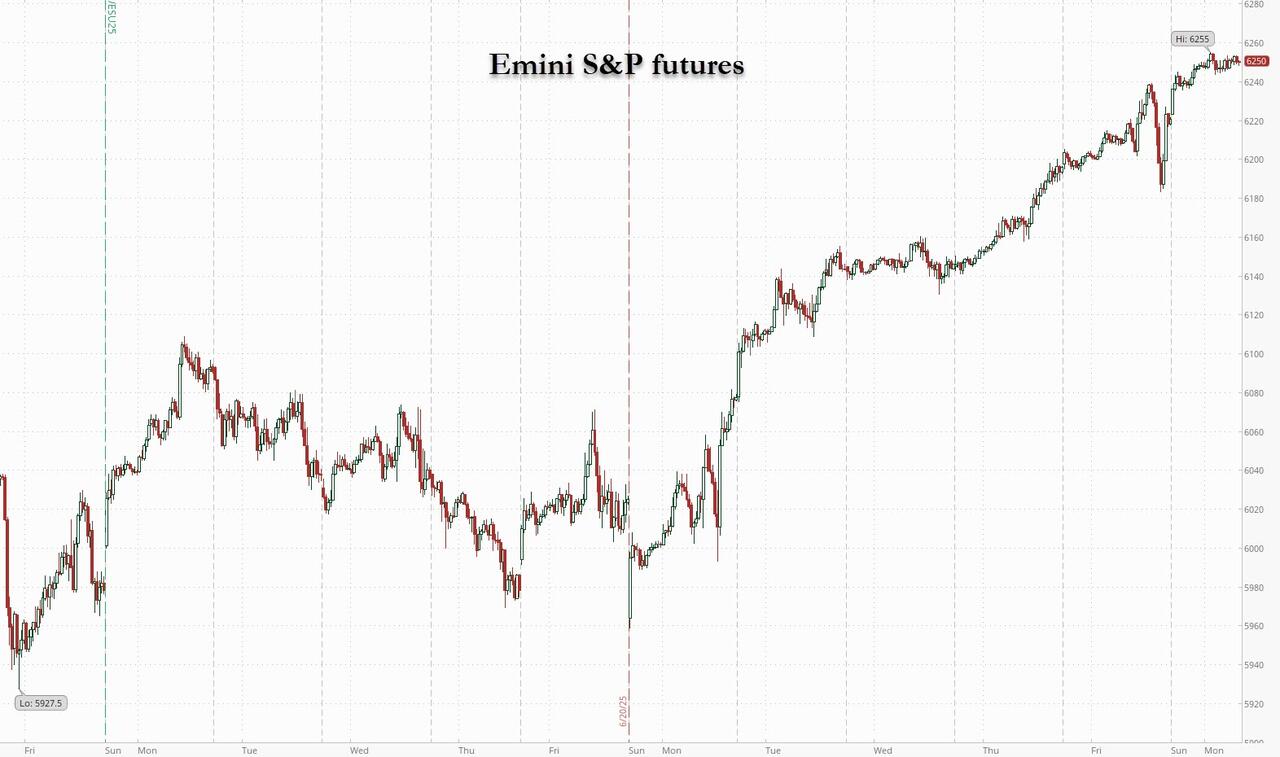

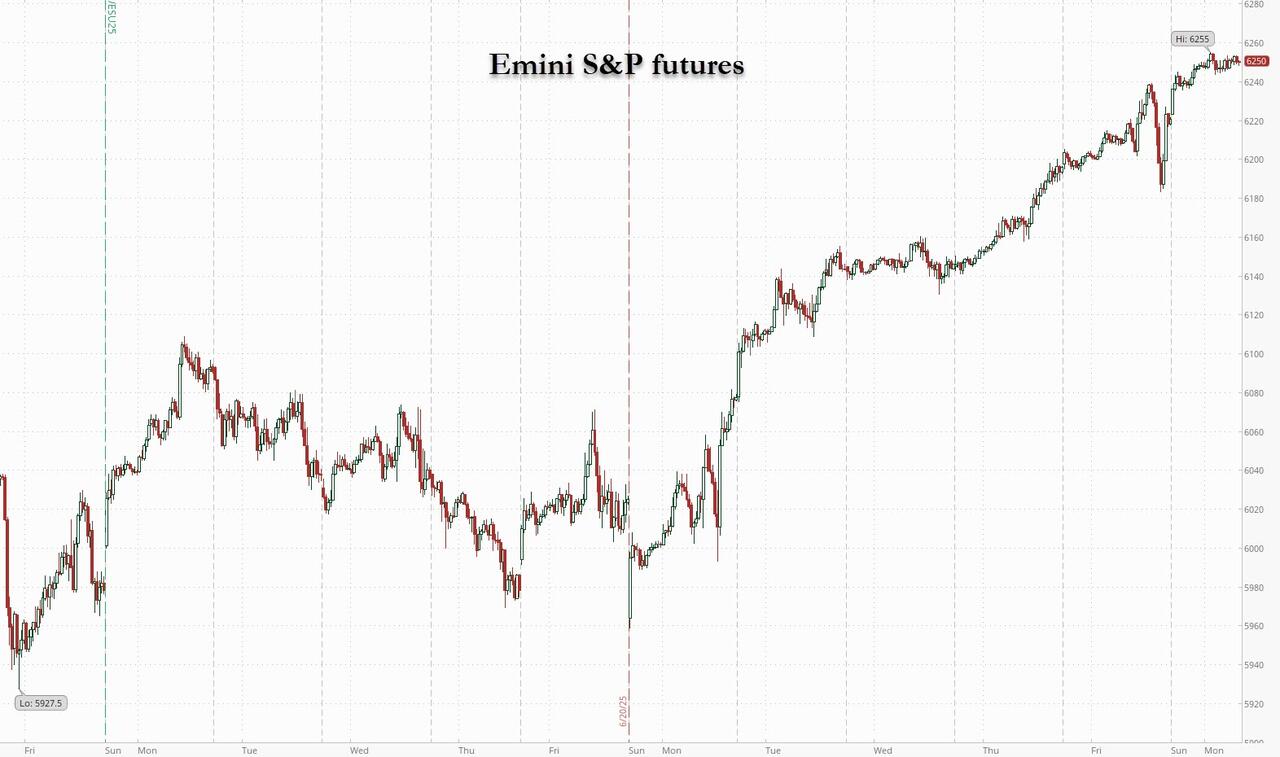

S&P 500 futures pushed deeper into record territory as progress in trade negotiations aids sentiment following Friday’s record high close for cash index, the first since February. As of 8:00am ET, S&P futures are up 0.4% on positive trade headlines, including US/Canada, US/EU, US/India, and US/Taiwan (on Friday, the US/Canada flare up limited gains late in the session, with Canada reversing just two days later and agreeing to withdrew its digital services tax on US tech companies to restart talks). Nasdaq futures gain 0.6% amid a continued meltup in AI names and the most shorted basket; tech stocks lead in premarket trading, with Mag7/semis producing early strength, banks higher on de-reg, with Industrials also pushing Cyclicals over Defensives. Major European markets are all lower with France leading and Spain lagging, while the Asian session saw Japan leading and HK lagging given weakness in HSTECH. Besides the Canadian U-turn, French Finance Minister Lombard said hes optimistic about securing a EU/US trade deal before the July 9th deadline; India’s trade team extended their stay in the US to work on a deal. Outside of trade, focus for the week will be on quarter-end today, Powell speaking and ISM Manf on Tuesday and Payrolls on Thursday, along with negotiations over Trump’s “One Big Beautiful Bill.” Yields are lower with the very front-end selling off while 10Y yields are down 2bps to 4.25%. Month-end bond index rebalancing at 4pm New York time has potential to drive buying by passive investors. The USD starts the week lower. Commodities are mixed with Energy weaker, precious higher, and Ags mixed. Today’s macro data focus is Chicago PMIs (9:45am), Dallas Fed Manf (10:30am), Fed’s Bostic (10am), Goolsbee (1pm); markets await jobs data over the next 3 sessions.

