West Texas Intermediate oil fell below $55 a barrel for the first time since February 2021, the latest sign that crude supplies are outpacing demand as the market braces for a large surplus, and further helped rising hopes for a potential peace deal in the Russia-Ukraine conflict.

OilPrice.com's Charles Kennedy notes that the ongoing talks about a potential peace deal in Ukraine chipped away at a longstanding geopolitical premium on crude after reports of positive discussions and progress made.

Rising optimism over a potential peace deal to end the Russia-Ukraine conflict added to downward pressure as U.S. officials proposed NATO-style security guarantees for Ukraine in talks with Kyiv in Berlin.

U.S. President Donald Trump suggested that the negotiators are “closer now than we have been ever.”

A peace agreement could ease sanctions on Russia’s oil flows and raise supply on an already well-supplied global market.

“Oil markets will be watching developments closely, given the significant supply risk from sanctions on Russia. While Russian seaborne oil exports have held up well since the imposition of sanctions on Rosneft and Lukoil, this oil is still struggling to find buyers,” ING’s commodities strategists Warren Patterson and Ewa Manthey wrote in a note on Tuesday.

“The result is a growing volume of Russian oil at sea. India, a key buyer of Russian oil since the Russia/Ukraine war began, will reportedly see imports of Russian crude fall to around 800k b/d this month, down from around 1.9m b/d in November,” the strategists added.

As Bloomberg reports, expectations of a surplus, driven by a wave of new supply from the OPEC+ alliance and countries in the Americas, as well as subdued demand growth, drove prices down this year.

At the same time, signs of weakness are mounting across the oil market, with Middle Eastern prices entering a bearish contango pattern early on Tuesday.

Elevated premiums for fuels like gasoline and diesel relative to crude, which supported prices last month, have also eased, with national average pump-prices in the US now well below $3/gallon - the lowest since Q1 2021...

And given the lead-lag nature of the energy supply-chain, pump-prices could be set to tumble further over the holiday season...

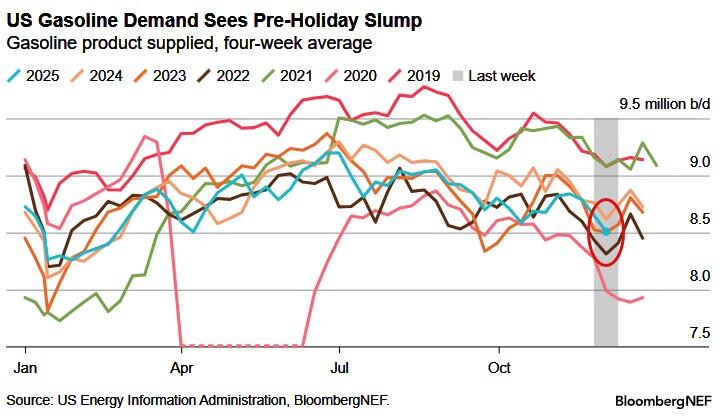

Piling on the bearish slide (bullish for Americans' pocketbooks), US gasoline demand continues to pull back heading into the final weeks of the year amid cold weather sweeping the country.

According to US Energy Information Administration data, the four-week average of product supplied is down 320,000 barrels a day over the last three weeks, and now sits 1.3% below year-ago levels.

This is relatively in line with typical seasonal trends as driving winds down heading into the holidays, though severe winter weather may be limiting driving activity nationwide.

But, despite all this 'peace deal' optimism Martijn Rats, Morgan Stanley’s global commodities strategist warned, however, that markets may be getting ahead of themselves. “We have seen this on a few occasions before and it turned out to be premature.”

Additionally, The FT reports that Energy Aspects, a consultancy, said it did not expect “a rapid peace deal” but described the latest negotiations as the biggest geopolitical wild card for the oil market, particularly during the Christmas and new year period when trading volumes are traditionally thin.

So, maybe a tank of gas is a great (affordable) Xmas gift this year?

https://www.zerohedge.com/energy/pump-prices-plummet-ukraine-peace-deal-progress-sparks-oil-plunge

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.