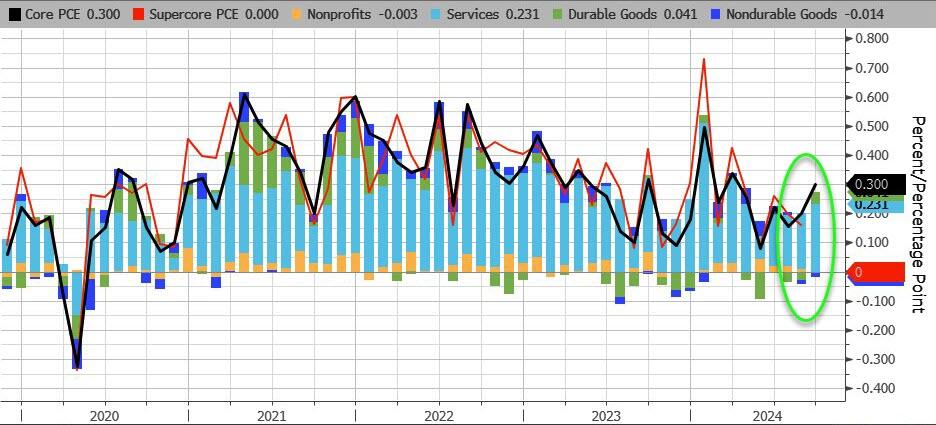

The Fed's favorite inflation indicator - Core PCE - printed hotter than expected in September (+2.7% vs +2.6% exp), flat with August's 2.7% rise...

Source: Bloomberg

The headline PCE rose 0.2% MoM, which dragged down YoY PCE to +2.1% - its lowest since Feb 2021...

Source: Bloomberg

On a MoM basis, PCE appears to be accelerating with Durable Goods and Services costs picking up...

Source: Bloomberg

And finally, the so-called SuperCore PCE (Services Ex-Shelter) rose 0.3% MoM leaving the YoY cange 'sticky' at around 3.2%...

Source: Bloomberg

Of significant note is the fact that cyclical inflation is awkwardly stuck extremely high while the cyclical segment of inflation has reverted to normal...

Source: Bloomberg

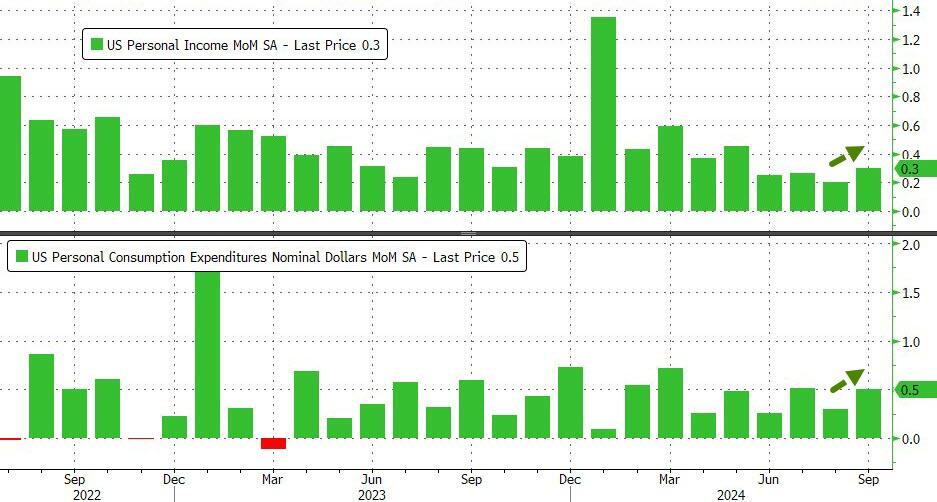

Personal Incomes rose 0.3% MoM (as expected) but Spending rose by more (+0.5% vs 0.4% exp)...