In premarket trading, Tesla is the only stock among Magnificent 7 companies falling, down 0.8%, as President Trump’s landmark budget bill passed a key senate hurdle over the weekend. The bill cuts electric vehicle and other clean energy credits. Other Mag7 names are all higher (Amazon +0.6%, Meta +1.9%, Apple +0.8%, Nvidia +0.7%, Alphabet +1.2%, Microsoft +0.6%).

- Circle Internet Group (CRCL) falls 4% after JPMorgan — a lead in its successful IPO this month — starts coverage with an underweight recommendation due a valuation pushed beyond the broker’s “comfort zone.”

- Disney (DIS) climbs 2% after Jefferies upgraded it’s rating to buy, with the broker now seeing limited risk for a slowdown for its key parks division in 2H 2025.

- Goldman Sachs Group (GS) rises about 2%, gaining with other US banks after the industry’s biggest names comfortably cleared the Federal Reserve’s annual stress test late Friday, setting the stage for lenders to boost buybacks and dividends for shareholders. Wells Fargo (WFC) +2%; Bank of America (BAC) +1%

- Juniper Networks (JNPR) gains 8.4% and HP Enterprise (HPE) rises 8% after the Justice Department settled its lawsuit challenging Hewlett Packard Enterprise’s $13 billion takeover of Juniper Networks, less than two weeks before a trial was set to start, clearing a key hurdle for the takeover.

- Moderna Inc. (MRNA) climbs 5% after saying its experimental flu shot met its goal in a late-stage trial, clearing the path for its broader strategy of selling combination vaccines.

