by Larry Kudlow via RealClearPolitics.com,

Forget the Biden circus — the real headline story today is a pro-growth, “America First” Trump platform a week ahead of the Milwaukee convention.

At the moment, the major press frenzy is whether President Biden is going to drop out of the race. For what it’s worth, I don’t think he will.

In Mr. Biden’s words, “The Lord almighty is not coming.” Let me add: you can bet on that.

All this Biden speculation, though, should not be permitted to obscure the fact that the Republican National Committee, a week ahead of the Milwaukee convention, has just adopted and released President Trump’s 2024 Republican Party platform.

This is today’s real headline story. The platform carries the same kind of message that Trump has been successfully talking about for the last several years.

It’s pro-growth and pro-opportunity, aims to close the southern border and restore an “America First” standing in the world. Peace through strength.

The document is short, pithy, and right to the point.

Some of the highlights include worker tax cuts and no tax on tips. Stopping Bidenflation. Restoring energy dominance. Ending unfair trade deals.

Keeping the dollar as the world’s reserve currency — this is especially important for high growth and low prices — Wall Street, will you finally listen?

Restoring America’s status as the dominant world energy producer and canceling the electric vehicle mandate. Cutting all costly and burdensome regulations.

Sealing the border, stopping the illegal migrant invasion, and deporting illegals.

Keeping men out of women’s sports, and radical, racial, and sexual woke policies out of schools.

The platform also states, and I quote, “unite our country by bringing it to new and record levels of success.”

These are the message points that have proved so popular on the campaign trail.

These are exactly the themes that Trump has used to organize a working-class coalition of Black Americans, Hispanics, Asians, young people, and women.

These were policies to successfully build on Trump’s first term as President. Policies that Art Laffer, has called one of the best policies of any first term president.

Tax cuts, deregulation, energy independence, superb Supreme Court picks, good trade deals, strong national security — including the Abraham Accords.

