With all eyes firmly focused on CapEx numbers to keep the AI-expansion narrative alive, Microsoft beat expectations on top- and bottom-line, and operating income, but a bigger than expected CapEx.

Microsoft posted adjusted earnings of $4.14 a share on revenue of $81.3 billion (better than expected earnings of $3.91 a share and revenue of $80.3 billion.

Intelligent Cloud revenue $32.91 billion, estimate $32.39 billion

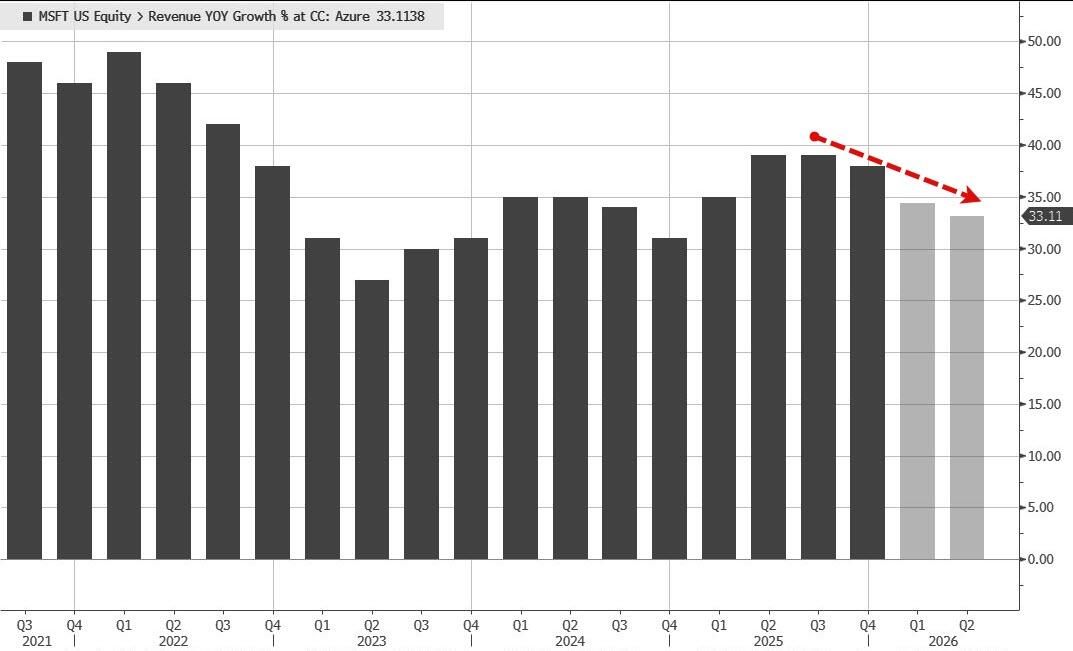

Azure and other cloud services revenue Ex-FX +38%, estimate +38%

Productivity and Business Processes revenue $34.12 billion, estimate $33.45 billion

More Personal Computing revenue $14.25 billion, estimate $14.33 billion

While Azure revenue rose 39% (beating stimates of 37.8%), it was down slightly from the first-quarter's 40% growth rate.

Additionally, Cloud gross margin also fell YoY to 67%.

Operating income beat expectations at $38.28 billion (versus a consensus estimate of $36.55 billion)

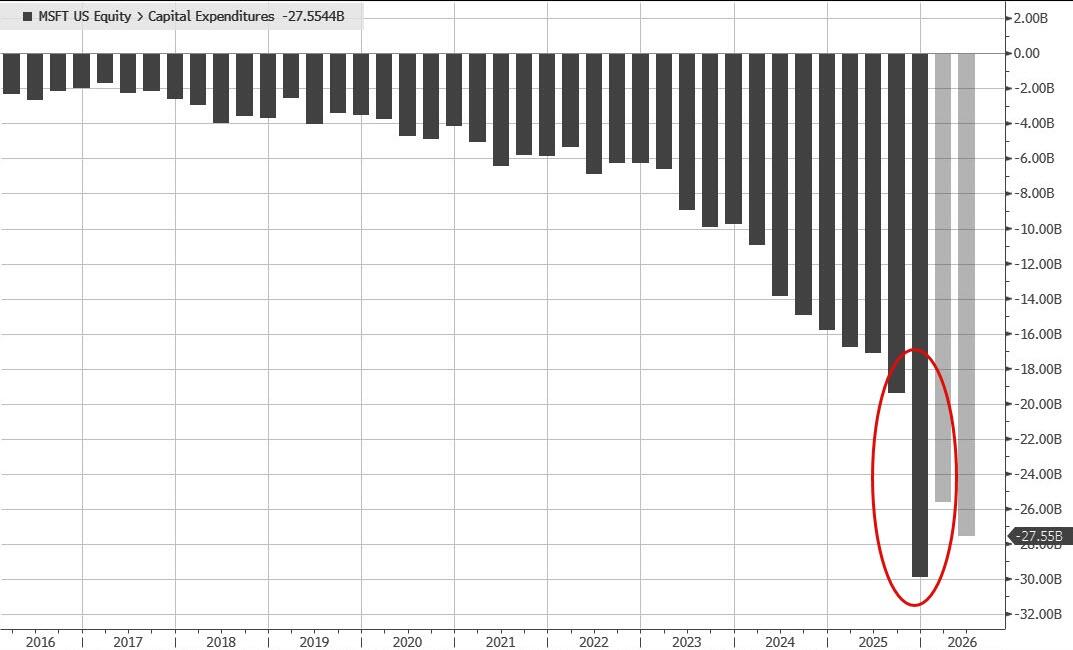

But Capital Expenditures were considerably higher than expected at $29.99 billion (versus consensus estimate of $23.78 billion).

Capital expenditures including assets acquired under finance leases were $37.5 billion, up 66% to support customer demand for our cloud and Al offerings. Roughly two-thirds of capital expenditures were for short-lived assets, primarily GPUs and CPUs, which support Azure platform demand, growing first-party applications and Al solutions, accelerating research and development by our product teams, as well as continued replacement for end-of-life server and networking equipment.

The remainder of capital expenditures were for long-lived assets which will support monetization over the next 15-year period and beyond. Finance leases, which are primarily for large datacenter sites, were $6.7B and are recognized at the time of lease commencement.

Cash paid for property and equipment was $29.9 billion, up 89%, lower than capital expenditures primarily due to finance leases

Additionally, following the renegotiation of their deal, Microsoft says net gains from OpenAI investments totaled $7.6B.

45% of Commercial RPO Driven by OpenAI Commitments

"In the second quarter of fiscal year 2026, net income and diluted earnings per share were impacted by net gains from investments in OpenAI, which resulted in an increase in net income and diluted earnings per share of $7.6 billion and $1.02, respectively."

The result of all this was selling pressure hitting MSFT (down over 8% after hours)...

It's unclear exactly what is triggering the selling pressure, but could it be that too much CapEx is now bad news not good news? Or is that Azure growth slowed?

https://www.zerohedge.com/markets/microsoft-tumbles-after-top-bottom-line-beats-capex-soars

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.