XOMA Corporation (Nasdaq: XOMA), the biotech royalty aggregator, today announced its Board of Directors has authorized XOMA’s first stock repurchase program, which permits the Company to purchase up to $50 million of XOMA’s common stock through January 2027.

Search This Blog

Tuesday, January 2, 2024

ImmunityBio in $210M royalty deal to get cancer drug to market

ImmunityBio has traded future profits for cash to kick off commercialization of its near-approval cancer drug candidate. Oberland Capital took the other side of the deal, handing the biotech $210 million, with more to follow, in return for quarterly royalty payments on global net sales.

California-based ImmunityBio spent most of last year trying to recover from the FDA’s rejection of a filing for approval of Anktiva, an IL-15 superagonist fusion protein, in non-muscle invasive bladder cancer. The setback, which the biotech blamed on contract manufacturing organizations, left ImmunityBio racing to refile while trying to bolster a bank balance that had dwindled to $43.5 million by the end of June.

ImmunityBio made progress on both fronts over the second half of 2023, securing a new FDA approval decision date and fresh financing from its founder Patrick Soon-Shiong. Days before the end of the year, the biotech finalized the deal with Oberland to further strengthen its near-term financial position.

Oberland has paid an initial $200 million for the right to receive tiered payments ranging from 3% to 7%. If the FDA approves Anktiva, Oberland will pay ImmunityBio a further $100 million in return for a higher royalty rate range, 4.5% to 10%. Oberland has also taken a $10 million equity stake in ImmunityBio and has an option to buy another $10 million in stock down the line.

The investor has secured terms that position it to generate a return on the investment. On the twelfth anniversary of the deal, ImmunityBio will pay whatever is needed to bring Oberland’s return up to 195%, unless the royalties have already reached that threshold. Oberland also has an option to end the deal early in various situations, including bankruptcy, and request a return ranging from 120% to 195%.

ImmunityBio’s agreement with those terms has secured its near-term financial future. The money adds to the $178 million the biotech had (PDF) in cash and equivalents at the end of September. Armed with the resources, ImmunityBio will ramp up commercialization work ahead of the anticipated FDA approval of Anktiva by April 23 and run clinical trials to expand use of the molecule into other solid tumors.

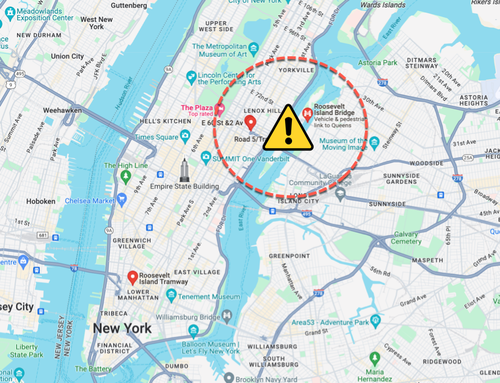

FDNY Responds To Report Of 'Small Explosions' Shaking Roosevelt Island

Firefighters were called to the 580 block of Main Street, located south of the Roosevelt Island Bridge & Tram, at approximately 0600 ET, in response to reports of multiple explosions and building shaking, the New York City Fire Department told MailOnline.

Roosevelt Island residents were jolted awake this morning by at least "three instances of a boom and a shake," with the third vibration "felt further away."

According to ABC7 New York, "Buildings at 2 and 4 River Road just south of the Roosevelt Island Bridge and Tram were experiencing power outages, indicating that the noise could have been electrical."

*Developing...

https://www.zerohedge.com/markets/fdny-responds-report-small-explosions-shaking-roosevelt-island

Anavex: Insignificant improvement in treatment from placebo in Rett

In an ad-hoc analysis, using the predefined mixed-effect model for repeated measure (MMRM) method, after 12 weeks of treatment, ANAVEX®2-73-treated patients improved LS Mean (SE) -12.93 (2.150) points on their RSBQ total score compared to LS Mean (SE) -8.32 (2.537) points in placebo-treated patients. The LS Mean difference (SE) of -4.61 (2.439) points between treated and placebo groups did not reach statistical significance (n=77; p=0.063). ANAVEX®2-73-treated patients demonstrated a rapid onset of action with improvements at 4 weeks after treatment with a RSBQ total score LS Mean (SE) -10.32 (2.086) points in the drug-treated group compared to a LS Mean (SE) -5.67 (2.413) points in placebo-treated patients. The LS Mean difference of -4.65 (2.233) points between treated and placebo groups was statistically significant (n=77; p=0.041).

Cardio Diagnostics AI-Powered Coronary Heart Disease Detection Test Gets Reimbursement Code

Cardio Diagnostics Holdings, Inc. (Nasdaq: CDIO), an AI-driven precision cardiovascular medicine company, today announced that the American Medical Association (AMA) has assigned a dedicated Current Procedural Terminology (CPT®) Proprietary Laboratory Analysis (PLA), 0440U, for the company’s AI-driven coronary heart disease (CHD) detection test, PrecisionCHD. Receipt of this new CPT PLA code, which will be effective on April 1, 2024, is a significant step toward payer billing and payment, facilitating broader adoption of the first and only integrated genetic-epigenetic diagnostic blood test for CHD.

Novartis signs gene therapy deal with Voyager for $100 mln upfront

Voyager Therapeutics said on Tuesday Swiss-based drugmaker Novartis would pay $100 million upfront as part of a licensing deal to develop gene therapy candidates for genetic disorders.

Voyager, whose shares jumped more than 30% in premarket trading, would be eligible to receive up to $1.2 billion on achieving certain milestones.

The gene therapy developer would provide Novartis access to its RNA-based screening platform — which helps in rapid discovery of experimental gene therapies — and would also be eligible for tiered royalties on global sales of products developed using the platform.

The companies would collaborate to develop a pre-clinical gene therapy candidate for Huntington's disease (HD), an inherited condition that causes nerve cells in parts of the brain to gradually break down and die.

Voyager would advance the pre-clinical development and Novartis would be responsible for all clinical studies and commercialization for the HD candidate.

Novartis would also gain access to Voyager's platform for discovery and development of potential gene therapies for treating spinal muscular atrophy, a group of rare genetic disorders which affect the nerve cells and cause muscle wasting and weakness.

Novartis had previously exercised an option to license novel capsids or gene therapy delivery vehicles generated from Voyager's drug discovery platform as a potential treatment for two undisclosed neurological conditions.

Separately, Voyager is developing an investigational gene therapy to treat a neurological disease, amyotrophic lateral sclerosis (ALS), and an antibody for the Alzheimer's disease.

https://finance.yahoo.com/news/1-novartis-signs-gene-therapy-123624857.html

AstraZeneca, Sanofi RSV infant shots approved in China

AstraZeneca said on Tuesday that its respiratory syncytial virus (RSV) immunization for infants developed with Sanofi has got approval in China.

The drug makers co-developed the RSV shot for infants and toddlers called Beyfortus, which has already been approved for use in the European Union and United States.

Beyfortus is expected to be available in China during the upcoming 2024-2025 RSV season, the London-listed drug maker said in a statement.

RSV, a highly contagious seasonal virus known for cold-like symptoms, is a leading cause of hospitalisation in both infants and the elderly.

Regulatory applications for the drug are currently under review in Japan and several other countries, the company added.

https://news.yahoo.com/astrazeneca-sanofis-rsv-infant-shots-071256026.html