The normally crucial consumer price index measure of inflation printing today for March is likely to take a back seat to the next red flashing headline on tariffs on everyone's Bloomberg terminal, but under the hood - with the Trump Put now exposed - can a cooler than expected CPI print raise the Powell Put strike enough to enable a true tradable bottom here?

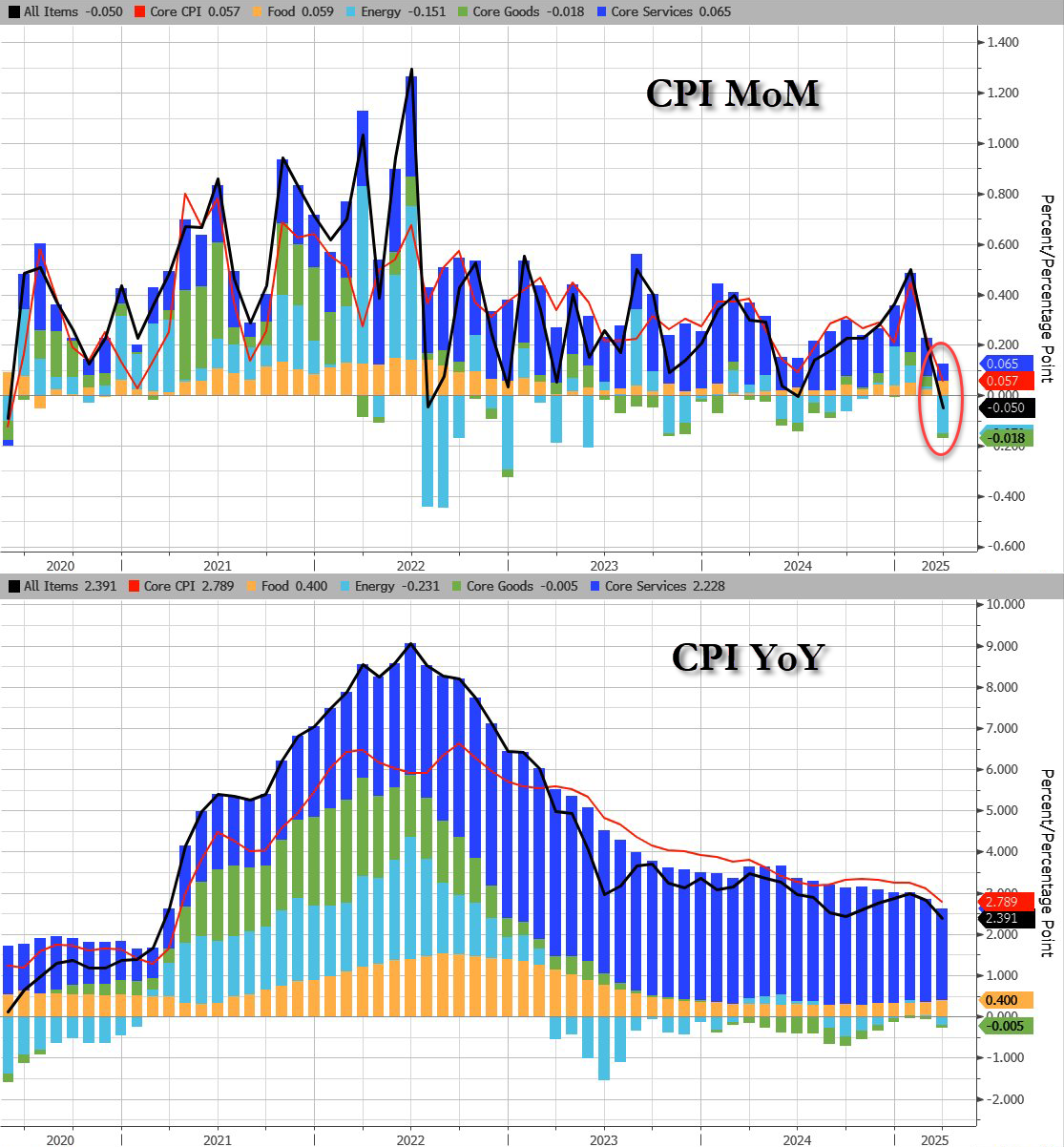

Having dipped lower in the previous month (following a few straight months of re-acceleration), expectations were for both headline and core measures to continue trending lower on a YoY basis... and they were.

Headline CPI FELL 0.1% MoM (vs +0.1% exp), which dragged the YoY CPI to +2.4%, matching the September lows...

Source: Bloomberg

That is the weakest MoM print since May 2020.