- The de-escalation in the conflict between Israel and Iran, combined with data highlighting the US economy’s resilience, propelled the S&P 500 to a record high last week, marking a stunning rebound from April’s tariff-induced rout. Subdued inflation is also strengthening market expectations for interest-rate cuts, even as the Federal Reserve maintains a cautious stance.

Sure enough, US futures continue to climb on positive trade developments ahead of the July 9th deadline; Canada withdrew digital service tax on tech firms to restart talks w/ US, France’s finance minister said EU can reach some form of agreement before July 9th deadline, India’s team extended their stay in the US to work on a deal, Taiwan noted constructive progress, although Japan talks reportedly stalled over auto tariffs. With Trump’s July 9 trade deadline fast approaching, officials say negotiations with major partners such as China and the European Union are making progress. Talks with Canada are back on track after the country withdrew a digital services tax, while India’s trade team extended their stay in Washington to iron out differences.

“There is room for further investments in stocks. However, let us not forget that the tariffs will bring a stagflation risk on the US economy,” said Fabien Benchetrit, head of target allocation for France and southern Europe at BNP Paribas Asset Management. “Looking at all the positioning indicators at my disposal, I can not exclude a melt-up.”

Elsewhere, Trump’s One Big Beautiful Bill Act starts a Senate debate/vote this morning with the goal still for a passage by July 4th, after passing a key procedural block by a narrow margin over the weekend. Negotiations are continuing as Republicans seek to convince holdouts to support it for final passage. The nonpartisan Congressional Budget Office estimates the measure would add nearly $3.3 trillion to US deficits over a decade, weighing on the greenback.

Momentum trades persisted not only in stonks, but also in FX, and the dollar resumed its decline, falling as much as 0.4% against a basket of currencies to trade near three-year lows. The Bloomberg dollar index is down almost 9% for the year, its worst first half since the gauge’s inception in 2005.

“The US dollar remains under cyclical downward pressure, driven by ongoing uncertainties surrounding US fiscal and trade policies,” noted Lloyd Chan, a strategist at Mitsubishi UFJ Financial Group. “One key driver that could further hurt the US dollar is the potential surge in fiscal debt stemming from President Trump’s one big beautiful bill.”

In Asia, the Taiwan dollar plunged more than 2% against the greenback. The sudden move in late trading followed a pattern seen on Friday, fueling speculation the central bank intervened to curb strength in the currency.

Investors are looking to upcoming data, including the monthly payrolls report, to assess the strength of the economy and the outlook for interest rates, with swap traders pricing in at least two quarter-points of Fed easing this year. The employment data “will be watched closely for any signs that the US economy is reaccelerating or slowing more than anticipated,” said Daniel Murray, chief executive officer of EFG Asset Management. “If the latter, then the Fed would be expected to cut rates earlier, although it would be more concerning from the corporate side of things.”

European stocks erase early gains as the Stoxx 600 declines 0.2% with auto, bank and mining shares leading the broader market lower. Here are the most notable movers:

- Serica Energy shares jump as much as 7.9% as it prepares to restart production on the Triton floating production, storage and offloading vessel in the UK North Sea after completing work on the project.

- Kardex shares rise as much as 8% to trade at their highest level in over four months after being upgraded by Kepler Cheuvreux.

- Real estate gains, and is the best-performing sector in Europe, as Deutsche Bank upgrades several names and says it favors commercial real estate over residential.

- STMicroelectronics and Infineon shares gain as both stocks are placed on positive catalyst watch at JPMorgan.

- Renewable energy stocks including Vestas and Orsted drop as the Senate’s latest version of President Donald Trump’s spending package looks to phase out key tax incentives for US wind and solar projects more aggressively.

- Forbo shares drop as much as 5.2%, the most in over six weeks, after announcing its Chief Financial Officer and interim Chief Executive Andreas Jaeger will be leaving the floor covering and adhesive manufacturer in the fourth quarter of 2025.

- Croda shares drop as much as 4.3% on Monday after Kepler Cheuvreux initiated coverage of the UK-based chemicals supplier with a reduce recommendation.

- Galderma shares fall as much as 4.5%, the most in over two months, as UBS cut the stock to neutral from buy following its recent strong performance. Broker sees limited upside ahead.

- Man Group shares fall as much as 3.6%, the most since mid-April, after Peel Hunt downgrades the investment management firm’s stock to add from buy, citing the performance of its AHL funds in the current market environment.

- WH Smith shares drop as much as 8.3%, the most in 14 months, after the retailer completed the sale of its high street business, but under revised terms that will see lower gross proceeds flow into its accounts.

- TT Electronics shares drop as much as 7.7%, pulling back from a six-month high, after the electronics company reported a drop in sales during the first five months of the year ahead of its annual general meeting later today.

