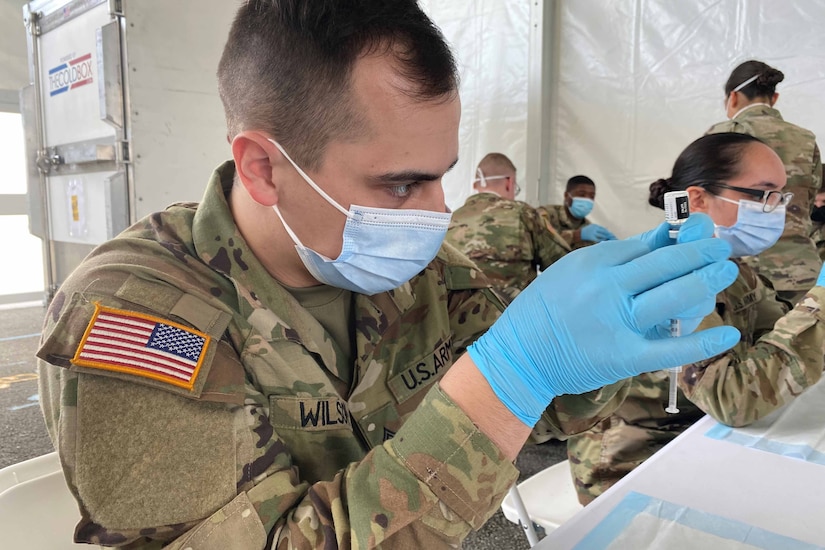

Large employers, from the meatpacking industry to airlines and pharmaceutical companies, are getting permission from public-health officials to administer Covid-19 vaccines, hoping to speed up inoculations of their employees.

Many businesses see giving vaccine doses to employees at work as a way to efficiently vaccinate staff but, in doing so, are joining a race for scarce shots.

Pharmaceutical company AbbVie Inc. has begun giving staff at its North Chicago headquarters doses, according to people familiar with the matter, giving priority to those over 65 years old and then workers in operations and manufacturing. Abbott Laboratories also has begun giving doses at its nearby headquarters to eligible workers, such as those in manufacturing, food service and daycare, a spokeswoman said, and Tyson Foods Inc. has delivered doses to staff at its Joslin, Ill., beef plant and to some workers in Iowa, a spokesman said.

Other large companies registered to provide doses include energy giant Exxon Mobil Corp., meatpacker Smithfield Foods Inc. and machinery-makers Caterpillar Inc. and Deere & Co., according to Illinois public-health records. Some of those companies run or are planning to run closed vaccine-giving events, meaning only their own staff are eligible, not the broader public. Sites are reliant on state and local public-health authorities for allocations of doses.

Money manager Fidelity Investments has registered to provide doses at its Boston headquarters and will begin giving shots to workers who are over 65 when it receives vaccines from Massachusetts, a spokesman said. A third-party health-and-wellness company will give the shots according to the state's prioritization guidelines, he added.

Throughout the pandemic, companies have jostled for access to safety-related tools, such as protective gear and testing capacity to protect workers and give customers and staff more confidence in shared spaces. Now their focus has shifted to vaccines.

Vaccine prioritization differs from state to state. In some jurisdictions, who is eligible for doses depends purely on age. In others, any worker in a prioritized sector, from healthcare to manufacturing, can get a dose regardless of whether their role involves interacting with the public, the ability to work from home or remotely, or the type of product they work on.

Companies that want to give shots to their workers typically have to register with public-health programs that approve who is eligible to receive allocations of Covid-19 vaccines. In general, the federal government allots doses to states, territories, a few large cities and some federal agencies, who then divvy them up among constituents or local health authorities.

Some healthcare-equity researchers say state prioritization guidelines can be overly broad, and risk having vaccine doses given to people who aren't at a high risk of contracting Covid-19 at work when supply remains constrained nationwide.