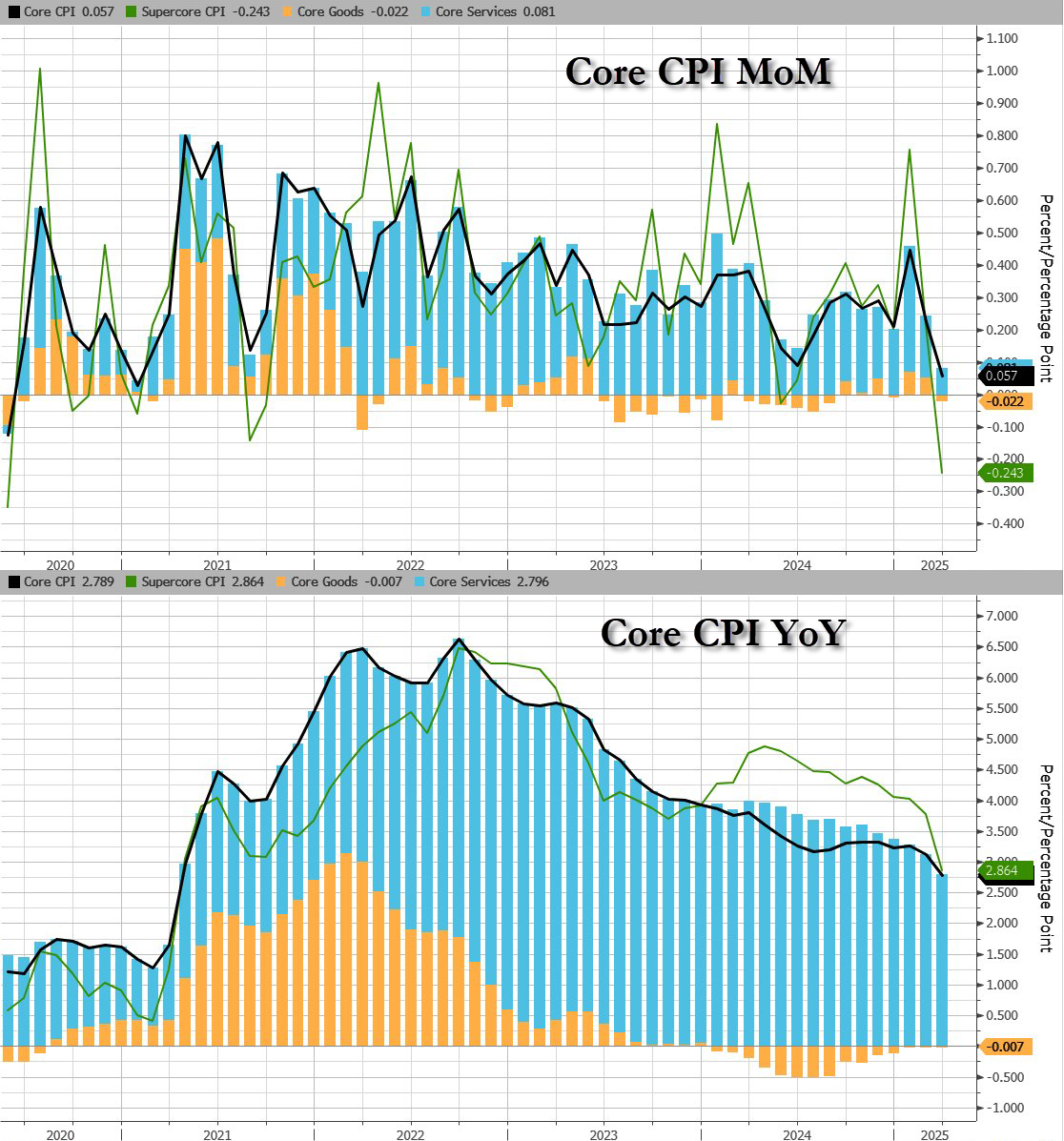

Core CPI also printed cooler than expected (+0.1% MoM vs +0.3% MoM exp), pulling the YoY print down t0 +2.8% YoY - the lowest since March 2021...

Source: Bloomberg

Services inflation tumbled...

Source: Bloomberg

CPI breakdown:

Headline:

CPI decreased 0.1% after rising 0.2% in February, and below the +0.1% estimate. Over the last 12 months, CPI rose 2.4%, below the 2.5% estimate.

Energy CPI fell 2.4% in March, as a 6.3% decline in the index for gasoline more than offset increases in the indexes for electricity and natural gas.

Food CPI rose 0.4% in March as the food at home index increased 0.5% and the food away from home index rose 0.4 percent over the month.

Core CPI:

The index for all items less food and energy rose 0.1% in March, following a 0.2% increase in February.

Indexes that increased over the month include personal care, medical care, education, apparel, and new vehicles.