Earlier in the session, Asian stocks edged lower, reversing early gains, as losses widened in Hong Kong and Taiwan in late trading. Tech shares weighed on the regional benchmark after making advances last week. The MSCI Asia Pacific Index erased an increase of as much as 0.4% to trade 0.2% lower, with TSMC, Tencent and Alibaba the biggest drags. Gauges in India and the Philippines also fall, while those in Japan, South Korea and Australia closed higher. Tech firms listed in Hong Kong mostly traded lower as investors took some money off the table ahead of a deadline for trade talks with the US next week. Shares fell more than 1% in Taiwan amid equity outflows and as the local currency slumped in a sudden move toward the end of trading.

In rates, treasury futures advance in early US session, outperforming European bonds gaining on UK GDP and regional German CPI data. Yields are 2bp-3bp richer across tenors with curve spreads little changed; 10-year TSY near 4.25% is about 2.5bp richer on the day and about 1bp better vs bunds and gilts in the sector. Month-end bond index rebalancing is projected to increase duration of Bloomberg Treasury index by 0.07 year. Bunds gain, having benefited from state inflation readings that point to the national rate coming in slightly below the consensus later on Monday. Italian CPI also rose less than expected. German 10-year borrowing costs fall 1 bp to 2.58%.

In FX, the Bloomberg Dollar Spot Index falls 0.2% while the yen take top spot among the G-10 currencies, rising 0.3% against the greenback. The pound is the weakest with a 0.1% fall.

In commodities, oil slightly lower following headlines of a potential sizeable OPEC+ production increase on Friday, with the meeting set for this weekend. CTA models are now firmly for sale in oil—nearly $10bn in selling expected over the week across Brent and WTI. WTI trades down 0.3% to around $65 a barrel. Energy remains a funding short. Spot gold climbs $10 to around $3,285/oz.

Looking at today's calendar, the US data slate includes June MNI Chicago PMI (9:45am, several minutes earlier for subscribers) and Dallas Fed manufacturing activity (10:30am). Ahead this week are ISM manufacturing, JOLTS, ADP employment and June employment report — on Thursday ahead of July 4 holiday. Fed speakers include Bostic (10am) and Goolsbee (1pm). Tuesday, Fed Chair Powell participates on a policy panel in Sintra with BOE Governor Andrew Bailey, ECB President Christine Lagarde, BOJ Governor Kazuo Ueda and Bank of Korea Governor Chang Yong Rhee.

Market Snapshot

- S&P 500 mini +0.4%

- Nasdaq 100 mini +0.6%

- Russell 2000 mini +0.5%

- Stoxx Europe 600 -0.2%

- DAX little changed

- CAC 40 little changed

- 10-year Treasury yield -3 basis points at 4.25%

- VIX +0.8 points at 17.07

- Bloomberg Dollar Index -0.2% at 1193.38

- euro +0.1% at $1.1732

- WTI crude little changed at $65.5/barrel

Top Overnight News

- Trump’s $4.5 trillion tax-cut bill faces a marathon voting session on dozens of amendments in the Senate today. It faces opposition from around eight Republican senators. The CBO estimates the proposal would add $3.3 trillion to US deficits over the next decade. BBG

- Congressional Budget Office said the Senate version of the Trump tax bill will add USD 3.3tln to US debt over the next decade: BBG

- Elon Musk posted on X that the latest Senate draft bill will destroy millions of jobs in America and cause immediate strategic harm to the country, while he added it is utterly insane and destructive, as well as gives out handouts to industries of the past while severely damaging industries of the future.

- Fox's Pergram says "Senate not expected to begin vote-a-rama until 9 am et on Big, Beautiful Bill. Most vote-a-ramas run 9 to 15 hours. House not expected to vote until Wednesday at the earliest": Fox

- Canada has scrapped a digital services tax that targeted US technology companies, in an effort to smooth trade negotiations with its neighbor after Trump described the levy as a “direct and blatant” attach. FT

- OpenAI is starting to utilize some of Google’s proprietary AI chips to power ChatGPT and other products, the first time it has used non-Nvidia silicon in a meaningful way (OpenAI hopes the Google chips will help reduce costs). The Information

- China’s NBS PMIs for June come in a bit ahead of expectations, including manufacturing at 49.7 (up from 49.5 in May and above the Street at 49.6) and non-manufacturing at 50.5 (up from 50.3 in May and above the Street at 50.3). WSJ

- Trump floated the idea of keeping 25% tariffs on Japan’s cars as talks between the two nations continued with little more than a week to go before a slew of higher duties are set to kick in if a trade deal isn’t reached.

