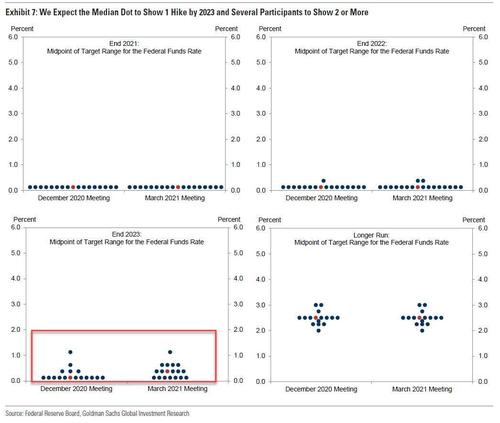

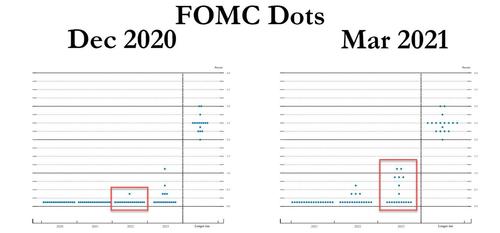

Yesterday, when we looked at Goldman's forecast for monetary policy over the next few years, one thing stood out: the bank's expectation that the median 2023 dot would show one rate hike, a hawkish prediction that spread like wildfire across markets and prompted speculation among some, such as JPM, that a shorter liftoff telegraphed by the Fed would spark a "repricing" across the entire rates complex which then obviously would also impact risk assets. It's also why others - such as Nomura's Charlie McElligott - said that the fate of that 2023 median dot could lead to a surge - either higher lower - in stocks depending on whether the Fed would go ahead with this tighter signaling.

Well, we now know that the Fed would have none of this, and while a handful of FOMC members did in fact push higher on their 2023 dots, the median remained unchanged.

Which brings us to Goldman's just published FOMC post-mortem in which the bank admits that it was wrong about the Fed, an error which it attributed to the Fed's new reaction function which suggests that "several FOMC participants have a higher inflation bar for liftoff than 2.1%." In other words, the economy will be really overheating when the Fed will a) taper and b) consider hiking rates.

Here is what Hatzius just published:

The FOMC made modest changes to the post-meeting statement and left the funds rate target range unchanged at 0–0.25% at the March meeting. The median projected path for the policy rate in the Summary of Economic Projections continued to show no change over the forecast horizon, against our expectations for one hike in the SEP. The March projections suggest that several FOMC participants have a higher inflation bar for liftoff than 2.1%. We continue to expect tapering to begin in early 2022 and the fed funds rate to remain unchanged until the first half of 2024.

Below are all the main points from Goldman:

1. The FOMC left the funds rate target range unchanged at 0–0.25% and left the policy outlook characterization and asset purchase policy unchanged. The statement’s characterization of the current economic situation continued to emphasize the effect of COVID-19 on economic activity and was updated to acknowledge that the pace of the recovery has “turned up recently” after previously moderating. The Committee also removed the language on oil prices “holding down”inflation and now more plainly states that “inflation continues to run below 2%.” In the implementation note, the FOMC increased the counterparty limit on overnight reverse repurchase agreements from $30bn to $80bn.

2. The median projected path for the policy rate in the Summary of Economic Projections (SEP) continued to show no change over the forecast horizon, against our expectations for one hike in the SEP. However, FOMC participants expressed divergent views, as six of the seven participants that expected at least one hike by the end of 2023 projected multiple hikes (vs. five previously with one or more hike;we had expected eleven at this meeting). Additionally, four participants showed a hike at the end of 2022 (vs. one previously; we had expected two at this meeting). The median longer run projection for the fed funds rate was unchanged at 2.5%, as expected.

3.Likely reflecting the American Rescue Plan Act and improvement in the public health situation, the GDP projections in the SEP were increased substantially, with the median growth projection for 2021 raised 2.3pp to 6.5% (median growth projections for 2022 and 2023 were little changed: +0.1pp and -0.2pp, respectively).But while the 2021 core inflation median increased sharply (+0.4pp to 2.2%), the median participant did not project much overheating in the medium-term: the 2023unemployment rate median fell only 0.2pp (to 3.5%), the longer-run unemployment rate median was surprisingly revised down (-0.1pp to 4.0%), the 2023 core inflation median rose 0.1pp to 2.1%, and only one participant projected core inflation rising above 2.2% over the forecast horizon.

Finally, in terms of what Goldman's revised view of the Fed's reaction function now means, Hatzius writes that "the March projections suggest that several FOMC participants have a higher inflation bar for liftoff than 2.1%. We continue to expect tapering to begin in early 2022 and the fed funds rate to remain unchanged until the first half of 2024."

https://www.zerohedge.com/markets/goldman-we-were-wrong-about-fed

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.