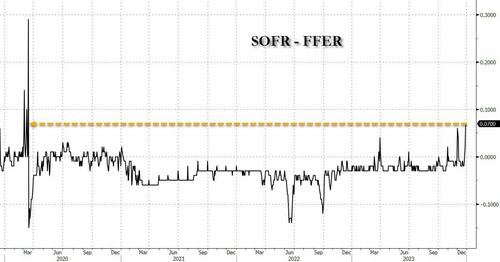

Earlier today, when discussing the sudden spike in the SOFR rate to an all time high 5.40% and which dragged the SOFR-Fed Funds spread to the highest since the March 2020 repo crisis...

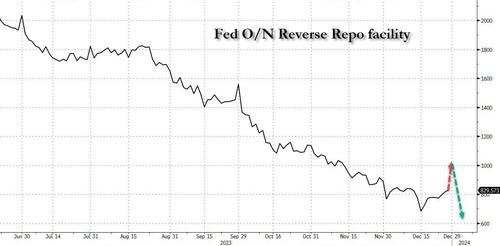

... we said that "two factors are the likely culprits: the year-end liquidity crunch, and the recent sharp increase in the Fed's reverse repo facility, which has increased from a multi-year low of $683 billion on Dec 15 to yesterday's $830 billion, and which STIR strategists expect will shoot up above $1 trillion in today's final for 2023 reverse repo operation as a whopping $300+ billion in short-term liquidity in pulled from markets in just days."

Moments ago that's precisely what happened when the NY Fed revealed that in the final reverse repo operation of 2023, 102 counterparties parked a whopping $1.018 trillion at the Fed in the now traditional year-end window dressing operation (yielding 5.30% or 10bps below the record high SOFR rate). This means that, as we speculated, over $300 billion in reserves had been drained by this operation in the past two weeks alone.

The flood of demand at the operation, which started at 12:45pm ET and whose results were announced at 1:15pm was likely leaked among the participants who were bracing for such an outcome, one which also explains the repricing of risk lower for much of this morning.

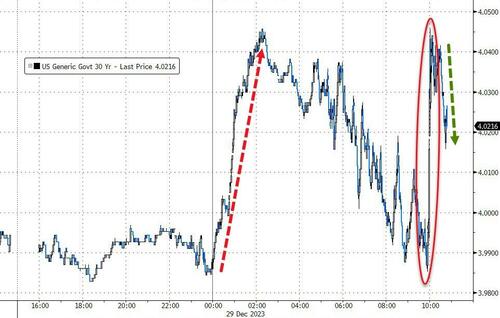

An additional factor for the sudden drop in bond prices may have been today's month end index pricing which at 1pm, which as Bloomberg notes took place three hours earlier than normal because of the Sifma recommended 2pm close of trading for cash bonds. According to BBG calculations, the month-end change to the Treasury index was expected to extend duration by an estimated 0.06 year only, which is why it's improbable that this was the driving factor, unless there had been a huge mismatch between what passive investors were expecting and the actual outcome, which is unlikely.

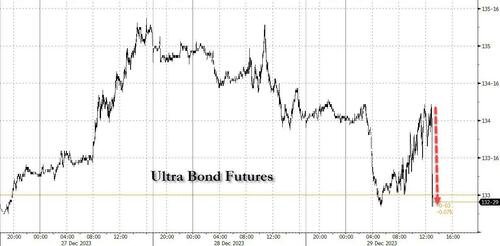

Still, between the index pricing and the liquidity drain, even a small sale order would have an outsized effect, and sure enough, one look at the 30Y future shows that that's precisely what happened.

In yield terms the 30Y spiked 6bps from low of day to high of day, in seconds...

The flip side to all this, as noted earlier, is that on Jan 2 reverse repo is almost guaranteed to plunge back to $700BN or lower, substantially boosting system liquidity with a flood of reserves, a daily liquidity tango back and forth which will continue until some time in late March when the reverse repo facility is finally drained and the real funding squeeze can begin.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.