- South Korea sees the need for trade negotiations with the US to continue past next week’s deadline as Seoul continues to seek exemptions from US tariffs including duties affecting the auto and steel industries. BBG

- Ukraine said Russia fired a record 537 missiles and drones yesterday, targeting seven regions. Meanwhile, Vladimir Putin expanded the range of information covered by a state secrecy law. BBG

- France’s finance minister said the EU can clinch some form of trade agreement with the US before a July 9 deadline. BBG

- Iran said it doubts the US-brokered ceasefire with Israel will last, and warned of a firm response to any aggression. Meanwhile, an intercepted call showed Tehran felt the strikes on its nuclear program were less damaging than expected. BBG, WaPo

Trade/Tariffs

- US President Trump announced on Friday that the US is stopping trade talks with Canada due to the latter putting a digital services tax on US tech companies. However, it was reported a few days later that Canada rescinded the Digital Services Tax to advance broader trade negotiations with the US, while PM Carney and US President Trump agreed that parties will resume negotiations with a view towards agreeing on a deal by July 21st.

- US President Trump said in an interview with Fox Business News, which aired on Sunday, that Japan takes in no American cars and its vehicles should be subject to a 25% auto tariff in the US.

- UK government said the UK-US trade deal has today come into force, slashing US export tariffs for the UK's automotive and aerospace sectors, while it added that UK car manufacturers can now export to the US under a reduced 10% tariff quota and that 10% tariffs on goods like aircraft engines and aircraft parts are removed with a commitment to maintain them at 0%.

- Canada acted to support its steel producers and workers in which it set new tariff rate quotas for steel mill product imports from non-FTA partners.

- China Customs said it resumed imports of qualified aquatic products from some Japanese regions.

- Indonesia is to ease import restrictions on some goods including forestry products, plastic materials and some fertilisers, while it offered the US to jointly invest in the Brownfield Project of critical minerals in Indonesia as part of tariff talks.

- Bank for International Settlements said the global economy and financial system have entered a new era of heightened uncertainty, while it added that rising protectionism and trade fragmentation are particularly concerning.

- EU Competition Commissioner Ribera say, on a EU-US deal, “We will not compromise … around sovereignty and around regulation on how to work in our own market,”, via Politico citing excerpts from The Capitol Forum.

- Japan's Tariff negotiator says they will continue working with the US to reach a tariff agreement, while defending national interests. Continuation of 25% auto tariffs would cause significant damage.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week mostly in the green following last Friday's record highs on Wall St but with some of the gains capped heading into month-end and as participants digested a slew of data including somewhat mixed Chinese PMIs. ASX 200 edged higher with strength in the defensive sectors but with upside limited by data including softer-than- expected private sector credit. Nikkei 225 outperformed despite disappointing Industrial Production data which showed a surprise Y/Y contraction and with the index also unfazed by recent comments from US President Trump who noted that Japanese vehicles should be subject to a 25% auto tariff in the US. Hang Seng and Shanghai Comp were mixed following the latest PMI data which showed headline Manufacturing PMI remained in contraction territory, as expected, although Non-Manufacturing PMI accelerated at a faster pace than forecast.

Top Asian News

- US officials are drawing up plans for US President Trump’s state visit to China later this year with a delegation of dozens of CEOs, according to Nikkei.

- US President Trump said they have a buyer for TikTok and that it is a group of very wealthy people.

- Canada’s Industry Minister ordered Hikvision (002415 CH) to cease all operations and close its business in the country after a national security review.

- Japanese government official said regarding factory output that sentiment among manufacturers is worsening over uncertainties in the production environment and the number of firms concerned about the impact of US tariffs on production and shipments slightly increased in May from April.

European bourses kicked off the first trading session of the week with modest gains following the upside on Wall Street, in which the sentiment reverberated into APAC markets before reaching Europe; Stoxx 600 +0.1%. However, gains are modest and benchmarks are gradually dipping into the red with traders cognisant of the looming July 9th reciprocal deadline. Sectors opened firmer with just Energy in the red, though the picture since has become more mixed but with the breadth of price action narrow. Focus on reports that US tariff policies coupled with low river levels are causing the worst supply chain congestion since COVID, according to FT. Issues at the ports of Rotterdam, Antwerp, and Hamburg are expected to last for several months.

Top European News

- UK launches the biggest financial advice shakeup in more than a decade with the regulator unveiling plans for targeted support to help individuals get better returns, according to FT.

- ECB's de Guindos says they are confronting "brutal uncertainty"; Q2, Q3 growth will be almost flat; Consumption as a driver has not happened; must keep all rate options open because of uncertainty.

- ECB updates its monetary policy strategy: Governing Council confirms symmetric 2% inflation target over the medium term; Symmetry requires appropriately forceful or persistent policy response to large, sustained deviations of inflation from target in either direction; all tools remain in toolkit and their choice, design and implementation will enable an agile response to new shocks; structural shifts such as geopolitical and economic fragmentation and increasing use of artificial intelligence make the inflation environment more uncertain.