Source: Bloomberg

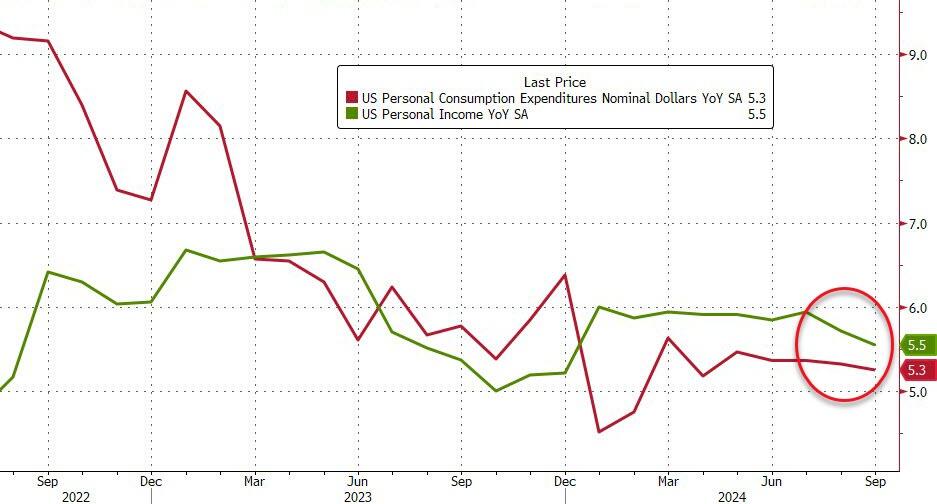

But on a YoY basis, bond spending and income growth is slowing...