The indexes for airline fares, motor vehicle insurance, used cars and trucks, and recreation were among the major indexes that decreased in March.

Core CPI details (MoM increase):

The shelter index increased 0.2% over the month.

The index for owners’ equivalent rent rose 0.% in March and the index for rent increased 0.3%.

The lodging away from home index fell 3.5 percent in March.

The personal care index rose 1.0%in March.

The index for education rose 0.4% over the month, as did the index for apparel.

The new vehicles index also increased over the month, rising 0.1%.

The index for airline fares fell 5.3% in March, after declining 4.0% in February.

The indexes for motor vehicle insurance, used cars and trucks, and recreation also fell over the month.

The household furnishings and operations index was unchanged in March.

The medical care index increased 0.2% over the month.

The index for hospital services increased 1.1% in March and the index for physicians’ services rose 0.3% over the month. In contrast, the prescription drugs index fell 2.0% in March.

Core CPI details (YoY increase):

The index for all items less food and energy rose 2.8 percent over the past 12 months.

The shelter index increased 4.0 percent over the last year, the smallest 12-month increase since November 2021.

Other indexes with notable increases over the last year include motor vehicle insurance (+7.5 percent), medical care (+2.6 percent), recreation (+1.9 percent), and education (+3.9 percent).

While goods inflation is flat (zero-ish), services cost inflation is fading fast...

Source: Bloomberg

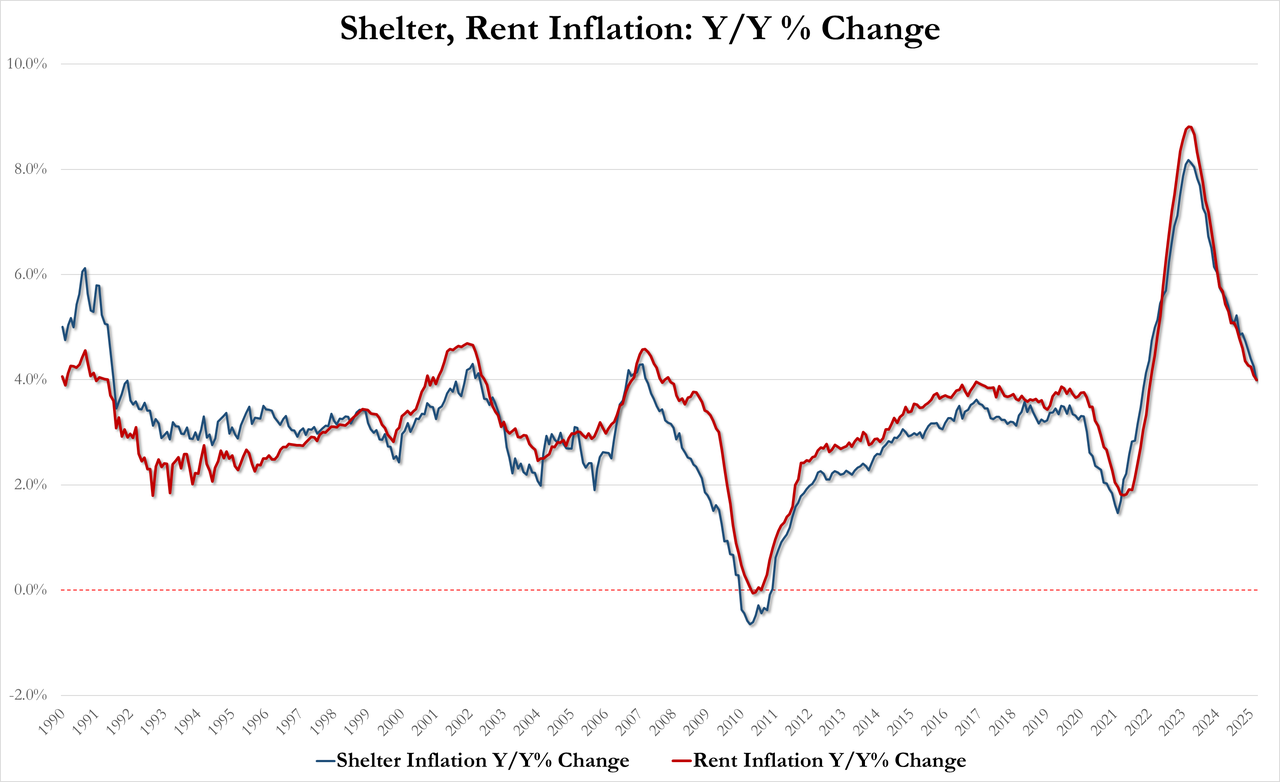

Shelter and Rent inflation is slowing fast:

