Since the last FOMC meeting on June 12, gold has outperformed (while the dollar and crude oil have lagged). Stocks and bonds are also both higher...

Source: Bloomberg

US macro 'hard' data has trended weaker overall since the last FOMC (albeit with a blip)...

Source: Bloomberg

...and the 'bad news' macro data has prompted 'good news' dovish shifts in rate-cut expectations which are dramatically higher since the last FOMC (pricing more than the Fed's two cuts this year)...

Source: Bloomberg

Expectations for today's FOMC are 'nothingburger'-y with just a 2% chance of a cut implied by the market (from 100% certain at the start of the year).

Source: Bloomberg

But all eyes and ears will be on the statement (which is expected to reflect 'more confidence' in the disinflationary path) and on Powell's soothingly dovish words.

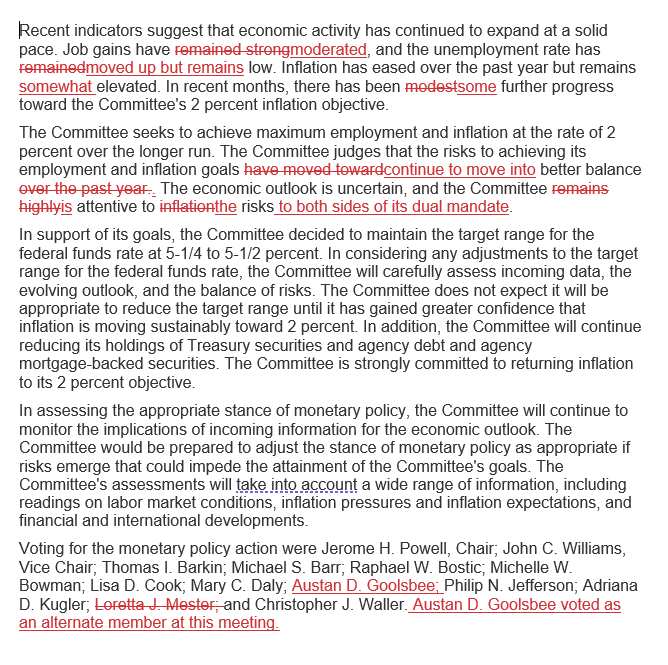

So, what did The Fed say?

Key headlines:

*FED HOLDS BENCHMARK RATE IN 5.25%-5.5% TARGET RANGE

*FED REPEATS WAITING FOR GREATER CONFIDENCE ON INFLATION TO CUT

*FED SAYS UNEMPLOYMENT RATE 'HAS MOVED UP BUT REMAINS LOW'

*FED: FOMC ATTENTIVE TO 'RISKS TO BOTH SIDES' OF DUAL MANDATE

Which has a hawkish bias to it compared to the market's dovishness.

Read the full red-line below:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.