FX

- DXY has commenced the week, month-end, quarter-end and half-year-end off on a mildly negative footing after a run of five consecutive losses last week. Down to a 96.97 low at worst, while the benchmark remains in the red it has managed to reclaim the figure, but remains shy of the earlier 97.299 peak. For reference, the mentioned session low is another multi-year trough.

- EUR contained. EUR/USD faded out initial gains, peaked at 1.1750, just before Friday's 1.1753 multi-year peak. Focus on the inflation front, though no significant move to German State or Italian prelim CPI thus far, with near term focus firmly on the trade agenda.

- JPY tops the G10 leaderboard. USD/JPY as low as 143.79, is now back to the 144.00 mark but someway shy of the 144.76 peak.

- Sterling marginally softer vs both the EUR and USD. Incremental drivers for the UK light, though today sees the UK-US deal come into force. Cable currently contained within Friday's 1.3683-1.3752 range.

- Antipodeans benefitting from the constructive risk tone and after the PBoC set a firmer Yuan reference rate overnight.

- PBoC set USD/CNY mid-point at 7.1586 vs exp. 7.1681 (Prev. 7.1627).

- South Africa’s DA Party leader said the Democratic Alliance will withdraw from national dialogue with immediate effect and is in the process of losing confidence in the President’s ability to lead the government.

Fixed Income

- Contained overnight ahead of a busy and front-loaded week. Focus remains firmly on the trade and fiscal fronts; awaiting the reciprocal deadline and monitoring the Reconciliation Bills Senate passage respectively.

- While pertinent, the above developments have not changed the macro picture just yet with USTs in the green by just a handful of ticks within a narrow 111-22 to 112-00+ band, a range that is almost a repeat of Friday’s 111-22+ to 112-02 parameter.

- Bunds are firmer on the session, began in the green and lifted on the morning's German data points of Import Prices and Retail Sales. Thereafter, State CPIs printed and while the metrics were mixed the overall skew was cooler-than-previous, defying consensus for a mainland uptick, lifting Bunds to a 130.52 peak.

- Gilts in the green as well, largely following suit to the above price action in Bunds and USTs. Newsflow lighter domestically as the scale of Labour rebellion to PM Starmer’s Welfare Bill appears to have moderated significantly after the u-turn on Friday. While firmer, Gilts remain shy of the 93.36 peak on Friday and by extension last week’s 93.57 high.

- Spanish Economy Minister says we should work to increase the supply of EUR-denominated assets such as joint EU debt issued to finance defence spending.

Commodities

- Crude benchmarks in the red but only modestly so with losses of c. USD 0.20/bbl, after a slightly choppy morning. Began the APAC session subdued given an absence of significant weekend newsflow. This morning, prices found a floor shortly after US President Trump posted that he is not offering Iran anything, and is not talking to Iran since destroying their nuclear sites.

- WTI resides in a USD 64.50-65.45/bbl range while its Brent counterpart trades in a USD 65.92-66.87/bbl range.

- Spot gold is firmer amid the Dollar softness and ahead of upcoming risk events. XAU stopped just shy of USD 3,300/oz this morning after rising from a USD 3,244/oz base.

- Copper futures are subdued with a similar performance to APAC seen in Europe amid the mixed risk appetite; overnight, the latest Chinese PMI data showed Manufacturing PMI remained in contraction territory despite the US-China trade truce, possibly also weighing on sentiment for the red metal.

- Israel’s Oil Refineries said it resumed partial operation of refining activity in Haifa after damage caused by an Iranian missile during the Israel-Iran war, with full operation expected by October.

- Smoke arose from Iran’s Tabriz refinery, which was caused by a nitrogen tank explosion, although there were no casualties from the incident.

Geopolitics: Middle East

- Israel’s army said it identified the launch of a missile from Yemen on Saturday.

- Egyptian Foreign Minister said work is underway on an upcoming agreement in Gaza that includes a 60-day truce, according to Alhadath via X.

- US President Trump said Israeli PM Netanyahu is in the process of negotiating a deal with Hamas to get hostages back.

- US President Trump said he knew exactly where Iran’s Supreme Leader Khamenei was sheltered and would not let Israel or US armed forces terminate his life, while Trump said he demanded that Israel bring back a very large group of planes that were headed directly to Tehran in the final act of the war. Furthermore, Trump said he was working on the possible removal of sanctions in the last few days and other things which would have given Iran a much better chance at a recovery but warned that Iran has to get back into the world order flow or things will only get worse for them.

- US justified its strikes on Iran as collective self-defence under the UN Charter in a letter to the UN Security Council and said the objective was to destroy Iran’s nuclear enrichment capacity and stop the threat that Tehran obtains and uses a nuclear weapon, while it added that the US remains committed to pursuing a deal with the Iranian government.

- IAEA chief Grossi said Iran has the capacity to start enriching uranium again for a possible bomb in a matter of months, according to BBC.