Source: Bloomberg

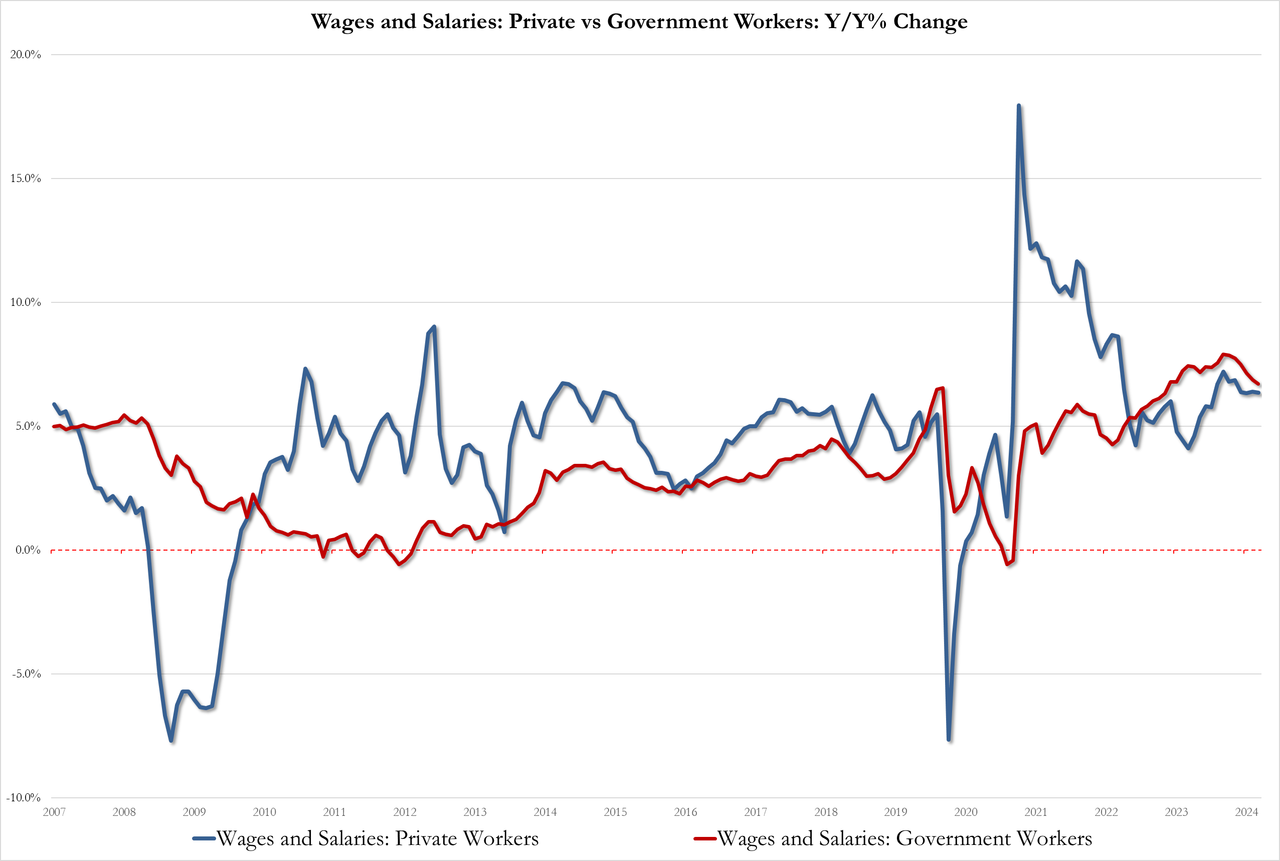

On the income side, Private wage growth 6.4% in Sept, unch while Government wage growth 6.7% in Sept, down from 6.9%, and well below record high 7.9% in March...

Source: Bloomberg

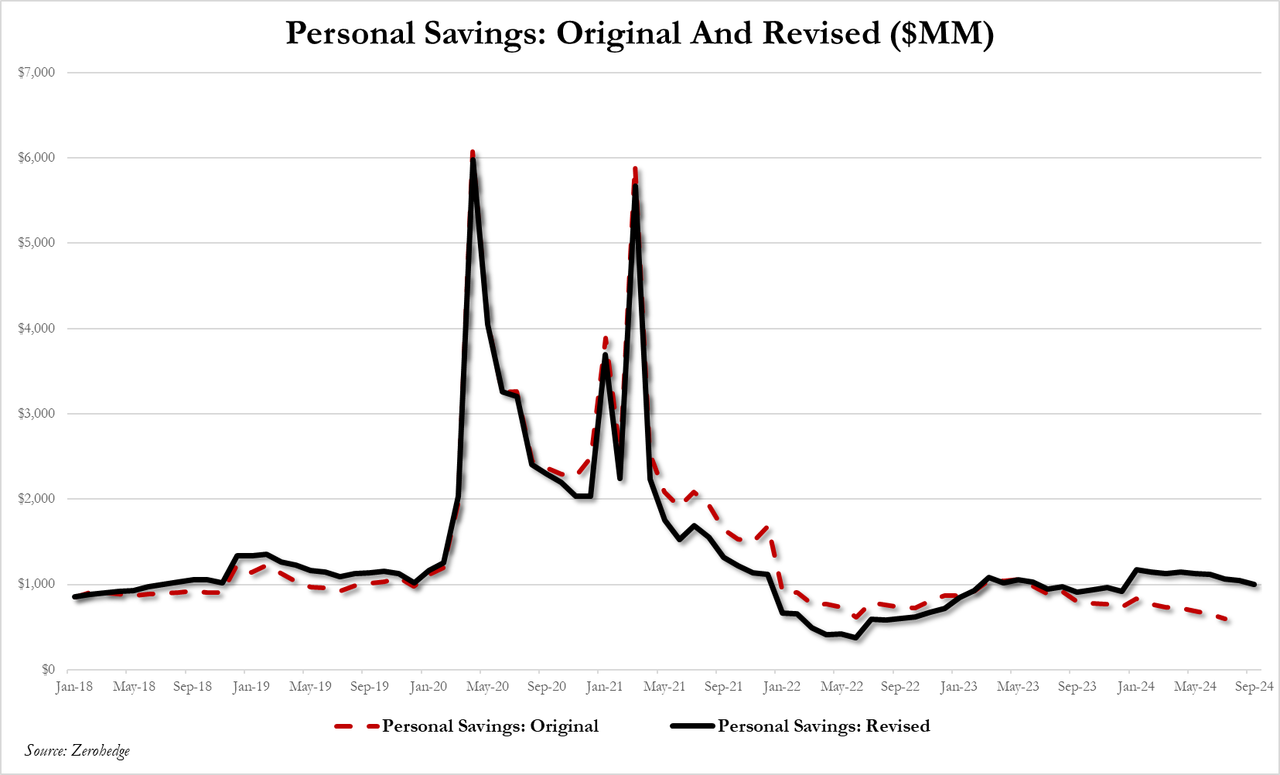

Overall, the savings rate declined. BUT, as is clear from out chart below, this 'higher' savings rate is a nonsense-ly revised higher level...