Shelter inflation +0.3% MoM, +3.99% YoY, down from 4.25% in February (lowest since Nov 2021)

Rent inflation +0.3% MoM, +3.99% YoY, down from 4.09% in February (lowest since Jan 2022)

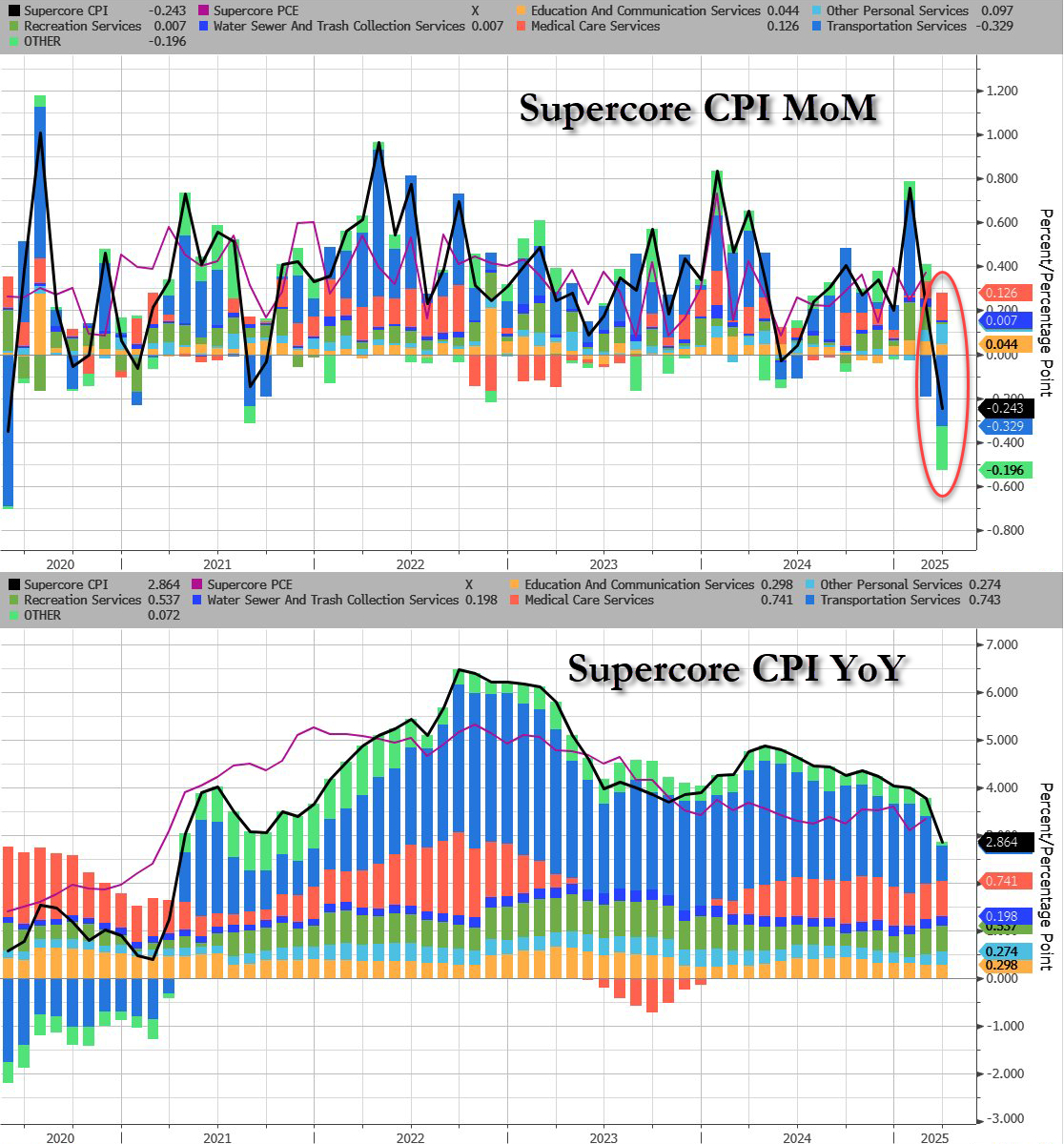

The so-called SuperCore CPI - Services Ex-Shelter - dropped 0.1% MoM dragging it down to +3.22% YoY - the lowest since Dec 2021...

Source: Bloomberg

Source: Bloomberg

Drill Baby Drill (and tariffs recession fears) have dragged energy prices lower and pulled CPI lower with it...

Source: Bloomberg

But, but, but... Democrats at UMich said inflation would explode because Orange Man Bad?

https://www.zerohedge.com/personal-finance/march-us-consumer-prices-fall-most-5-years

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.