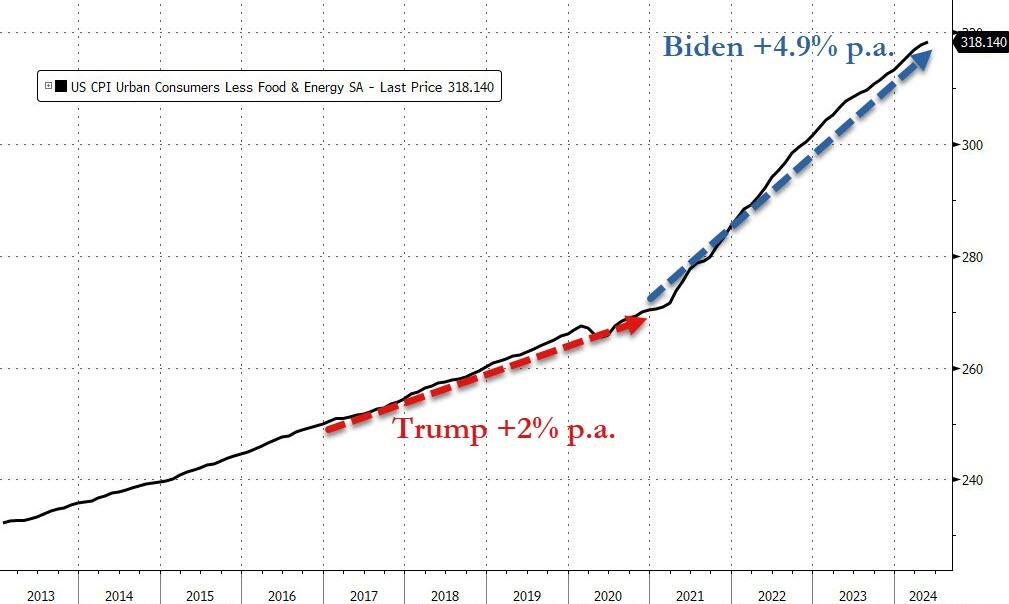

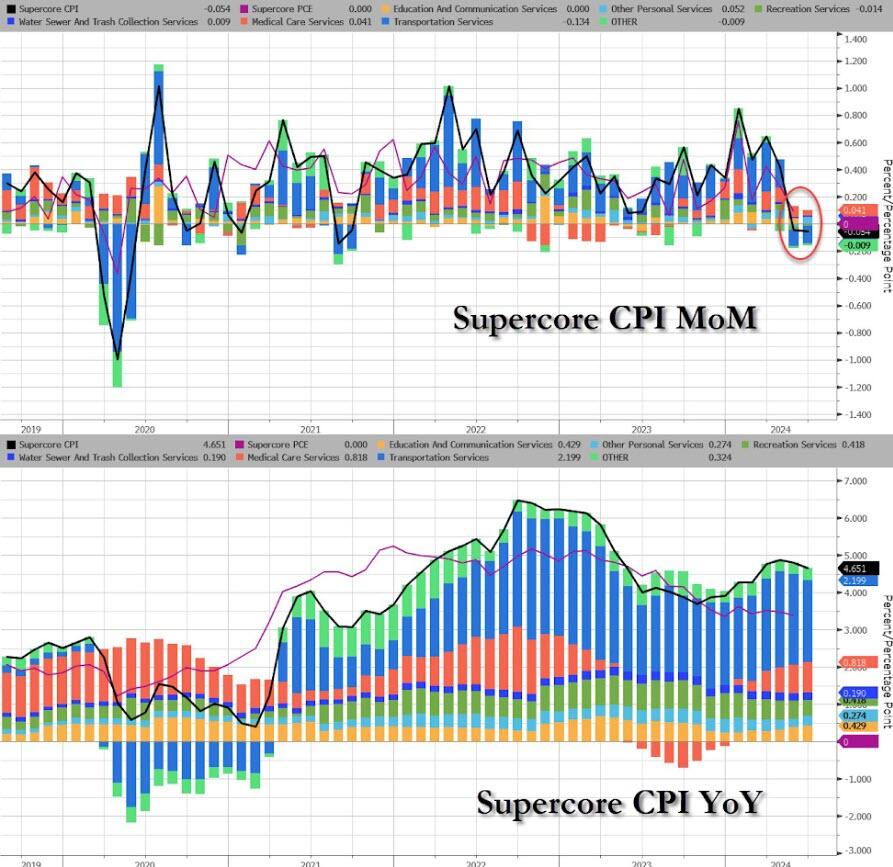

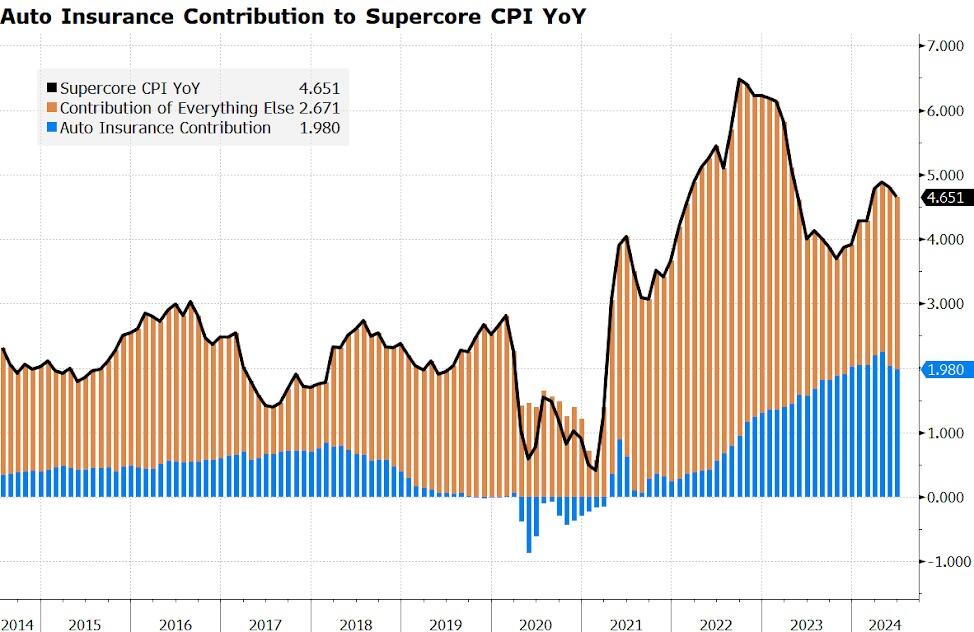

Today, amid 20 percent Bidenflation, we have an affordability crisis with falling real wages and high mortgage and credit card borrowing costs, the nationwide crime and public safety ravages of Mr. Biden’s illegal immigration catastrophe, and raging fires overseas — most folks know that they were better off four or five years ago.

That’s Trump’s message. Success is the best uniter.

https://www.zerohedge.com/markets/kudlow-trumps-pro-growth-america-first-platform