Source: Bloomberg

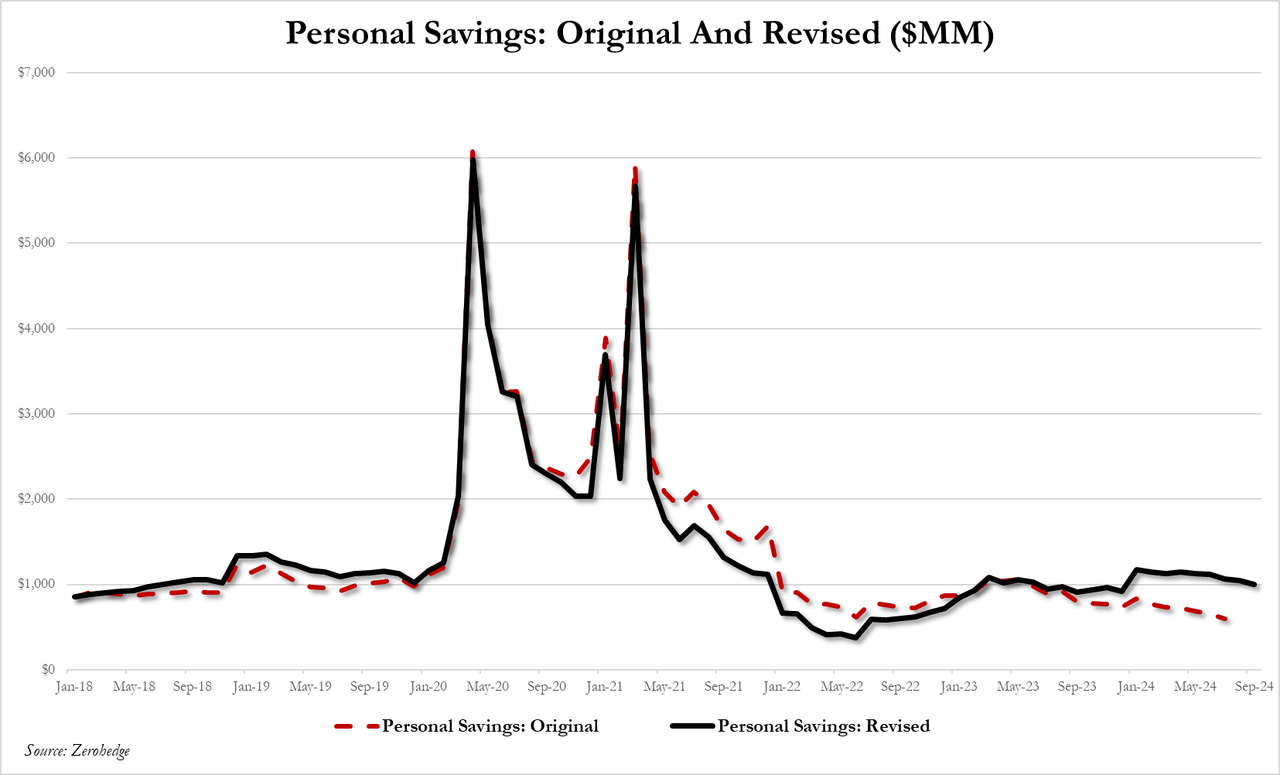

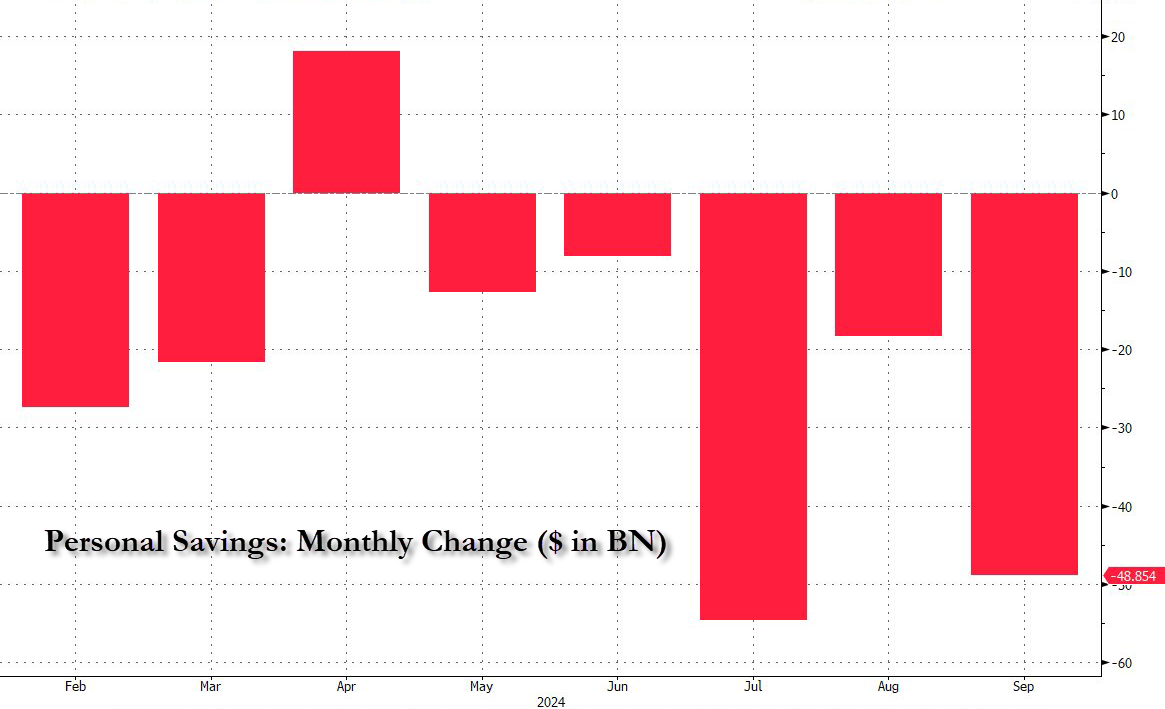

...which means personal savings tumbled by $49 Billion in September to $1.00 trillion...

Source: Bloomberg

That's the 7th month of the last 8 that Americans have drained their savings...

Source: Bloomberg

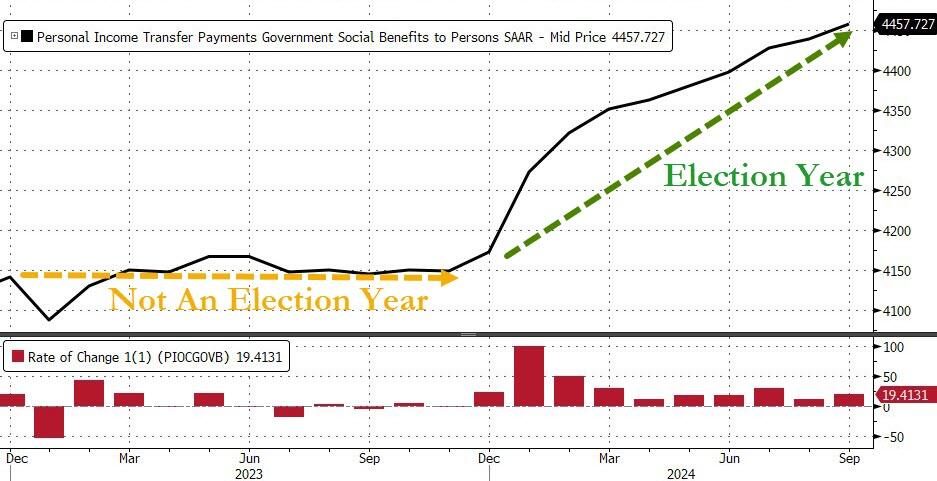

And finally, imagine how bad things would be if the government wasn't having over billions to 'we, the people' all of a sudden...

Source: Bloomberg

Not exactly the kind of data that enshrines The Fed with a god-given right to cut rates.

https://www.zerohedge.com/economics/feds-favorite-inflation-indicator-hotter-expected-september

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.