by Andrew Moran via The Epoch Times,

A word once a badge of honor for President Joe Biden might have turned into a political liability. "Bidenomics," a term used to describe his economic doctrine, is being used less, and the press is beginning to take notice.

In recent weeks, President Biden has refrained from uttering "Bidenomics." It has been absent in nearly all of his public appearances this month, from his prepared remarks in Colorado, where he touted the Inflation Reduction Act, to his speeches at the Asia-Pacific Economic Cooperation (APEC) in California.

The last time President Biden touted the term was in a Nov. 1 speech in Minnesota, where he mentioned it four times and compared it to the American Dream.

"Folks, Bidenomics is just another way of saying 'the American Dream,'" President Biden said then.

But it has not entirely disappeared. Instead, President Biden's re-election campaign has used the "Bidenomics" branding in subtler forms. During the Colorado event, there were signs with the label. The term is also inserted into the title of President Biden's events or speeches. His team has used it in social media messages.

“In Colorado, [Biden] highlighted how Bidenomics is creating jobs and opportunities – unleashing over $7 billion in new investments across the state,” the White House wrote on X (previously Twitter) on Nov. 30.

Mainstream media outlets, including NBC News, have noticed that the White House has removed the term when President Biden talks about the economy.

A chorus of prominent Democrats and many of President Biden's allies and supporters have warned that the "Bidenomics" branding would backfire because many Americans are still financially struggling and might link their challenges with the economic message.

"Whatever stories Americans are told about the strength of the economy under President Joe Biden, they are not going to be persuaded to look past the issue of their own living standards," liberal economist James Galbraith wrote last month.

A plethora of polls have highlighted the same thing: A majority of U.S. voters do not like "Bidenomics."

According to a new Gallup poll, 67 percent of Americans disapprove of the way President Biden is handling the economy. A recent Harvard CAPS-Harris Poll found that just 44 percent of respondents approve of President Biden's handling of the economy. Just 14 percent of U.S. voters say they are better off financially now than when President Biden took office, a new Financial Times-University of Michigan monthly survey learned.

"With less than a year to go until the presidential election, Biden continues to receive tepid ratings from the American public. His overall job approval rating is still at his personal low and is in historically dangerous territory for an incumbent seeking reelection," Gallup wrote in its summary of the latest polling data.

"In addition, political independents’ record-low rating of Biden is striking. Biden’s even weaker ratings on the economy, foreign affairs and the Middle East suggest that his performance in these areas is dragging down his overall job performance rating."

The White House insists that the U.S. economy is heading on the right track, alluding to various data points to support these claims.

Treasury Secretary Janet Yellen told reporters in North Carolina on Nov. 30 that "inflation has now come way down" and "now wage gains are really translating into more real income."

Treasury Secretary Janet Yellen speaks at an event on the Biden administration’s economic strategy toward the Indo-Pacific in Washington on Nov. 2, 2023. (Madalina Vasiliu/The Epoch Times)

"So my hope is that Americans gradually will see that things are getting better," Ms. Yellen said.

The headline numbers have pointed to a robust economic landscape.

In the third quarter, the GDP growth rate clocked in at a better-than-expected 5.2 percent, although government spending contributed 1.5 percent to the final print.

Despite the Federal Reserve’s rising interest rates, the labor market remains solid, with an unemployment rate below 4 percent and millions of new jobs in 2023.

However, the higher cost of living continues to affect voters’ perception of the economy.

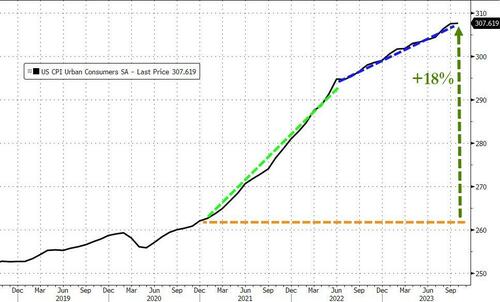

The headline inflation rate remains above 3 percent, down from the June 2022 peak of 9.1 percent. However, cumulative inflation since January 2021 has been more than 17 percent. Plus, there have been many other factors pointing to a struggling population.

Real wage growth has tumbled approximately 3 percent since 2021. In addition, according to the Bureau of Labor Statistics, real (inflation-adjusted) average hourly earnings rose by 0.2 percent in October, but "real average weekly earnings decreased 0.1 percent over the month due to the change in real average hourly earnings combined with a 0.3-percent decrease in the average workweek."

A new analysis from the U.S. Senate Joint Economic Committee found that Americans require an additional $11,400 today to afford the same living standards they did in January 2021.

Lending Club data found that 60 percent of Americans are living paycheck to paycheck.

Consumers might be tapped out, too. Credit card debt topped $1 trillion in the third quarter, the personal savings rate is below 4 percent, and pandemic-era savings have been exhausted.

President Biden acknowledged that families are still enduring a rough environment.

“We know that prices are still too high for too many things, that times are still too tough for too many families,” President Biden said on Nov 27. “But we’ve made progress.”

[ZH: No... no you haven't...

...lower INFLATION does not mean lower PRICES...]

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.