Piper Sandler Cos

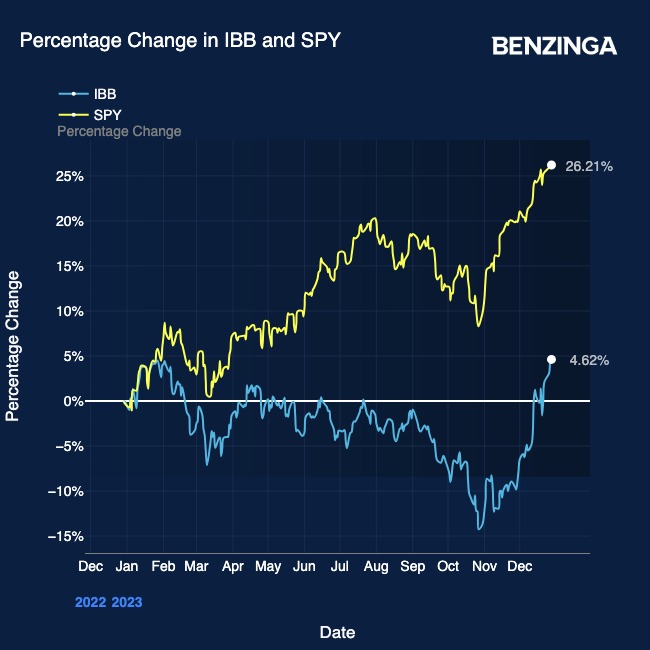

As illustrated in the data below, the biotech sector is lagging behind the broader U.S. equity market, as indicated by the performance of the SPDR S&P 500 ETF

.The iShares Biotechnology ETF is a popular benchmark to gauge the performance of biotech equities in the U.S.As reported by CNBC, Piper Sandler analysts Edward Tenthoff and Thad Barney remain optimistic about the biotech industry. They see attractive valuations and upcoming product launches ahead. Here are three of their top picks from the sector.

Arrowhead Pharmaceuticals: Unlocking the Potential of Gene Therapies

Arrowhead Pharmaceuticals Inc

Additionally, cardiovascular outcome trials for plozasiran or zodasiran could further solidify their impact. GlobalData projects sales of these therapies to reach $651 million and $399 million by 2030 and 2029, respectively. Despite a year-to-date share price decline of nearly 20%, Piper Sandler anticipates a 90% increase over the next 12 months.

Legend Biotech: Carvykti’s Rise to Prominence

Legend Biotech Corp

Predicting a substantial revenue surge from $506 million in 2023 to $1.05 billion in 2024, the investment bank foresees global supply reaching 10,000 doses annually by 2025, potentially pushing peak revenue beyond $5 billion.

Legend Biotech’s robust CAR-T Cell therapy pipeline and recent collaboration with Novartis contribute to Piper Sandler’s bullish outlook, expecting a 53.3% increase in shares over the next year.

Alnylam Pharmaceuticals: A Focus on Neurological Disorders

Alnylam Pharmaceuticals Inc

Despite a year-to-date share price dip of nearly 16%, Piper Sandler sees a 10.3% potential upside over the next 12 months, projecting a share price of $217.

With the biotech sector showing signs of recovery and potential benefits from expected U.S. Federal Reserve interest rate cuts in the upcoming year, these selections offer attractive prospects for investors looking for growth possibilities in 2024.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.