- Iran’s Foreign Minister said if US President Trump is genuine about wanting a deal, he should put aside the disrespectful and unacceptable tone towards Iran’s Supreme Leader.

- Iran’s Armed Forces Chief of Staff Mousavi told Saudi Arabia’s Defence Minister that they highly doubt Israel’s commitment to the ceasefire, according to Tasnim.

- Iran permitted the transiting of international flights over the centre and west of the country. In relevant news, Emirates cancelled all flights to and from Tehran until July 5th due to the regional situation, while it is to recommence operations to Baghdad on July 1st and Basra on July 2nd.

- US President Trump says he is not offering Iran anything, and is not talking to Iran since destroying their nuclear sites.

- "A source involved in the negotiations for a ceasefire in Gaza told the pro-Qatari news website Arabi 21 this morning that it is believed that an Israeli delegation will arrive in Cairo in the next two days", according to Israeli Radio's Kai.

- Iran's MFA spokesperson Baghaei says Iran and the EU have not agreed on a date for the next round of discussions. Talks are ongoing with the E3.

Geopolitics: Ukraine

- Russia said its troops captured Novoukrainka in eastern Ukraine, according to RIA.

- US President Trump said on Friday that he may send patriot missiles to Ukraine and commented that he will get the conflict solved with North Korea’s leader Kim.

Geopolitics: Other

- India’s Ministry of External Affairs said they have seen and rejected the official statement by the Pakistan Army seeking to blame India for the attack in Waziristan on June 28th.

US Event Calendar

- 9:45 am: Jun MNI Chicago PMI, est. 42.85, prior 40.5

- 10:30 am: Jun Dallas Fed Manf. Activity, est. -12, prior -15.3

Central Banks speakers

- 10:00 am: Fed’s Bostic Speaks on the Economic Outlook

- 1:00 pm: Fed’s Goolsbee Speaks in a Moderated Discussion

DB's Jim Reid concludes the overnight wrap

Good morning and welcome to the last day of a tumultuous H1. I think I got heatstroke three times over the weekend so I'm looking forward to work and air con today. Good luck in parts of France, Spain, Italy, Portugal and Greece (amongst others) as you continue to battle temperatures over 40 degrees.

If the heat doesn't impact you, standby to be disorientated in other ways in this holiday shortened week, as payrolls sees a rare Thursday outing ahead of the Independence Day holiday on Friday. We also have the US ISMs tomorrow and Wednesday, and the various global PMI numbers from tomorrow which will give us a good guide to global economic momentum in June. Elsewhere a highlight will be the ECB forum in Sintra starting today and the European inflation numbers today and tomorrow. The US tax bill should be finalised this week although at the moment it needs to pass the Senate today (or possibly tomorrow), after a drama filled weekend of horse trading, and then back to the House for final approval. The President wants it done by Friday's holiday. At that point attention will swiftly focus to the July 9th deadline extension for reciprocal tariffs. Indeed you'll probably get headlines build up this week and the risk to the market is that with the S&P 500 hitting a new record high at the end of last week, with Treasury yields more becalmed, and with a new tax cutting bill, it's possible that the Trump Administration feels emboldened to be aggressive again. On Friday the US announced that they were stopping trade talks with Canada in retaliation for their digital service taxes and that new tariffs would be launched within a week. However, overnight Canada has dropped this tax to enable talks to restart. This is perhaps a warning shot for the world. So before next Wednesday a lot of water will flow under the global trade bridge.

As noted at the top there is still a fair amount to get through this week first and we'll now go through a few of the main highlights of the week ahead, but remember the full day-by-day calendar is at the end as usual.

For payrolls, DB expects the headline number (+100k forecast vs. +139k previously) to be slightly below the consensus of +113k, with a similar story for private payrolls (DB +100k, consensus +110k, vs. +140k previously). This would also be below the three-month average of 135k and 133k, respectively. Their rationale is based on 1) initial jobless claims being up 8.8% during the June survey week relative to May; and 2) their observation of a recent pattern of subdued summer payroll gains. They also expect the unemployment rate to edge up a tenth to 4.3% but with the risks skewed to it staying unchanged.

Although 100k on payrolls seems low, our economists think the breakeven rate which keeps the unemployment rate steady, is around 100k at the moment and could even be as low as 50k given the Trump Administrations' migration policies. If correct we could have a situation where low payroll growth still tightens the labour market. See US Economic Perspectives: Potential paths for breakeven employment for more on this.

Leading up to payrolls we have JOLTS tomorrow, ADP on Wednesday and also watch out for the employment components in today’s Chicago PMI, tomorrow’s manufacturing ISM, and Wednesday’s Services ISM.

In Europe, the big event will be the ECB's forum on central banking in Sintra running from today through to Wednesday. The policy panel tomorrow will feature heads of the Fed, the ECB, the BoJ, the BoE and the BoK. So plenty of potential headlines there. The ECB will also release its account of the June policy meeting on Thursday and their consumer expectations survey is due tomorrow. Elsewhere in Europe, the BoE will publish its DMP, bank liabilities and credit conditions surveys on Thursday.

