Large-cap pharma stocks have had a decent 2018, with strong earnings momentum primarily responsible for the optimism in the space. Tax cuts enabled companies to augment cash reserves, giving them flexibility to pursue inorganic growth to enrich product pipelines.

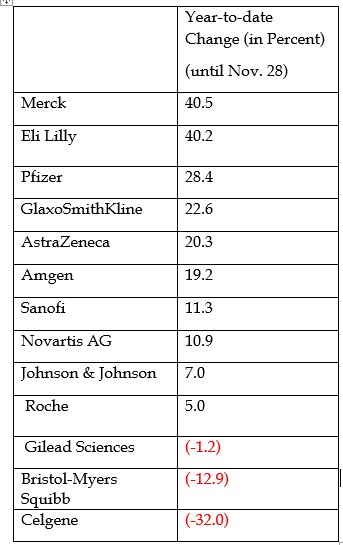

Here’s how large-cap pharmas have performed year-to-date through Nov. 28.

The top performer so far this year has been Kenilworth, New Jersey-based Merck & Co., Inc. MRK 0.89%, with shares hitting a seven-year high.

Merck’s Revenue Sources

Merck reports revenue in the pharmaceutical, animal health livestock, companion animal and other segments.

In Merck’s recent Q3 print, the pharmaceutical segment earned about $9.66 billion, or 90 percent of the company’s total revenue of $10.79 billion.

The revenue breakdown for Merck’s four top-selling products is as follows:

- Keytruda: 18 percent.

- The diabetes franchise comprising Januvia and Janumet: 14 percent.

- The HPV-related cancer vaccines Gardasil/Gardasil 9: 10 percent.

- Proquad, MMR II and Varivax (MMR and Varicella vaccines): 5 percent.

- These products accounted for roughly half of Merck’s total revenue in the quarter.

Citing strong confidence in its pipeline, long-term revenue growth, cash flow projections and overall balance sheet strength, Merck raised its quarterly dividend by about 15 percent to 55 cents per share and announced a $10-billion stock buyback plan.

A Wonder Drug Called Keytruda

Keytruda, chemically pembrolizumab, is an immunotherapy product that fights cancer with the help of one’s own immune system. Immunotherapy is considered a next frontier in cancer treatment.

Keytruda was first approved in 2014 to treat advanced melanoma and has more than 10 approved indications so far.

The most recent approval for Keytruda was announced in October: first-line treatment of metastatic squamous, non-small cell lung cancer, or NSCLC, in combination with the chemotherapy regimen carboplatin and either paclitaxel or nab-paclitaxel.

Non-squamous NSCLC patients whose tumors do not express EGFR or ALK were the primary driver of Keytruda sales in Q3, Merck executive Adam Schechter said on the earnings call. The drug was approved for the indication in August in combination with pemetrexed and platinum.

Keytruda’s sales breakdown by indication were as follows, Schechter said:

- About 65 percent in NSCLC;

- 10 percent in melanoma;

- 5 percent in head and neck cancer;

- 5 percent in bladder cancer;

- 5 percent in MSI-high;

- and 10 percent in other indications.

If Merck maintains its 40-percent long-term share of the U.S. IO market, the franchise would boast a sales potential of $9.4 billion by 2030, CNBC reported, citing BMO Capital Markets analyst Alex Arfaei.

Other Oncology Drugs

Apart from Keytruda, Merck boasted strong growth in Lynparza, indicated for ovarian and breast cancer, and Lenvima, a tyrosine kinase inhibitor approved for advanced liver cancer, advanced kidney cancer and differentiated thyroid cancer.

Lynparza is being co-developed with AstraZeneca plc AZN 0.25% and Lenvima with Japan’s Eisai.

The Rest Of The Portfolio

Merck’s vaccine portfolio generated a combined $2.2 billion in sales in Q3, a 13-percent year-over-year increase.

Gardasil has received a shot in the arm following its Chinese launch. The company views the vaccine as possessing a long run rate.

The company’s diabetes Januvia and Janumet diabetes franchise saw stable sales in quarter as pricing pressure in the U.S. offset strong demand in markets outside the U.S.

Promising Pipeline

Merck has a rich and deep pipeline of assets in development that hold promise for the future. The company has about 10 late-stage monotherapy and combo therapy candidates for indications ranging from cancer to bacterial infection to cough to heart failure.

Source: Merck

Merck has several supplemental applications under review.

The Stock

Merck shares have fared well so far in 2018 following a modest retreat in 2017.

Citigroup, which has a Buy rating on Merck, recently raised the price target for shares from $79 to $84.

The average analyst price target for Merck is $79.12, according to the Yahoo database.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.