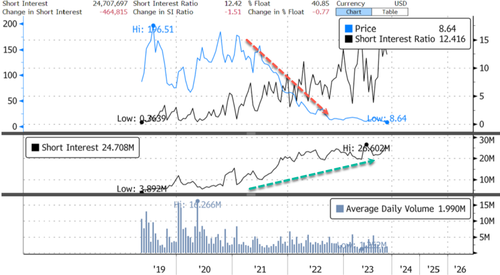

Even with today's dismal report, the company's shares unexpectedly jumped 9% in the early cash session. This surge is likely attributable to a substantial short position. About 40% of the float, or 24.7 million shares, are short.

Just a fad.

This is yet more proof Americans don't want to eat fake meat, nevertheless insects.

https://www.zerohedge.com/markets/beyond-meat-slashes-outlook-fake-meat-demand-falls

Putin revokes Russian ratification of global nuclear test ban treaty

President Vladimir Putin on Thursday signed a law withdrawing Russia's ratification of the global treaty banning nuclear weapons tests, a step condemned by the organisation which promotes adherence to the landmark arms control pact.

The move, though expected, is evidence of the deep chill between the United States and Russia, whose ties are at their lowest level since the 1962 Cuban missile crisis over the war in Ukraine and what Moscow casts as Washington's attempts to stymie the emergence of a new multipolar world order.

Washington expressed deep concern about Russia's decision and it was a step in the wrong direction.

"Russia's action will only serve to set back confidence in the international arms control regime," U.S. Secretary of State Antony Blinken said in a statement.

Moscow says its deratification of the Comprehensive Nuclear Test Ban Treaty (CTBT) is merely designed to bring Russia into line with the United States, which signed but never ratified the treaty. Russia will not resume nuclear testing unless Washington does, say Russian diplomats.

Nor, they say, will the move change the nuclear posture of Russia, which has the world's largest nuclear arsenal, or the way it shares information about its nuclear activities as Moscow will remain a treaty signatory.

But some Western arms control experts are concerned that Russia may be inching towards a nuclear test to intimidate and evoke fear amid the Ukraine war.

Putin said on Oct. 5 that he was not ready to say whether or not Russia should resume nuclear testing after calls from some Russian security experts and lawmakers to test a nuclear bomb as a warning to the West.

Such a move, if it did happen, could usher in a new era of big power nuclear testing.

Robert Floyd, head of the Comprehensive Nuclear-Test-Ban-Treaty Organization, whose job is to promote recognition of the treaty and build up its verification regime to ensure no nuclear tests go undetected, condemned Russia's step.

'DEEPLY REGRETTABLE'

"Today’s decision by the Russian Federation to revoke its ratification of the Comprehensive Nuclear-Test-Ban Treaty is very disappointing and deeply regrettable," Floyd, who had tried to lobby senior Russian officials to get them to change their mind, said on X, formerly known as Twitter.

The treaty established a global network of observation posts that can detect the sound, shockwaves or radioactive fallout from a nuclear explosion.

Post-Soviet Russia has not carried out a nuclear test. The Soviet Union last tested in 1990 and the United States in 1992. No country except North Korea has conducted a test involving a nuclear explosion this century.

Andrey Baklitskiy, senior researcher at the United Nations Institute for Disarmament Research, has said Russia's deratification of the CTBT is part of a "slippery slope" towards resuming testing.

It is part of a disturbing trend in recent years that has seen arms control pacts scrapped or suspended, he said last month on X.

"We don’t know what steps will follow and when, but we know where this road ends. And we don’t want to go there," he said.

Putin's approval of the de-ratification law was posted on a government website which said the decision took immediate effect. Russia's parliament has already approved the step.

https://news.yahoo.com/putin-revokes-russias-ratification-nuclear-095456691.html