In terms of European data, June CPI will continue to be in focus after Friday's prints for France and Spain showed a slight uptick in inflation. Reports for Germany and Italy are out today, with the Eurozone-wide release scheduled for tomorrow. Swiss inflation data is due on Thursday. We also have May German retail sales (today) and factory orders (Friday), Italian retail sales and French IP on Friday.

In Japan the BoJ's Q2 Tankan survey results come out tomorrow with our economists forecasting that the business condition index for large manufacturers in the Tankan survey will worsen -3 points to +9. They expect a similar gauge for large non-manufacturers to slip -2 points to +33. This could be one of a few factors that help influence whether the BoJ hikes again in July, although there's lots of moving parts at the moment including trade agreements with the US.

Asian equity markets are predominantly trading higher this morning. The Nikkei (+1.64%) is standing out, with the index surging to near a one-year peak, propelled by technology stocks. The KOSPI (+0.69%) and the S&P/ASX 200 (+0.52%) are also higher. Chinese stocks are more mixed with the Hang Seng (-0.56%) trading lower, the CSI (-0.02%) flat, but the Shanghai Composite (+0.20%) edging up. S&P 500 (+0.41%) and NASDAQ 100 (+0.57%) futures are both pretty firm for this time of day.

Early morning data indicated that China's manufacturing sector contracted for the third consecutive month in June, although at a slightly slower pace than anticipated. The official manufacturing PMI rose to 49.7 in June (49.6 expected) from the previous month's 49.5. However, the non-manufacturing PMI accelerated a touch, increasing to 50.5 in June, exceeding expectations that it would remain stable at 50.3. Consequently, China's Composite PMI improved to 50.7 in June from 50.4 in May.

In other news, Japan's industrial output fell significantly short of expectations, with a mere +0.5% month-on-month increase compared to the expected +3.4% growth. Although production saw improvements in critical sectors such as machinery and automobiles, five categories—led by non-auto transport equipment—experienced declines.

Recapping last week now and markets were in a buoyant mood, with the S&P 500 rising +3.44% to a new all-time high of 6,173 (+0.52% on Friday) as we closed out the week. Tech stocks outperformed, with the NASDAQ (+4.25%, +0.52% Friday) advancing every day last week to a new high of its own. In Europe, the STOXX 600 (+1.32%) posted a modest weekly gain, with the DAX (+2.90%) outperforming, led by German defense companies. And in Japan, the Nikkei had its best week of 2025 so far, up +4.55% (+1.43% on Friday).

The positive mood started with the de-escalation in the Middle East after Trump announced Monday evening that Israel and Iran agreed on a “Complete and Total CEASEFIRE.” Following this, Brent crude saw its biggest weekly decline since 2022, down -12.00% to $67.77/bbl (+0.06% Friday). Meanwhile, gold fell -2.79% on the back of declining geopolitical risk (-1.61% Friday).

Last week’s upbeat tone was also helped by rising expectations of Fed rate cuts despite decent economic data. The positive data included the flash US PMIs for June (52.8 vs. 52.2 expected) and Friday’s UoM consumer survey, that saw current conditions rebound to a four-month high. On the softer side, we saw higher continuing jobless claims (+1,974k vs +1,950k expected) on Thursday and an unexpected drop in May real personal spending (-0.3% vs. 0.0% expected) on Friday.

Lower oil prices and comments from Michelle Bowman, the Fed’s Vice Chair for Supervision, saw pricing of a July rate cut rise as high as 25% on Wednesday, though it was down to 19% by Friday following a slightly stronger (2.7% vs. 2.6% expected) US core PCE inflation print. Still, the next Fed rate cut is now fully priced by September and 64bps of easing is priced by December (+12.7bps on the week). In turn, Treasury yields moved lower, with the 2yr down -16.0bps (+2.9bps Friday) to 3.75%, its lowest since early April, while the 10yr yield was down -9.9bps to 4.28% (+3.6bps Friday). Treasuries were also supported by the Fed announcing a planned easing of banks’ Supplementary Leverage Ratio.

By contrast In Europe, 10yr bund yields rose +7.4bps to 2.59% (+2.2bps Friday) as the German government unveiled a faster-than-expected ramp up of its fiscal stimulus. However, OATs (+1.7bps) and BTPs (-2.4bps) saw smaller moves, with the 10yr BTP-bund spread falling to its lowest level since 2015 at 88bps. The contrasting rates moves on the two sides of the Atlantic saw EURUSD rise +1.69% on the week to 1.1718, its highest level since September 2021.

https://www.zerohedge.com/markets/futures-push-higher-record-territory-amid-trade-talk-progress