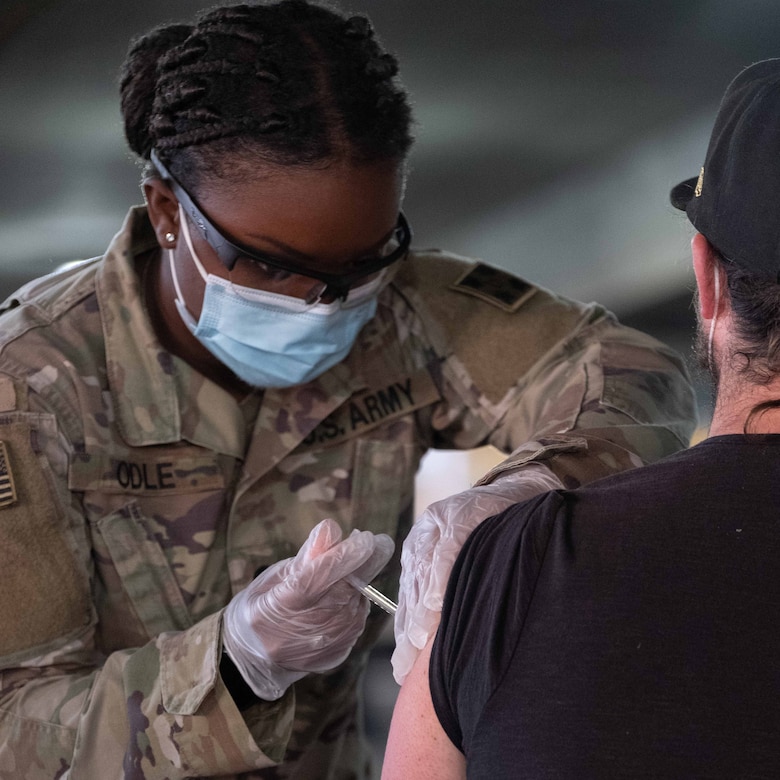

Vaccination in the workplace helps remove transit and time-off challenges for hourly workers, and it does efficiently get doses to those in high-risk positions, such as those where social distancing isn't possible, said Dr. Janice Bowie, professor in the department of health, behavior and society at the Johns Hopkins Bloomberg School of Public Health. It also highlights a problem with classifying entire sectors as essential, when workers' roles, on-the-job risks and health conditions vary widely, she said.

"This is certainly not black or white" from an ethical perspective, given the current limited supply of vaccines nationally, Dr. Bowie said about businesses receiving doses to give to staff.

Some healthcare-equity experts said Covid-19 vaccine administration by employers can help speed up distribution because it takes eligible workers out of line at public sites and eases the appointment-making process. The challenge is that not all companies seek or are granted dose allocations, they said.

"It's a balancing act," Mark Pfister, executive director of the Lake County Health Department in Illinois, said of allocations to dose administrators in his jurisdiction, which include Abbott and AbbVie. Vaccine supply has increased since the early days of the rollout, but many more entities now want doses, he said. His department asks companies to give priority to workers who are 65 and older, working close together on manufacturing lines or living in ZIP Codes hardest hit by Covid-19 hospitalizations and deaths.

Providing on-site doses gives employers better visibility into who has received shots than if workers traveled to publicly run facilities, corporate medical advisers say. It also saves employers missed hours if workers have to travel to vaccine-administration sites during business hours and saves staff the cost of lost wages, child care and transit.

"Employers have found this is the best way to get your population back to work as safely as possible," said Tobias Barker, chief medical officer at Everside Health, which assists employers with vaccination events and record-keeping.

An Abbott spokeswoman said the company is working with public-health officials in places where it has manufacturing facilities to offer vaccines to eligible workers when doses are available. Any vaccine doses the company receives go only to employees who meet government requirements for initial vaccine phases, she said.

A Deere & Co. spokeswoman said vaccines for its employees began last week at its five Illinois locations. It will make doses available to production and maintenance employees at its manufacturing units, and for salaried employees who consistently reported to its factories or offices since March 2020, which is a minority of such staff.

Keira Lombardo, chief administrative officer at Smithfield, said the company and its partners can facilitate rapid distribution of vaccines to food and agriculture workers and is doing so based on state-specific guidelines. The company is prepared to help with distribution to workers in other essential categories, she added.

An Exxon spokesman said doses would be given according to local health-authority requirements, prioritized for those in roles deemed critical by the company. A spokeswoman for Caterpillar declined to comment.

Airlines including United Airlines Holdings Inc. and American Airlines Group Inc. said they started giving doses of the Johnson & Johnson vaccine last week to certain staff at their respective health clinics at Chicago's O'Hare International Airport. United said employees who live or work in Chicago would be eligible if they are at least 65 years old or are flight-crew members. American said its O'Hare-based mainline and regional employees are eligible, but those with customer-facing roles would be given priority.

The Biden administration expects to have vaccine doses available for all adults nationwide by May, though it isn't clear when people would be able to receive them. Increases in vaccine supply have fanned some employers' hopes for bringing staff back to offices this year.

Many have tried to encourage but not mandate vaccination. Several companies with public-facing staff, from Trader Joe's to Instacart Inc. and Dollar General Corp., have given workers the equivalent of several hours of pay in exchange for getting vaccinated.

Medical advisers say offering doses on site can create a network effect in which colleagues see their bosses or co-workers get doses and then become more receptive to doing so themselves.

https://www.marketscreener.com/quote/stock/DEERE-COMPANY-12279/news/Having-Trouble-Getting-the-Covid-Vaccine-Your-Company-Might-Soon-Offer-It-32626352/