Something odd is happening in the market: while stocks are tumbling, pushing most tech names into a deep bear market amid the worst turmoil for markets in years, inflows into stocks - both institutional and retail - are soaring. According to EPFR data compiled by Bank of America, cumulative equity flows YTD in 2021 have hit a record $153bn, exceeding the pace of early-2021 (when the year started with $151bn in inflows, ahead of a record year of more than $1tn inflows).

How can this be? Well, the catalyst behind this unprecedented scramble for risk is that despite falling prices, investors are bailing on other even more impacted securities, and with a record outflows from money markets/cash as well as huge capital flight out of bond funds, this money has to go somewhere, and that "somewhere" is stocks for now, even though if the Fed is indeed set to hike 7 times this year and drain $2+ trillion from its balance sheet, the pain for stocks is only just starting.

Here are the weekly fund flow details:

- Huge $46.6bn inflow to global equities, $0.3bn into gold, $10.5bn from bonds, $47.5bn outflow from cash.

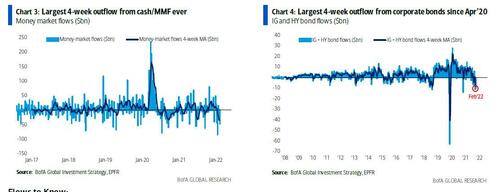

- largest 4-week outflow from cash/MMF ever (-$35.2bn, Chart 3) – this despite soon-to-be-inverted yield curve encouraging reallocation from long-end to short-end;

- largest 4-week outflow from corporate bonds since Apr’20 (-$8.6bn Chart 4);

Largest inflow into US large cap equity funds ever ($34.1bn);

- In summary: as noted above, cumulative equity inflows YTD $153bn exceed the record pace of early-2021 ($151bn in '21, record year of $1tn inflows); this despite bullish “sentiment” as measured by AAII falling to lowest level since Aug’20 (Chart 5); and despite big reversal in credit flows -$32bn in ’22 vs $58bn inflows in '21 (Chart 6).

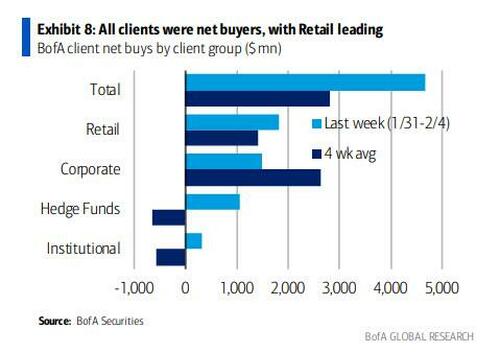

Drilling further down into the source of inflows, earlier this week Bank of America's Jill Carey Hall reported that last week, during which the S&P 500 was +1.5%, clients were big net buyers of US equities for the second week - the $5.2BN in inflows was the 9th-largest weekly flow in BofA's post-08 data history, with clients buying equities across all thee size segments (small/mid/large).

It wasn't just institutions, as retail clients led the buying after also leading in Jan. (typical Jan. seasonality following tax loss selling by the group in Dec., vs. earlier tax loss selling by mutual funds in Oct.). But institutional clients and hedge funds were also buyers (for the second week and first time in four weeks, respectively).

And speaking of retail, JPMorgan writes that during Thursday's post-CPI/ Bullard rout, retail investors bought $1.7bn, second highest amount on record ($1.95bn on Feb 1).

In short, even though the Fed is now openly asking for a significant deflationary market correction, it has instilled such an unprecedented BTFD Pavlovian instinct across all investor groups - including retail - that not even a crash may be sufficient to get them to pull their money out of the rigged casino.

https://www.zerohedge.com/markets/despite-turmoil-stocks-seeing-largest-ever-inflows-2022

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.